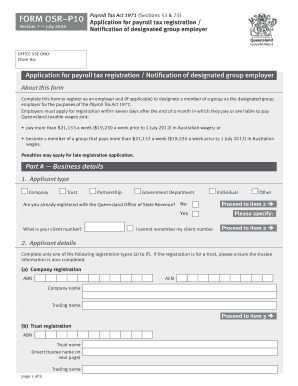

P10 Form

What is the P10 Form

The P10 form is a tax document used primarily in the United States for reporting certain types of income. This form is essential for individuals and businesses to accurately report their earnings and comply with federal tax regulations. It is particularly relevant for those who need to disclose income that may not be reported on traditional W-2 forms, such as self-employed individuals or independent contractors. Understanding the purpose and requirements of the P10 form is crucial for maintaining compliance and avoiding potential penalties.

How to use the P10 Form

Using the P10 form involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents that pertain to your income for the reporting period. This may include invoices, receipts, and bank statements. Next, carefully fill out the form, ensuring that all income is reported accurately. It's important to double-check your entries for any errors. Once completed, you can submit the P10 form electronically or via mail, depending on your preference and the guidelines provided by the IRS.

Steps to complete the P10 Form

Completing the P10 form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant financial documents.

- Access the P10 form from a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring each entry is accurate and complete.

- Review the form for any mistakes or omissions.

- Submit the form electronically or print it for mailing.

Legal use of the P10 Form

The P10 form is legally binding when completed and submitted in accordance with IRS regulations. To ensure its validity, it must be filled out truthfully and accurately, reflecting your actual income. Any discrepancies or false information can lead to legal repercussions, including fines or audits. Utilizing a reliable eSignature solution can further enhance the legal standing of your submitted form by providing a secure and verifiable signature.

Filing Deadlines / Important Dates

Filing deadlines for the P10 form are crucial to avoid penalties. Typically, the form must be submitted by April 15 of the following tax year. However, if you require an extension, you may file for one, but it is essential to pay any estimated taxes owed by the original deadline to avoid interest and penalties. Keeping track of these important dates ensures compliance and helps maintain good standing with the IRS.

Required Documents

To complete the P10 form accurately, certain documents are necessary. These may include:

- Invoices and receipts related to income.

- Bank statements showing deposits.

- Previous tax returns for reference.

- Any relevant 1099 forms received from clients or employers.

Having these documents on hand will facilitate a smoother completion process and ensure that all income is reported accurately.

Quick guide on how to complete p10 form

Complete P10 Form conveniently on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without any holdups. Manage P10 Form on any device using the airSlate SignNow Android or iOS applications and simplify your document operations today.

How to alter and eSign P10 Form effortlessly

- Find P10 Form and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device of your preference. Edit and eSign P10 Form and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p10 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a p10 form, and how is it used in airSlate SignNow?

A p10 form is a specific document used for reporting income tax and other important financial information. In airSlate SignNow, you can easily create, send, and eSign p10 forms, ensuring that your documents are legally binding and securely stored.

-

How can airSlate SignNow simplify the process of managing p10 forms?

airSlate SignNow streamlines the management of p10 forms by allowing you to automate the signing process, track document status, and store templates for future use. This not only saves time but also reduces the chances of errors in your financial reporting.

-

Is there a pricing plan for using airSlate SignNow for p10 forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Whether you're a small business or a large enterprise, our plans provide cost-effective solutions for managing your p10 forms efficiently.

-

What features does airSlate SignNow offer for p10 form management?

airSlate SignNow includes features like customizable templates, in-built eSignature capabilities, and real-time document tracking. These features ensure that your p10 forms are processed quickly and securely, enhancing your overall workflow.

-

Can airSlate SignNow integrate with other applications for handling p10 forms?

Absolutely! airSlate SignNow integrates seamlessly with various business applications like CRM systems, cloud storage services, and accounting software. This integration makes it easier to manage your p10 forms within your existing workflows.

-

What are the security features of airSlate SignNow for protecting p10 forms?

Security is a top priority at airSlate SignNow. We implement robust measures such as encryption, multi-factor authentication, and detailed audit trails, ensuring that your p10 forms and sensitive information are protected against unauthorized access.

-

How does airSlate SignNow help with the compliance of p10 forms?

airSlate SignNow helps ensure that your p10 forms comply with legal standards by providing templates that meet regulatory requirements. Additionally, our platform keeps track of all changes and actions taken on the documents, facilitating compliance audits.

Get more for P10 Form

- Hotel and lodging tax over 30 day exemption form alameda acgov

- Dd form 2853 10076090

- Section 6 3 life substances answer key form

- Ubd template google doc form

- City of los alamitos location filming permit application form

- Actors equity contract template form

- Addendum contract template form

- Addendum to construction contract template form

Find out other P10 Form

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile