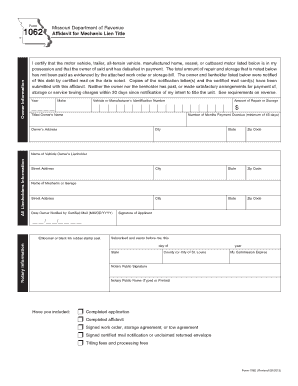

Form 1062

What is the Form 1062

The Form 1062 is a tax document used primarily for reporting specific financial information to the Internal Revenue Service (IRS). This form is essential for certain entities, including partnerships and corporations, to disclose income, deductions, and other relevant tax data. Understanding the purpose of Form 1062 is crucial for compliance with federal tax regulations.

How to use the Form 1062

Using Form 1062 involves several key steps. First, determine if your business structure requires this form. Next, gather all necessary financial information, including income statements and expense reports. Complete the form accurately, ensuring all entries reflect your financial activities for the tax year. Finally, submit the completed form to the IRS by the designated deadline to avoid penalties.

Steps to complete the Form 1062

Completing Form 1062 requires careful attention to detail. Follow these steps:

- Review the form's instructions to understand the required information.

- Collect relevant financial documents, such as income statements and balance sheets.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check your entries for any errors or omissions.

- Sign and date the form before submission.

Legal use of the Form 1062

The legal use of Form 1062 hinges on its compliance with IRS regulations. To ensure the form is legally binding, it must be filled out correctly and submitted on time. Additionally, electronic signatures are permissible under U.S. law, provided they meet the standards set by the ESIGN Act and UETA. Using a reliable eSignature platform can enhance the legal validity of your submission.

Filing Deadlines / Important Dates

Filing deadlines for Form 1062 are critical to avoid penalties. Typically, the form must be submitted by the 15th day of the third month following the end of the tax year. For example, if your tax year ends on December 31, the deadline would be March 15 of the following year. It is essential to keep track of these dates to ensure timely compliance.

Required Documents

To complete Form 1062, you will need several supporting documents. These may include:

- Income statements detailing revenue and expenses.

- Balance sheets that reflect the financial position of your entity.

- Previous tax returns for reference and consistency.

- Any additional documentation required by the IRS for specific deductions or credits.

Form Submission Methods (Online / Mail / In-Person)

Form 1062 can be submitted through various methods. You may file it electronically using IRS-approved e-filing software, which can streamline the process and reduce errors. Alternatively, you can mail a paper copy of the form to the appropriate IRS address based on your location. In-person submission is generally not available, as the IRS encourages electronic filing for efficiency.

Quick guide on how to complete form 1062

Accomplish Form 1062 effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any holdups. Manage Form 1062 on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centered task today.

The easiest way to modify and eSign Form 1062 with minimal effort

- Locate Form 1062 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact confidential information with tools that airSlate SignNow specially provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Form 1062 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1062

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1062 and how does airSlate SignNow assist in its completion?

Form 1062 is used for specific tax purposes, and airSlate SignNow facilitates its completion by allowing users to upload, edit, and eSign the document electronically. With a user-friendly interface, businesses can streamline the file preparation process, ensuring that form 1062 is completed accurately and efficiently.

-

Is airSlate SignNow suitable for businesses that frequently use form 1062?

Absolutely! airSlate SignNow is designed for businesses of all sizes that need to manage documents like form 1062. Its robust features help simplify the eSigning process, making it ideal for companies that require frequent use of tax-related forms.

-

What are the pricing options for using airSlate SignNow with form 1062?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, ensuring that accessing and managing form 1062 is budget-friendly. Each plan includes essential features that support document management and eSigning, which can be tailored based on the volume of documents processed.

-

Can airSlate SignNow integrate with other software when handling form 1062?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing its functionality when managing form 1062. Users can connect it with CRM, project management tools, and more, ensuring a unified workflow that simplifies document handling.

-

What features does airSlate SignNow offer to ensure secure handling of form 1062?

airSlate SignNow incorporates robust security features, including encryption and secure cloud storage, to safeguard the handling of form 1062. This ensures that sensitive tax information remains protected while allowing for compliant eSigning and document sharing.

-

How does airSlate SignNow streamline the eSigning process for form 1062?

The eSigning process for form 1062 is made efficient by airSlate SignNow's intuitive platform, which enables quick upload and sending of documents for signature. Users can track the status of their forms in real-time, ensuring that the document is signed and returned promptly.

-

What benefits does using airSlate SignNow provide for managing form 1062?

Using airSlate SignNow for managing form 1062 yields signNow benefits, including time savings, enhanced accuracy, and improved workflow efficiency. By automating the process, businesses can focus more on core operations while ensuring that their tax documents are handled correctly.

Get more for Form 1062

- Louisiana tech university vehicle registration latech form

- Oral presentation rubric fashion show form

- Brief in support of motion to dismiss north carolina business bb form

- Volleyball tournament registration form 37482437

- Ppf 07 form

- Will county subpoena form

- Companion change of beneficiary form

- Mobile app terms of use and privacy statement form

Find out other Form 1062

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney