PT 021 Property Tax Division Propertytax Utah Form

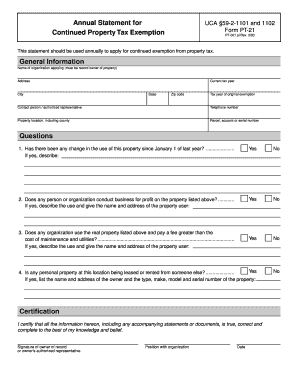

What is the PT 021 Property Tax Division Propertytax Utah

The PT 021 Property Tax Division Propertytax Utah form is a crucial document used by property owners in Utah to report property tax information. This form is essential for ensuring compliance with state tax regulations and helps determine the assessed value of properties for tax purposes. It is primarily utilized by individuals and businesses who own real estate within the state, allowing them to declare property details and any applicable exemptions. Understanding the purpose and requirements of this form is vital for accurate tax reporting and to avoid potential penalties.

Steps to complete the PT 021 Property Tax Division Propertytax Utah

Completing the PT 021 Property Tax Division Propertytax Utah form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding your property, including its location, size, and any improvements made. Next, fill out the form carefully, providing details as required in each section. It is important to review the form for any errors or omissions before submission. Finally, submit the completed form by the specified deadline, either online or via mail, depending on the submission options available.

Legal use of the PT 021 Property Tax Division Propertytax Utah

The legal use of the PT 021 Property Tax Division Propertytax Utah form is governed by state tax laws. This form must be completed accurately to ensure that property owners are in compliance with tax regulations. Failure to submit the form or providing incorrect information can lead to penalties, including fines or increased tax assessments. It is essential to understand the legal implications of this form and to ensure that all information provided is truthful and complete, as inaccuracies can result in legal consequences.

Form Submission Methods (Online / Mail / In-Person)

The PT 021 Property Tax Division Propertytax Utah form can be submitted through various methods, providing flexibility for property owners. Online submission is often the most efficient option, allowing for quick processing and confirmation. Alternatively, property owners may choose to mail the completed form to the appropriate tax authority. In some cases, in-person submission may be available, allowing for direct interaction with tax officials. It is important to check the specific submission guidelines for the most current options and any associated deadlines.

Required Documents

When completing the PT 021 Property Tax Division Propertytax Utah form, certain documents may be required to support the information provided. These documents can include proof of property ownership, recent property tax assessments, and any relevant exemption certificates. Having these documents readily available will help ensure a smooth completion process and can aid in resolving any questions that may arise during the review of the form. It is advisable to verify the specific documentation requirements with the local tax authority.

Key elements of the PT 021 Property Tax Division Propertytax Utah

The PT 021 Property Tax Division Propertytax Utah form contains several key elements that must be accurately completed. These include the property owner's name, address, and contact information, as well as detailed descriptions of the property itself, such as its type, size, and any improvements. Additionally, the form may require information about any exemptions being claimed, such as those for veterans or senior citizens. Understanding these key elements is essential for ensuring that the form is filled out correctly and complies with state regulations.

Eligibility Criteria

Eligibility criteria for using the PT 021 Property Tax Division Propertytax Utah form typically include property ownership within the state of Utah. Property owners must also meet specific requirements related to the type of property being reported, such as residential, commercial, or agricultural classifications. Certain exemptions may have additional eligibility requirements, such as age or disability status. It is important for property owners to review these criteria to ensure they qualify for any exemptions and to complete the form accurately.

Quick guide on how to complete pt 021 property tax division propertytax utah

Prepare PT 021 Property Tax Division Propertytax Utah effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers a fantastic environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle PT 021 Property Tax Division Propertytax Utah on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to alter and eSign PT 021 Property Tax Division Propertytax Utah with ease

- Obtain PT 021 Property Tax Division Propertytax Utah and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign PT 021 Property Tax Division Propertytax Utah and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pt 021 property tax division propertytax utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PT 021 Property Tax Division Propertytax Utah?

The PT 021 Property Tax Division Propertytax Utah is a specific form used for property tax assessment in Utah. It allows property owners to understand their tax obligations and ensures they are compliant with local regulations. Utilizing this form can help streamline the taxation process and avoid potential legal issues.

-

How does airSlate SignNow simplify the signing process for the PT 021 Property Tax Division Propertytax Utah?

airSlate SignNow simplifies the signing process by providing an intuitive platform for eSigning the PT 021 Property Tax Division Propertytax Utah documents. Users can easily upload and send documents for signatures, ensuring a quick and efficient process. This eliminates the need for physical paperwork and allows for faster transactions.

-

What are the pricing options for using airSlate SignNow with the PT 021 Property Tax Division Propertytax Utah?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, ensuring affordability when handling the PT 021 Property Tax Division Propertytax Utah. Plans come with various features, allowing businesses to choose the one that best fits their requirements. Additionally, you can take advantage of a free trial to explore the service.

-

Can airSlate SignNow integrate with other software for managing PT 021 Property Tax Division Propertytax Utah documents?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage PT 021 Property Tax Division Propertytax Utah documents. These integrations ensure that you can connect with your existing workflow efficiently, saving you time and effort in document management and signature collection.

-

What benefits does airSlate SignNow offer for handling the PT 021 Property Tax Division Propertytax Utah?

Using airSlate SignNow for the PT 021 Property Tax Division Propertytax Utah provides numerous benefits, including increased efficiency and improved compliance. The platform allows users to easily track documents, manage signing workflows, and ensures that all necessary approvals are obtained on time. This ultimately helps businesses to maintain accurate records.

-

Is airSlate SignNow secure for signing PT 021 Property Tax Division Propertytax Utah documents?

Absolutely, airSlate SignNow ensures high levels of security for all documents, including the PT 021 Property Tax Division Propertytax Utah. The platform employs advanced encryption and authentication measures to protect sensitive information, giving you peace of mind while managing your property tax documents. Compliance with legal standards is also a priority.

-

How quickly can I send and receive signed PT 021 Property Tax Division Propertytax Utah documents with airSlate SignNow?

With airSlate SignNow, you can send and receive signed PT 021 Property Tax Division Propertytax Utah documents in a matter of minutes. The platform’s user-friendly interface allows for swift document preparation and sending, ensuring that you won’t experience unnecessary delays. You will be notified as soon as the document is signed, allowing for prompt follow-up.

Get more for PT 021 Property Tax Division Propertytax Utah

- Innihaldslisti og flutningsfyrirmli packing list and shipping form

- Hollywood gaming manning valley race coursehorseme form

- Fillable online application for excess over primary policy form

- Photon international gmbh form

- Download the scholarship application here save 2nd base form

- Onlinebanking belizebank com form

- Warenbegleitschein herbert waldmann gmbh amp co kg form

- Plan financial budget sexy staci taurus sho sporting goods store in form

Find out other PT 021 Property Tax Division Propertytax Utah

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation