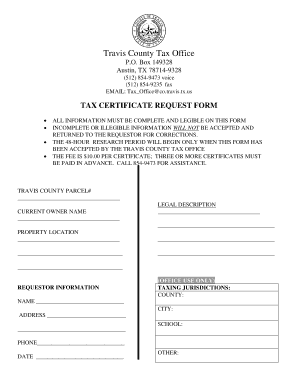

Travis County Tax Certificate Request Form

What is the Travis County Tax Certificate Request

The Travis County Tax Certificate Request is an official document that certifies the status of property taxes for a specific property within Travis County, Texas. This certificate is essential for various transactions, including real estate sales, refinancing, and obtaining loans. It provides information about any outstanding taxes, liens, or other encumbrances on the property. Understanding this request is crucial for property owners and potential buyers to ensure that they are fully informed about the tax obligations associated with a property.

How to use the Travis County Tax Certificate Request

Using the Travis County Tax Certificate Request involves several steps. First, determine the specific property for which you need the tax certificate. Next, gather the necessary information, such as the property address and the owner's name. You can then submit your request through the appropriate channels, which may include online forms, mail, or in-person visits to the county tax office. Once submitted, the county will process your request and provide the tax certificate, which can be used for legal and financial purposes.

Steps to complete the Travis County Tax Certificate Request

Completing the Travis County Tax Certificate Request requires following a systematic process:

- Identify the property by its address and owner details.

- Access the Travis County tax office website or visit in person to find the request form.

- Fill out the form with accurate information regarding the property.

- Submit the completed form along with any required fees, either online, by mail, or in person.

- Wait for processing, which typically takes a few business days.

Legal use of the Travis County Tax Certificate Request

The Travis County Tax Certificate Request serves a legal purpose by providing verified information regarding property tax status. This certificate can be used in various legal contexts, such as real estate transactions, where it assures buyers and lenders that there are no outstanding tax liabilities. It is important to ensure that the certificate is obtained through proper channels to maintain its legal validity.

Required Documents

To successfully submit a Travis County Tax Certificate Request, you may need to provide certain documents. These typically include:

- A completed tax certificate request form.

- Proof of identity, such as a government-issued ID.

- Payment for any associated fees.

- Additional documentation that may verify ownership or interest in the property.

Who Issues the Form

The Travis County Tax Certificate Request form is issued by the Travis County Appraisal District or the county tax office. These offices are responsible for managing property tax assessments and ensuring that all tax-related documents are accurate and up to date. It is advisable to contact them directly for the most current information regarding the request process and any specific requirements.

Quick guide on how to complete travis county tax certificate request

Easily prepare Travis County Tax Certificate Request on any device

Managing documents online has become increasingly popular for both organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without delays. Manage Travis County Tax Certificate Request effortlessly on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Travis County Tax Certificate Request effortlessly

- Locate Travis County Tax Certificate Request and click Get Form to begin.

- Leverage the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Travis County Tax Certificate Request to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the travis county tax certificate request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax certificate in Travis County?

A tax certificate in Travis County is an official document that provides proof of payment or delinquency of property taxes. It serves to confirm the tax status of a property, which is essential for buyers and lenders. Obtaining a tax certificate is important for ensuring that you are meeting all regulatory requirements when purchasing property.

-

How can airSlate SignNow help me obtain a tax certificate in Travis County?

airSlate SignNow streamlines the process of obtaining a tax certificate in Travis County by allowing you to electronically sign and send documents efficiently. Our platform simplifies document management, making it easier to gather necessary approvals and submit requests. With our solution, you can expedite the process and ensure compliance with local taxation laws.

-

What are the costs associated with acquiring a tax certificate in Travis County?

The costs for acquiring a tax certificate in Travis County can vary based on property type and the services needed. Typically, fees can range from minimal application fees to additional charges for late payments. Using airSlate SignNow can help save time and reduce overall operating costs when dealing with tax-related documentation.

-

What features does airSlate SignNow offer for managing tax certificates?

airSlate SignNow includes features such as document templates, electronic signatures, and automatic reminders that are ideal for managing tax certificates in Travis County. These features enhance efficiency by ensuring that all necessary documentation is completed accurately and on time. Our platform also supports secure online storage for easy access to your records.

-

Is airSlate SignNow compliant with legal requirements for tax certificates in Travis County?

Yes, airSlate SignNow is fully compliant with legal requirements for procuring tax certificates in Travis County. Our adherence to legal standards ensures that your electronically signed documents hold up in court and meet all local regulations. Using our platform gives you peace of mind that you're following the law when obtaining your tax certificates.

-

Can I integrate airSlate SignNow with other software for tax certificate processing?

Absolutely! airSlate SignNow offers seamless integrations with various software applications that facilitate tax certificate processing in Travis County. This allows you to connect with accounting tools, document management systems, and customer relationship management software. Such integrations enhance your workflow and improve efficiency in handling tax-related documents.

-

What are the benefits of using airSlate SignNow for tax certificates in Travis County?

Using airSlate SignNow for tax certificates in Travis County offers numerous benefits, including increased efficiency, improved document security, and reduced turnaround time. Our platform’s user-friendly interface simplifies the process, allowing you to focus on core business activities without being bogged down by paperwork. Furthermore, the cost-effective solution helps businesses save money while accessing vital documents.

Get more for Travis County Tax Certificate Request

Find out other Travis County Tax Certificate Request

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free