Living Will PDF 2012-2026

What is the Living Will PDF

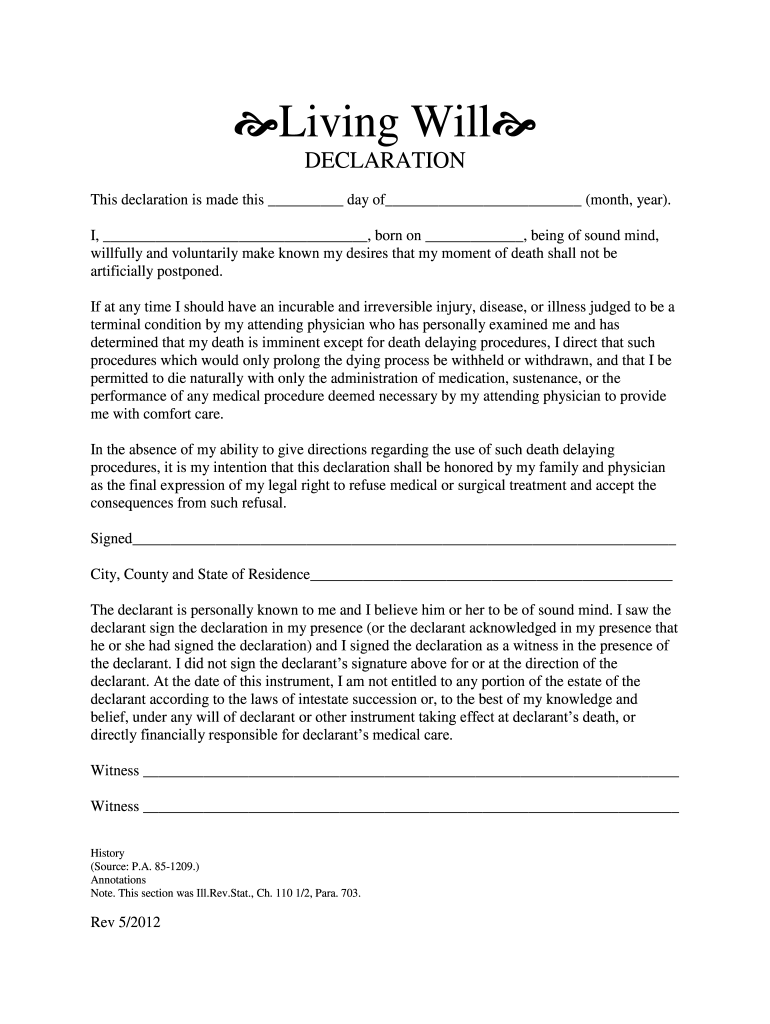

A living will PDF is a legal document that outlines an individual's preferences regarding medical treatment in situations where they may be unable to communicate their wishes. This document typically includes directives about life-sustaining treatments, resuscitation efforts, and other critical healthcare decisions. In Illinois, a living will serves to ensure that a person's healthcare choices are respected, even when they cannot express them verbally.

Key Elements of the Living Will PDF

The essential components of a living will PDF include:

- Patient Identification: Full name, date of birth, and other identifying information.

- Healthcare Preferences: Specific instructions regarding the types of medical treatment desired or refused.

- Signature: The document must be signed by the individual creating the living will, often requiring witnesses or notarization to be legally binding.

- Revocation Clause: A statement indicating that the living will can be revoked at any time by the individual.

Steps to Complete the Living Will PDF

Completing a living will PDF involves several straightforward steps:

- Download the Form: Obtain the official living will form for Illinois, which is typically available in PDF format.

- Fill Out Personal Information: Provide your full name, address, and other identifying details as required.

- Specify Healthcare Wishes: Clearly articulate your preferences regarding medical treatments and interventions.

- Sign and Date: Ensure you sign and date the document, possibly in the presence of witnesses or a notary.

- Distribute Copies: Share copies of the completed living will with healthcare providers, family members, and anyone else involved in your care.

Legal Use of the Living Will PDF

The living will PDF holds legal weight in Illinois as long as it meets specific state requirements. It is essential to ensure that the document complies with Illinois law, which may include having it witnessed or notarized. This legal recognition allows healthcare providers to follow the outlined directives during medical emergencies, ensuring that the individual's wishes are honored.

State-Specific Rules for the Living Will PDF

In Illinois, there are particular regulations governing living wills. These include:

- Individuals must be at least eighteen years old to create a living will.

- The document must be signed in the presence of two witnesses or a notary public.

- Witnesses cannot be related to the individual or have any financial interest in the individual's estate.

How to Obtain the Living Will PDF

Obtaining a living will PDF in Illinois can be done through various means:

- Online Resources: Many legal websites and state health department sites offer downloadable living will forms.

- Legal Offices: Local attorneys specializing in estate planning can provide the necessary forms and guidance.

- Healthcare Providers: Some hospitals and clinics may offer living will forms as part of their patient care services.

Quick guide on how to complete living will form

Explore the simpler method to manage your Living Will Pdf

The traditional approach to finalizing and approving paperwork consumes an excessive amount of time compared to modern document management solutions. You would previously search for suitable official forms, print them, fill in all the information, and dispatch them via mail. Now, you can locate, fill out, and sign your Living Will Pdf all within a single internet browser tab with airSlate SignNow. Completing your Living Will Pdf is more straightforward than ever before.

Steps to finalize your Living Will Pdf using airSlate SignNow

- Access the category page you require and find your state-specific Living Will Pdf. Alternatively, utilize the search bar.

- Ensure the version of the form is accurate by reviewing it.

- Click Get form and enter editing mode.

- Fill in your document with the necessary information using the editing tools.

- Examine the included information and click the Sign tool to validate your form.

- Choose the easiest method to create your signature: generate it, draw your signature, or upload an image of it.

- Click DONE to apply changes.

- Download the document to your device or proceed to Sharing settings to send it electronically.

Robust online solutions like airSlate SignNow simplify the process of completing and submitting your forms. Experience it to discover how much time document management and approval processes are truly meant to take. You’ll save a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

How do I fill out a FAFSA form if I'm a US citizen living abroad?

How do I fill out a FAFSA form if I'm a US citizen living abroad?U.S. citizens are eligible for U.S. federal student aid regardless of where they live and regardless of whether their parents are U.S. citizens or not.If you file a U.S. federal income tax return, use that to complete the FAFSA. Otherwise, substitute the foreign income tax return, which is considered by the FAFSA to be the equivalent of IRS Form 1040. All financial figures should be converted into U.S. dollars using the exchange rate in effect on the date the FAFSA was filed or the most recent exchange rate prior to that date. Use the exchange rates that can be found on the Federal Reserve web site, Foreign Exchange Rates - H.10.If your parents are not U.S. citizens or permanent residents, use 000–00–0000 instead of a Social Security Number for them. They will need to print a signature page, sign and mail it.As a U.S. Citizen, you should have a Social Security Number. If your parents never filed SSA Form SS-5 to get you a Social Security Number, you will need to do so now. You will need to provide documents to prove age, identity and U.S. citizenship. Obtaining these documents, such as a birth certificate, can take time, so get started as soon as possible. You may need to schedule a meeting at the local U.S. embassy or consulate.Since you are a U.S. Citizen, you should be able to obtain a FSA ID to sign the FAFSA electronically. The main challenge will involve getting the forms to accept a foreign address. Otherwise, you will need to print, sign and mail the signature page.If you live in Mexico, Canada, a U.S. territory or a military installation, select the corresponding entry from the State menu. Otherwise, select “Foreign Country” and list your city and country in the field for City and enter 00000 in the Zip Code field.

-

How do I apply for a Schengen visa in the USA as an Indian?

Choose a country you want to visit , and apply for a tourist visa. Pls note if you are on B1/B2 visa then you should apply from your home country and you should avoid applying from usa.

-

How do I fill out a W4 form if am I a dependent of my father -who is a non US citizen living abroad, but pays for most of my living expenses?

You can be claimed as a dependent for tax purposes by a parent if:1. You are under age 19 at the end of the year, or under age 24 and a full-time student, or permanently and totally disabled; and2. You lived with that parent for at least half of the year (counting time spent temporarily absent from the home, i.e. at school); and3. You did not provide more than half of your own support.I bring that up just in case your mother - who you did not mention - meets all of those requirements. Note that the support requirement is only that you don't provide more than half of your own support - and not that the claiming parent does, so it's possible that you may still be your mother's dependent.Assuming that's not the case, then yor father, as a nonresident alien, would not generally be allowed to claim any exemption for dependents (assuming he has a US tax obligation). He might be able to do so if you qualify as his dependent otherwise and he is a resident of Canada or Mexico, but that's an unusual circumstance.On the W4 it doesn't really matter that much; claiming 1 instead of zero only means that the employer will withhold less in taxes, and many people report a different number than the allowance calculator (which the IRS doesn't see) computes. What does matter is that you know your dependency status for the year when it comes time to actually file your return. If you can be claimed as a dependent on someone else's return, you cannot claim your own exemption - even if that other person does not claim you.

-

How do I fill out a Form 10BA if I lived in two rented homes during the previous year as per the rent agreement? Which address and landlord should I mention in the form?

you should fill out the FORM 10BA, with detail of the rented house, for which you are paying more rent than other.To claim Section 80GG deduction, the following conditions must be fulfilled by the taxpayer:HRA Not Received from Employer:- The taxpayer must not have received any house rent allowance (HRA) from the employer.Not a Home Owner:- The taxpayer or spouse or minor child must not own a house property. In case of a Hindu Undivided Family (HUF), the HUF must not own a house property where the taxpayer resides.Form 10BA Declaration:- The taxpayer must file a declaration in Form 10BA that he/she has taken a residence on rent in the previous year and that he/she has no other residence.format of form-10BA:-https://www.webtel.in/Image/Form...Amount of Deduction under Section 80GG:-Maximum deduction under Section 80GG is capped at Rs.60,000. Normally, the deduction under Section 80GG is the lower of the following three amounts :-25% of Adjusted Total IncomeRent Paid minus 10% of Adjusted Total IncomeRs.5000 per Month

-

One of my friends lives far away from my school but he still wants to go to this school. He is using our address. How do we fill out the school form? We don't know what to exactly put on the form, we need massive help. We need to finish this today.

My district has a window of time that allows students to transfer to chosen schools. Almost all transfers are accepted.There is a specific procedure to do this correctly.If the student lives in a different district, they have to officially notify that district that they are planning on going to a neighboring district. Paperwork must be signed by both districts.Please contact all the districts involved. They can help you with the steps.Each year the student must reapply for the transfer. My district only denies transfers when attendance or behavior has been an issue.

-

How do I fill out form i-9 if I don't reside in the US or if I'm not a US citizen? Is there an alternative form for this for non-US residents? I live in Kenya and I'm a Kenyan citizen.

Employees who do not work in the U.S. are not required to complete an I-9, nor are employers required to keep an I-9 on file for them.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the living will form

How to generate an eSignature for your Living Will Form online

How to generate an eSignature for the Living Will Form in Google Chrome

How to create an eSignature for signing the Living Will Form in Gmail

How to generate an eSignature for the Living Will Form from your smart phone

How to generate an eSignature for the Living Will Form on iOS devices

How to create an eSignature for the Living Will Form on Android

People also ask

-

What is a Living Will PDF and how can it be used?

A Living Will PDF is a legal document that outlines your healthcare preferences in case you become unable to communicate your wishes. By using airSlate SignNow, you can easily create, customize, and sign your Living Will PDF to ensure your medical decisions are respected.

-

How can I create a Living Will PDF using airSlate SignNow?

Creating a Living Will PDF with airSlate SignNow is straightforward. Simply select a template, fill in your details, and customize it according to your preferences. Once completed, you can eSign the document and download it as a PDF.

-

Is there a cost associated with creating a Living Will PDF on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include the ability to create and manage your Living Will PDF. You can choose a plan that fits your needs, ensuring you have access to essential features at a cost-effective rate.

-

Can I store my Living Will PDF securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including your Living Will PDF. This ensures your sensitive information is protected and easily accessible whenever you need it.

-

Does airSlate SignNow offer templates for a Living Will PDF?

Yes, airSlate SignNow provides a variety of templates specifically designed for creating a Living Will PDF. These templates help streamline the process, ensuring that you include all necessary information while saving time.

-

Can I share my Living Will PDF with my healthcare provider through airSlate SignNow?

Yes, you can easily share your Living Will PDF with your healthcare provider directly through airSlate SignNow. This feature allows for seamless communication and ensures that your wishes are known and documented.

-

Are there any integrations available for managing my Living Will PDF?

Yes, airSlate SignNow integrates with various applications that can help you manage your Living Will PDF. These integrations enhance your workflow, allowing you to connect with tools you already use, making document management more efficient.

Get more for Living Will Pdf

Find out other Living Will Pdf

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document