Nyc Htx Form

What is the Nyc Htx Form

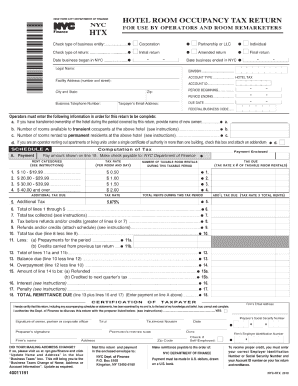

The Nyc Htx Form is a specific document used for various administrative and legal purposes within New York City. This form may be required for applications, permits, or compliance with local regulations. Understanding its purpose is crucial for individuals and businesses to ensure they meet legal requirements and avoid potential penalties. The form typically includes sections for personal information, specific requests, and declarations relevant to the applicant's situation.

How to Use the Nyc Htx Form

Using the Nyc Htx Form involves several key steps. First, ensure you have the correct version of the form, which can be obtained from official city resources. Next, carefully read the instructions provided with the form to understand the requirements and necessary information. Complete the form accurately, providing all requested details. Once filled out, the form can be submitted electronically or via traditional mail, depending on the specific guidelines associated with the form.

Steps to Complete the Nyc Htx Form

Completing the Nyc Htx Form requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Download the latest version of the Nyc Htx Form from an official source.

- Review the instructions carefully to understand what information is required.

- Fill in your personal details accurately, ensuring all sections are completed.

- Double-check your entries for accuracy and completeness.

- Submit the form as instructed, either online or by mailing it to the designated address.

Legal Use of the Nyc Htx Form

The Nyc Htx Form holds legal significance when completed and submitted according to the prescribed guidelines. For the form to be considered valid, it must be filled out accurately and signed where required. Compliance with local laws and regulations is essential, as improper use of the form can lead to penalties or denial of requests. Utilizing a reliable eSignature platform can enhance the legal standing of the form by ensuring secure and compliant electronic signatures.

Key Elements of the Nyc Htx Form

Several key elements are essential to the Nyc Htx Form. These include:

- Personal Information: This section typically requires the applicant's name, address, and contact details.

- Purpose of the Form: Clearly state the reason for submitting the form, whether it is for a permit, application, or compliance.

- Signature: A signature is often required to validate the information provided and confirm the applicant's intent.

- Supporting Documents: Any additional documentation that may be required to support the application must be included.

Form Submission Methods

The Nyc Htx Form can be submitted through various methods, depending on the specific requirements outlined in the form's instructions. Common submission methods include:

- Online Submission: Many forms can be submitted electronically through designated city websites, allowing for faster processing.

- Mail: If online submission is not an option, the form can be printed and mailed to the appropriate office.

- In-Person: Certain situations may require individuals to submit the form in person at designated locations.

Quick guide on how to complete nyc htx form

Effortlessly Prepare Nyc Htx Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It presents an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the desired form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Handle Nyc Htx Form on any device with the airSlate SignNow apps for Android or iOS, and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Nyc Htx Form

- Obtain Nyc Htx Form and click on Get Form to begin.

- Make use of the tools available to fill out your form.

- Highlight signNow sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide on how you wish to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Nyc Htx Form while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc htx form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nyc Htx Form and why is it important?

The Nyc Htx Form is a critical document used in various business processes within New York City. It ensures compliance and proper record-keeping for transactions and agreements. Understanding this form is essential for any business operating in NYC.

-

How can airSlate SignNow help with the Nyc Htx Form?

airSlate SignNow streamlines the process of completing and signing the Nyc Htx Form. With our user-friendly platform, you can easily fill out, eSign, and share the form digitally, reducing paperwork and saving time for your business.

-

Is there a cost associated with using airSlate SignNow for the Nyc Htx Form?

Yes, airSlate SignNow offers several pricing plans tailored to various business needs. Each plan provides features that facilitate the completion and management of documents like the Nyc Htx Form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Nyc Htx Form?

AirSlate SignNow provides features such as templates, document sharing, real-time tracking, and secure storage, all specifically designed to manage the Nyc Htx Form effectively. These tools enhance collaboration and ensure that all stakeholders can access and sign the document easily.

-

Can I integrate airSlate SignNow with other software for the Nyc Htx Form?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software applications, allowing you to connect your workflows when managing the Nyc Htx Form. Whether it's CRM systems or project management tools, integration simplifies your document processes.

-

What are the benefits of using airSlate SignNow for the Nyc Htx Form?

Using airSlate SignNow for the Nyc Htx Form offers multiple benefits, including improved efficiency and reduced turnaround time for document processing. Additionally, the platform enhances security and compliance, ensuring your forms are handled safely.

-

Is airSlate SignNow suitable for small businesses needing the Nyc Htx Form?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Its cost-effective solution simplifies filling out the Nyc Htx Form, making it an excellent choice for those looking to optimize their document workflow.

Get more for Nyc Htx Form

- Iras form

- Pt 401 form 17980

- Advance health care directive university of hawaii hawaii form

- Latitude and longitude grid scott foresman social studies form

- Registration form merrimack valley housing partnership mvhp

- Labor payment affidavit property name property loc form

- Fashion contract template form

- Fashion stylist contract template form

Find out other Nyc Htx Form

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free