Tdi Tax Form Ri

What is the TDI Tax Form RI?

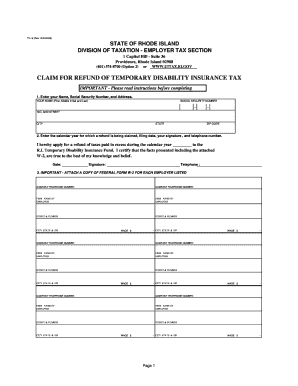

The TDI tax form RI, officially known as the Rhode Island Temporary Disability Insurance Tax Form, is a document used by employees in Rhode Island to report their temporary disability insurance contributions. This form is essential for ensuring compliance with state regulations regarding disability benefits. The contributions collected through this form help fund the state’s temporary disability insurance program, which provides financial support to eligible individuals who are unable to work due to non-work-related injuries or illnesses.

How to Use the TDI Tax Form RI

Using the TDI tax form RI involves several steps to ensure accurate reporting of contributions. First, individuals must obtain the form, which can typically be accessed through the Rhode Island Department of Labor and Training's website. Once you have the form, carefully fill it out with the required information, including your personal details and contribution amounts. It is important to double-check for accuracy before submission. After completing the form, it can be submitted electronically or mailed to the appropriate state agency, depending on your preference and the guidelines provided.

Steps to Complete the TDI Tax Form RI

Completing the TDI tax form RI requires attention to detail. Follow these steps for a smooth process:

- Obtain the Form: Download the TDI tax form RI from the official state website.

- Fill in Personal Information: Enter your name, address, and Social Security number accurately.

- Report Contributions: Indicate the total amount of contributions made during the reporting period.

- Review for Accuracy: Check all entries for correctness to avoid delays or issues.

- Submit the Form: Choose your submission method—online or by mail—and follow the instructions provided.

Legal Use of the TDI Tax Form RI

The TDI tax form RI serves a legal purpose in the context of Rhode Island’s disability insurance program. It is essential for ensuring that employees meet their obligations under state law regarding temporary disability contributions. Proper completion and submission of this form are necessary for eligibility in receiving benefits should the need arise. Furthermore, compliance with the regulations surrounding this form protects individuals from potential penalties or legal issues related to non-compliance.

Required Documents

When completing the TDI tax form RI, certain documents may be necessary to support your submission. These typically include:

- Your Social Security number for identification.

- Proof of income, such as pay stubs or W-2 forms, to verify contribution amounts.

- Any previous TDI forms submitted, if applicable, for reference.

Having these documents ready can streamline the process and ensure that your form is completed accurately.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the TDI tax form RI to avoid penalties. Typically, the form must be submitted by the end of the quarter in which contributions were made. Important dates to remember include:

- Quarterly deadlines for submission: January 31, April 30, July 31, and October 31.

- Annual review and reconciliation deadlines, if applicable.

Staying informed about these dates helps ensure compliance and timely submission of your contributions.

Quick guide on how to complete tdi tax form ri

Effortlessly prepare Tdi Tax Form Ri on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Administer Tdi Tax Form Ri on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

The simplest method to edit and electronically sign Tdi Tax Form Ri with ease

- Obtain Tdi Tax Form Ri and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Produce your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searches, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Tdi Tax Form Ri to guarantee clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tdi tax form ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TDI form and how is it used in airSlate SignNow?

A TDI form is a specific type of document used for collecting data and signatures electronically. In airSlate SignNow, users can easily create, send, and eSign TDI forms, streamlining processes and improving efficiency for businesses.

-

How does airSlate SignNow ensure the security of my TDI forms?

airSlate SignNow employs robust encryption and security protocols to protect your TDI forms. User authentication features and audit trails are also included to guarantee that your documents remain confidential and secure throughout the signing process.

-

Can I customize my TDI forms with airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your TDI forms to fit your business needs. You can add fields, change design elements, and incorporate your branding to create a personalized experience for your users.

-

What are the pricing options for using airSlate SignNow for TDI forms?

airSlate SignNow offers competitive pricing plans to accommodate various needs, whether you are a small business or a large enterprise. You can choose from monthly or annual subscriptions, often with a free trial option to evaluate their features designed for TDI forms.

-

Is it easy to integrate airSlate SignNow with other software for managing TDI forms?

Absolutely! airSlate SignNow provides seamless integrations with popular applications like Google Drive, Salesforce, and many more. This compatibility enhances the functionality of TDI forms by allowing data to flow smoothly across platforms.

-

What are the benefits of using airSlate SignNow for TDI forms?

Using airSlate SignNow for TDI forms offers numerous benefits, including time savings and improved accuracy. The platform simplifies the document workflow by allowing electronic signatures, which helps speed up approvals and reduces the risk of errors.

-

Can I track the status of my TDI forms in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your TDI forms. You can easily monitor who has signed, who still needs to sign, and view the history of changes made to the document, giving you full visibility into your workflows.

Get more for Tdi Tax Form Ri

- Hospital discharge planning checklist for tuberculosis patients nyc form

- Recallsample form

- Westchester county pba pbawcpd form

- Egn 4912 form

- Smhc mychart form

- City of tupelo certificate of occupancy application department of development services po box 1485 tupelo ms 388021485 phone form

- Prelim access connection request form traffic generator dotd

- Standard confidentiality agreement template form

Find out other Tdi Tax Form Ri

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors