Sstgb Form F0003 Exemption Certificate State of Tennessee

Understanding the SSTGB Form F0003 Exemption Certificate in Tennessee

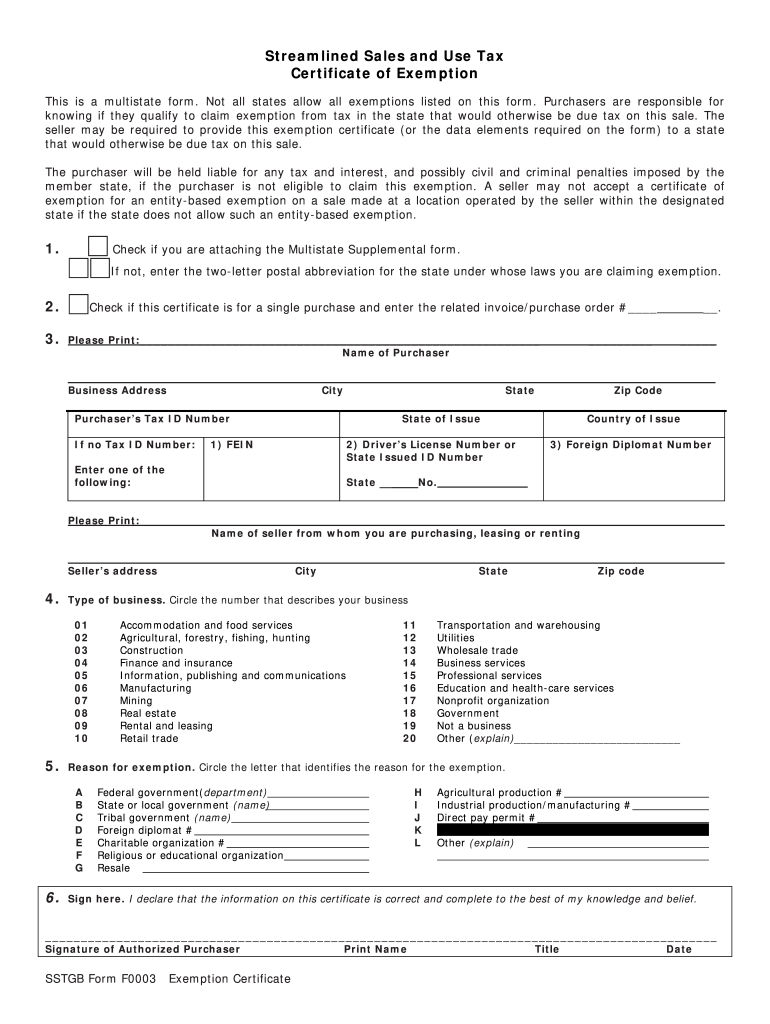

The SSTGB Form F0003 is a crucial document for businesses in Tennessee seeking tax exemption. This form serves as a certificate of exemption, allowing eligible entities to make purchases without incurring sales tax. It is primarily used by organizations that qualify under specific criteria set by the state, such as non-profit organizations, government agencies, and certain educational institutions. Understanding the purpose and requirements of this form is essential for businesses aiming to optimize their tax obligations.

Steps to Complete the SSTGB Form F0003 Exemption Certificate

Completing the SSTGB Form F0003 involves several important steps to ensure accuracy and compliance. Begin by gathering necessary information, including the buyer's name, address, and the type of exemption being claimed. Next, clearly indicate the reason for the exemption, referencing the applicable statute. After filling out the form, both the buyer and seller must sign it to validate the transaction. It is advisable to keep a copy for your records, as this may be required for future audits or inquiries.

Eligibility Criteria for the SSTGB Form F0003 Exemption Certificate

To qualify for the SSTGB Form F0003 exemption, businesses must meet specific eligibility criteria outlined by the Tennessee Department of Revenue. Generally, organizations that are non-profit, educational, or governmental in nature may qualify. Additionally, certain purchases related to the organization's mission may be exempt. It is essential to review the guidelines carefully to determine if your organization meets the necessary requirements before submitting the form.

Legal Use of the SSTGB Form F0003 Exemption Certificate

The legal use of the SSTGB Form F0003 is governed by Tennessee state law. This form must be used in compliance with the regulations set forth by the Department of Revenue. Incorrect use of the exemption certificate can lead to penalties, including back taxes and fines. Therefore, it is crucial to ensure that the form is filled out correctly and used only for eligible purchases. Understanding the legal implications helps protect both the buyer and seller during transactions.

How to Obtain the SSTGB Form F0003 Exemption Certificate

Obtaining the SSTGB Form F0003 is a straightforward process. The form can typically be downloaded from the Tennessee Department of Revenue's official website. Alternatively, businesses can request a physical copy from their local revenue office. It is important to ensure that you are using the most current version of the form, as outdated forms may not be accepted. Once obtained, follow the completion steps to ensure proper use.

Examples of Using the SSTGB Form F0003 Exemption Certificate

There are various scenarios in which the SSTGB Form F0003 can be utilized. For instance, a non-profit organization purchasing supplies for a community event may present this form to avoid sales tax. Similarly, a government agency acquiring equipment for public use can use the exemption certificate to facilitate tax-free transactions. Understanding these examples can help organizations effectively apply the exemption in their purchasing practices.

Quick guide on how to complete tn form certificate exemption

Accomplish Sstgb Form F0003 Exemption Certificate State Of Tennessee effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Sstgb Form F0003 Exemption Certificate State Of Tennessee on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and electronically sign Sstgb Form F0003 Exemption Certificate State Of Tennessee with ease

- Find Sstgb Form F0003 Exemption Certificate State Of Tennessee and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, the exhausting search for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Sstgb Form F0003 Exemption Certificate State Of Tennessee and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Where can I get the form for migration certificate?

Migration is issued by the Universities themselves.The best way is to inquire your college they will guide you further.In case you happen to be from A.P.J Abdul Kalam Technical Universityhere is the link to get it issued online.Hope it helpsStudent Service (Dashboard) Dr. A.P.J. Abdul Kalam Technical University (Lucknow)Regards

-

As a Canadian working in the US on a TN-1 visa should I fill out the IRS Form W-8BEN or W9?

Use the W-9. The W-8BEN is used for cases where you are not working in the U.S., but receiving income relating to a U.S. Corporation, Trust or Partnership.

Create this form in 5 minutes!

How to create an eSignature for the tn form certificate exemption

How to make an eSignature for your Tn Form Certificate Exemption online

How to create an eSignature for your Tn Form Certificate Exemption in Chrome

How to make an eSignature for signing the Tn Form Certificate Exemption in Gmail

How to generate an electronic signature for the Tn Form Certificate Exemption from your smartphone

How to generate an electronic signature for the Tn Form Certificate Exemption on iOS

How to generate an eSignature for the Tn Form Certificate Exemption on Android devices

People also ask

-

What is the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

The Sstgb Form F0003 Exemption Certificate State Of Tennessee is a document used to signNow that certain sales are exempt from sales tax in the state of Tennessee. This form is essential for businesses looking to make tax-exempt purchases, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

airSlate SignNow simplifies the process of completing and signing the Sstgb Form F0003 Exemption Certificate State Of Tennessee digitally. Our platform allows users to easily fill out the form, obtain necessary signatures, and securely store the document for future reference.

-

Is there a cost associated with using airSlate SignNow for the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

Yes, while airSlate SignNow offers various pricing plans, users can benefit from a cost-effective solution for managing the Sstgb Form F0003 Exemption Certificate State Of Tennessee. We also provide a free trial to explore our features before committing to a subscription.

-

What features does airSlate SignNow offer for managing the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

airSlate SignNow includes features such as customizable templates, real-time tracking, and automated reminders for the Sstgb Form F0003 Exemption Certificate State Of Tennessee. These tools enhance workflow efficiency and ensure timely compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

Absolutely! airSlate SignNow seamlessly integrates with various tools and platforms, making it easy to manage the Sstgb Form F0003 Exemption Certificate State Of Tennessee alongside your existing software. This integration enhances productivity and streamlines document management.

-

What are the benefits of using airSlate SignNow for the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

Using airSlate SignNow for the Sstgb Form F0003 Exemption Certificate State Of Tennessee provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. Our user-friendly platform makes it easier to manage tax-exempt transactions.

-

How secure is the information I submit with the Sstgb Form F0003 Exemption Certificate State Of Tennessee?

Security is a top priority at airSlate SignNow. When you submit the Sstgb Form F0003 Exemption Certificate State Of Tennessee, your information is protected with advanced encryption and secure storage, ensuring that your sensitive data remains confidential and safe.

Get more for Sstgb Form F0003 Exemption Certificate State Of Tennessee

- Usdepartmentoftheyreasuryfms form fms treas

- Florida lien waiver release forms

- Mariners national insurance questionnaire form

- Sample quit claim deed form nevada

- Roundpoint mortgage borrow assistance fax number form

- Scrap tire survey form trucktirescom

- Fsis form 9290 1 food safety and inspection service fsis usda

- Suffolk county community college student appeal of cancellation of financial aid www3 sunysuffolk form

Find out other Sstgb Form F0003 Exemption Certificate State Of Tennessee

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation