Fannie Mae Liquidity Test Worksheet Form

What is the Fannie Mae Liquidity Test Worksheet

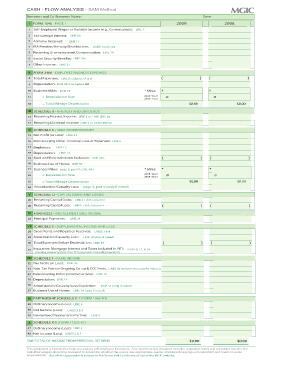

The Fannie Mae Liquidity Test Worksheet is a crucial document used to assess the liquidity position of borrowers seeking financing. It helps lenders evaluate the cash flow and financial stability of individuals or businesses applying for loans. The worksheet includes various financial metrics, such as income, expenses, and assets, which are essential for determining a borrower's ability to meet financial obligations. Proper completion of this worksheet is vital for ensuring that the lender has a comprehensive understanding of the applicant's financial situation.

How to use the Fannie Mae Liquidity Test Worksheet

Using the Fannie Mae Liquidity Test Worksheet involves several steps to ensure accurate assessment. First, gather all necessary financial documents, including income statements, bank statements, and any other relevant financial records. Next, input the required information into the worksheet, focusing on key areas such as monthly income, recurring expenses, and any outstanding debts. Once all data is entered, review the calculations to ensure accuracy. This thorough approach helps lenders make informed decisions regarding loan applications.

Steps to complete the Fannie Mae Liquidity Test Worksheet

Completing the Fannie Mae Liquidity Test Worksheet requires a systematic approach. Follow these steps:

- Gather financial documents: Collect all relevant financial information, including income sources and expenses.

- Fill in income details: Record all sources of income, such as salary, bonuses, or rental income.

- List expenses: Document all monthly expenses, including mortgage payments, utilities, and other obligations.

- Calculate net liquidity: Subtract total expenses from total income to determine net liquidity.

- Review for accuracy: Double-check all entries and calculations to ensure the worksheet is filled out correctly.

Legal use of the Fannie Mae Liquidity Test Worksheet

The Fannie Mae Liquidity Test Worksheet is legally recognized as part of the loan application process. It is essential for lenders to use this worksheet in compliance with applicable regulations. Proper completion and submission of the worksheet ensure that the lender can accurately assess the borrower's financial situation, which is crucial for making informed lending decisions. Additionally, maintaining accurate records of the completed worksheet can protect both the borrower and lender in case of disputes.

Key elements of the Fannie Mae Liquidity Test Worksheet

Several key elements are essential in the Fannie Mae Liquidity Test Worksheet. These include:

- Monthly income: A comprehensive list of all income sources.

- Monthly expenses: Detailed documentation of all recurring costs.

- Assets: Information on any liquid assets that can be accessed in case of financial need.

- Debt obligations: A summary of all outstanding debts that impact liquidity.

Examples of using the Fannie Mae Liquidity Test Worksheet

Practical examples of using the Fannie Mae Liquidity Test Worksheet can help clarify its application. For instance, a self-employed individual may use the worksheet to document fluctuating income and assess their ability to cover business expenses. Similarly, a family applying for a mortgage can use the worksheet to evaluate their financial readiness by comparing their income against their monthly housing costs and other obligations. These examples illustrate how the worksheet aids in making informed financial decisions.

Quick guide on how to complete fannie mae liquidity test worksheet

Effortlessly Prepare Fannie Mae Liquidity Test Worksheet on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Fannie Mae Liquidity Test Worksheet on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

The easiest method to modify and eSign Fannie Mae Liquidity Test Worksheet seamlessly

- Find Fannie Mae Liquidity Test Worksheet and select Get Form to begin.

- Utilize the tools available to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your alterations.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any chosen device. Modify and eSign Fannie Mae Liquidity Test Worksheet to ensure clear communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fannie mae liquidity test worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fannie Mae liquidity test calculator?

The Fannie Mae liquidity test calculator is a specialized tool designed to help lenders assess their liquidity position based on Fannie Mae guidelines. This calculator simplifies the process of determining whether a company meets liquidity requirements, making it an essential resource for mortgage professionals.

-

How does the Fannie Mae liquidity test calculator benefit my business?

Using the Fannie Mae liquidity test calculator can signNowly enhance your business's operational efficiency. It allows for quick and accurate assessments of liquidity, which can lead to improved decision-making and compliance with Fannie Mae regulations, ultimately saving time and reducing errors.

-

Is the Fannie Mae liquidity test calculator easy to use?

Absolutely! The Fannie Mae liquidity test calculator is designed to be user-friendly, allowing even those with limited financial expertise to navigate it effectively. Its intuitive interface ensures that you can quickly input data and receive results without complications.

-

Are there any integration options for the Fannie Mae liquidity test calculator?

Yes, the Fannie Mae liquidity test calculator can integrate seamlessly with various financial software tools. This allows for efficient data transfers and enhances your overall workflow, making it easier to stay compliant with Fannie Mae requirements while maintaining your existing systems.

-

What pricing plans are available for the Fannie Mae liquidity test calculator?

The Fannie Mae liquidity test calculator comes with competitive pricing options tailored to fit the needs of different businesses. We offer flexible subscription plans that provide access to this essential tool without breaking the bank, ensuring you get the best value for your investment.

-

Can the Fannie Mae liquidity test calculator help with regulatory compliance?

Yes, the Fannie Mae liquidity test calculator is specifically designed to help users comply with Fannie Mae's regulatory standards. By accurately assessing liquidity positions, it aids in meeting compliance requirements, reducing the risk of penalties or sanctions.

-

Is customer support available for the Fannie Mae liquidity test calculator?

Absolutely! Our dedicated customer support team is readily available to assist you with any queries regarding the Fannie Mae liquidity test calculator. Whether you need technical assistance or guidance on best practices, we’re here to help ensure your experience is smooth and successful.

Get more for Fannie Mae Liquidity Test Worksheet

- Oklahoma tax commission motor vehicle division vehicle pwof form

- Nyslrs form

- Ucsf declaration of missing receipt form

- Model adverse action notice form

- Relias learning course crosswalk to the carf behavioral health tn form

- Ga secretary board of barbers fax number form

- Cheer coach introduction letter to parents form

- Floodplain development permit application form

Find out other Fannie Mae Liquidity Test Worksheet

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document