Utah TC 20, Utah Corporation Franchise and Income Tax Form

Understanding the Utah TC-20 Form

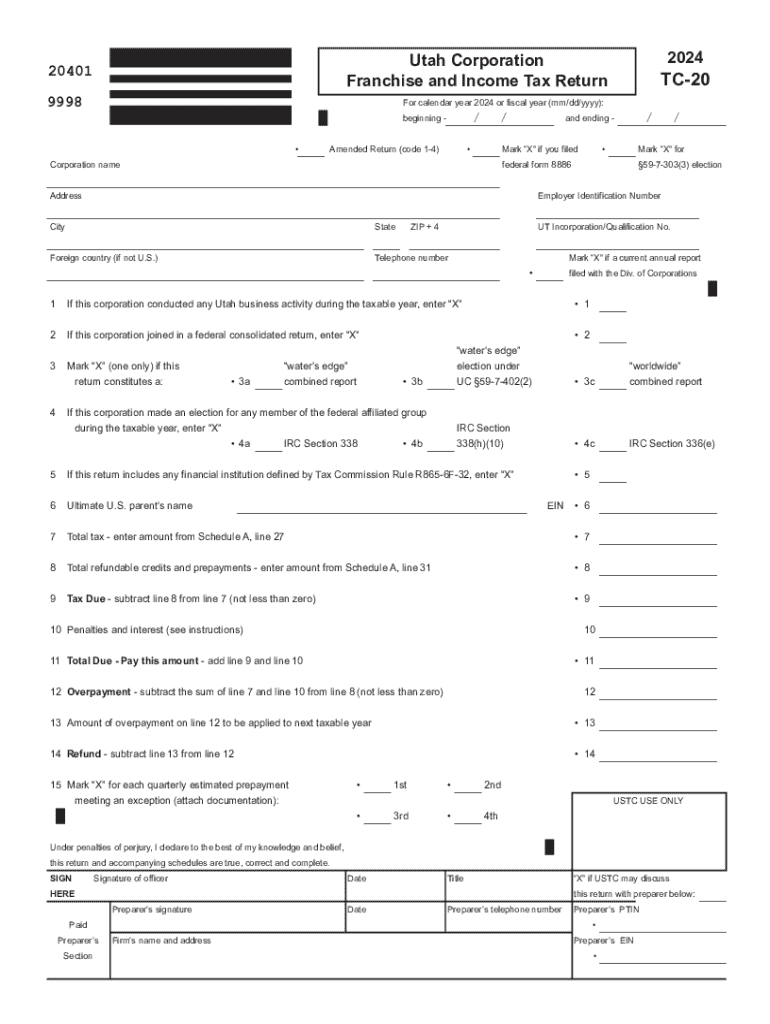

The Utah TC-20, officially known as the Utah Corporation Franchise and Income Tax Form, is essential for corporations operating within the state. This form is used to report income, calculate franchise taxes, and determine the overall tax liability for corporations. It is crucial for compliance with state tax laws and ensures that businesses contribute appropriately to state revenue.

Steps to Complete the Utah TC-20 Form

Completing the Utah TC-20 involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the form with accurate financial data, ensuring all sections are completed.

- Calculate the franchise tax based on the provided income and applicable rates.

- Review the completed form for accuracy before submission.

Each step is critical to ensure compliance and avoid potential penalties.

Filing Deadlines for the Utah TC-20

Corporations must be aware of the filing deadlines associated with the Utah TC-20. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April 15. Timely submission is vital to avoid late fees and penalties.

Obtaining the Utah TC-20 Form

The Utah TC-20 form can be obtained through the Utah State Tax Commission's website or at local tax offices. It is available in both digital and paper formats, allowing businesses to choose the method that best suits their needs. Digital versions can be filled out electronically, simplifying the process for many corporations.

Key Elements of the Utah TC-20 Form

The Utah TC-20 includes several important sections that must be completed:

- Identification Information: This section requires the corporation's name, address, and federal employer identification number (EIN).

- Income Reporting: Corporations must report all sources of income, including sales, services, and investments.

- Tax Calculation: This part involves calculating the franchise tax based on the reported income and applicable rates.

- Signature Section: An authorized representative must sign the form, certifying that the information provided is accurate.

Legal Use of the Utah TC-20 Form

The Utah TC-20 is legally required for corporations conducting business in Utah. Proper completion and timely submission of this form ensure compliance with state tax laws. Failure to file or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. It is essential for corporations to understand their legal obligations regarding this form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the utah tc 20 utah corporation franchise and income tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for Utah state tax forms 2024?

Using airSlate SignNow for Utah state tax forms 2024 streamlines the eSigning process, making it faster and more efficient. Our platform allows you to easily send, sign, and manage your tax documents securely. This not only saves time but also reduces the risk of errors, ensuring your forms are submitted correctly.

-

How does airSlate SignNow integrate with other software for managing Utah state tax forms 2024?

airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to manage your Utah state tax forms 2024. This connectivity allows you to import data directly from your existing systems, reducing manual entry and improving accuracy. Our API also enables custom integrations tailored to your business needs.

-

What is the pricing structure for using airSlate SignNow for Utah state tax forms 2024?

airSlate SignNow offers flexible pricing plans to accommodate different business sizes and needs when handling Utah state tax forms 2024. Our plans are designed to be cost-effective, ensuring you only pay for the features you need. You can choose from monthly or annual subscriptions, with discounts available for longer commitments.

-

Is airSlate SignNow compliant with regulations for Utah state tax forms 2024?

Yes, airSlate SignNow is fully compliant with all relevant regulations for Utah state tax forms 2024. We prioritize security and compliance, ensuring that your documents are handled in accordance with state and federal laws. Our platform uses advanced encryption and security measures to protect your sensitive information.

-

Can I track the status of my Utah state tax forms 2024 with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your Utah state tax forms 2024. You can easily monitor the status of your documents, see who has signed, and receive notifications when actions are completed. This feature enhances transparency and keeps you informed throughout the process.

-

What features does airSlate SignNow offer for managing Utah state tax forms 2024?

airSlate SignNow includes a variety of features specifically designed for managing Utah state tax forms 2024. These features include customizable templates, automated workflows, and secure eSigning capabilities. Our user-friendly interface makes it easy to navigate and utilize these tools effectively.

-

How can airSlate SignNow help reduce errors in Utah state tax forms 2024?

By using airSlate SignNow for Utah state tax forms 2024, you can signNowly reduce errors through automated data entry and validation features. Our platform minimizes the chances of mistakes by guiding users through the signing process and ensuring all required fields are completed. This leads to more accurate submissions and fewer delays.

Get more for Utah TC 20, Utah Corporation Franchise And Income Tax Form

Find out other Utah TC 20, Utah Corporation Franchise And Income Tax Form

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF