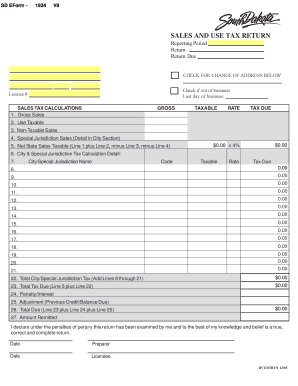

SD Sales Tax Return State of South Dakota State Sd Form

Understanding the South Dakota Income Tax

The South Dakota income tax system is unique, as the state does not impose a personal income tax on its residents. This means that individuals and businesses in South Dakota do not need to file state income tax returns. However, it is essential to be aware of other taxes that may apply, such as sales tax and property tax. Understanding the overall tax landscape in South Dakota can help residents manage their finances effectively.

Key Elements of South Dakota Taxation

While South Dakota does not have a personal income tax, it does have a sales tax rate that applies to most goods and services. The current state sales tax rate is four percent, with additional local taxes that can increase the total rate in certain areas. Businesses must collect and remit sales tax on taxable sales, and they are required to file sales tax returns regularly. Additionally, property taxes are levied at the local level, which can vary significantly by county.

Filing Deadlines and Important Dates

Although there is no income tax filing for residents, businesses must be aware of sales tax filing deadlines. Typically, sales tax returns are due on a monthly or quarterly basis, depending on the volume of sales. It is crucial for businesses to stay informed about these deadlines to avoid penalties. Keeping a calendar of important dates can help ensure timely compliance with tax obligations.

Required Documents for Businesses

For businesses operating in South Dakota, certain documents are necessary for tax compliance. These may include the South Dakota sales tax permit, sales tax returns, and records of sales transactions. Maintaining accurate records is vital for substantiating sales tax collected and for preparing returns. Businesses should also keep documentation related to any exemptions claimed, as this information may be required during audits.

Penalties for Non-Compliance

Failure to comply with South Dakota tax regulations can result in significant penalties. Businesses that do not file sales tax returns on time may face late fees and interest on unpaid taxes. Additionally, repeated non-compliance can lead to more severe consequences, including the potential for legal action. It is essential for businesses to understand their responsibilities and to take proactive steps to ensure compliance.

Digital vs. Paper Submission Methods

Businesses in South Dakota have the option to submit their sales tax returns either digitally or via paper forms. Digital submission is often more efficient, allowing for quicker processing and confirmation of receipt. The South Dakota Department of Revenue provides an online portal for filing returns and making payments. However, businesses may also choose to submit paper forms by mail if they prefer traditional methods.

Quick guide on how to complete sd sales tax return state of south dakota state sd

Complete SD Sales Tax Return State Of South Dakota State Sd seamlessly on any device

Digital document management has become popular among organizations and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Handle SD Sales Tax Return State Of South Dakota State Sd on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign SD Sales Tax Return State Of South Dakota State Sd effortlessly

- Obtain SD Sales Tax Return State Of South Dakota State Sd and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Alter and eSign SD Sales Tax Return State Of South Dakota State Sd and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sd sales tax return state of south dakota state sd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How does airSlate SignNow simplify the process of managing South Dakota income tax documents?

airSlate SignNow provides businesses with an efficient solution for managing South Dakota income tax documents. With electronic signatures and secure document storage, you can easily handle your tax forms without the hassle of physical paperwork. This ensures that all necessary documents are signed and submitted on time.

-

What features does airSlate SignNow offer for managing South Dakota income tax forms?

airSlate SignNow offers several features that enhance the management of South Dakota income tax forms, including customizable templates and automated workflows. These tools streamline the process, allowing you to focus on compliance rather than logistics. Additionally, the platform allows for real-time tracking of document status.

-

Is airSlate SignNow cost-effective for managing South Dakota income tax documentation?

Yes, airSlate SignNow is a cost-effective solution for managing South Dakota income tax documentation. With flexible pricing plans, businesses of all sizes can find an option that fits their budget. This allows you to streamline your tax processes without overspending on tax management tools.

-

Can I integrate airSlate SignNow with other accounting software for South Dakota income tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your South Dakota income tax. This integration allows for a smooth transfer of data, reducing the time spent on manual entries, and ensuring that your tax documents are accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for South Dakota income tax preparation?

Using airSlate SignNow for South Dakota income tax preparation offers multiple benefits, including time savings and increased organization. You can efficiently collect signatures and manage documents in one secure place, reducing the risk of lost paperwork. This ensures that your tax preparations are thorough and compliant.

-

Is airSlate SignNow suitable for both individuals and businesses managing South Dakota income tax?

Absolutely! airSlate SignNow is suitable for both individuals and businesses handling South Dakota income tax. Its user-friendly interface and customizable features cater to various needs, making it an excellent choice for anyone looking to simplify their tax documentation process.

-

How does airSlate SignNow ensure the security of South Dakota income tax documents?

airSlate SignNow prioritizes the security of your South Dakota income tax documents by employing robust encryption and security protocols. All documents are stored securely, and access is controlled through user authentication. This provides peace of mind that your sensitive tax information is protected.

Get more for SD Sales Tax Return State Of South Dakota State Sd

- Perc nj notification of intention to commence negotiations form

- Annual consumer reporting form crf delaware health and dhss delaware

- Iu health fmla department form

- Application for terminal inspection chp 365 chp ca form

- Erivedge enrollment form

- Visa application 2220 form

- Instructions for use of resale certificates for non new jersey form

- Request for re evaluation independent students form

Find out other SD Sales Tax Return State Of South Dakota State Sd

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement