Work Authorization Form Contractor

What is the Work Authorization Form Contractor

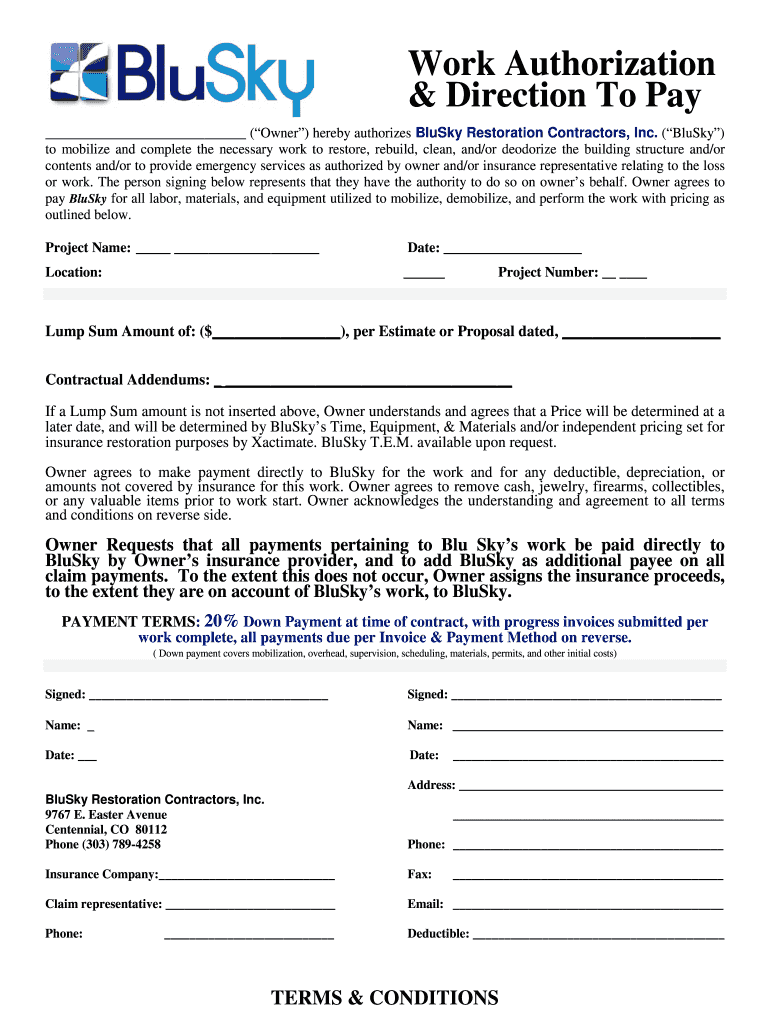

The contractor work authorization form is a legal document that grants permission for a contractor to perform specific tasks or services on behalf of a client. This form outlines the scope of work, payment terms, and timelines, ensuring that both parties understand their obligations. It serves as a binding agreement that protects the rights of both the contractor and the client, making it crucial for any construction or service-related project.

How to use the Work Authorization Form Contractor

Using the contractor work authorization form involves several key steps. First, ensure that all relevant details are accurately filled out, including the contractor's name, contact information, and a detailed description of the work to be performed. Next, both parties should review the terms and conditions, confirming their understanding and agreement. Once finalized, both the contractor and the client should sign the form, either electronically or in print, to make it legally binding.

Steps to complete the Work Authorization Form Contractor

Completing the contractor work authorization form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary information, including project details and contractor credentials.

- Clearly outline the scope of work, including specific tasks and deliverables.

- Define payment terms, including total cost, payment schedule, and acceptable payment methods.

- Include timelines for project milestones and completion dates.

- Review the form with all parties involved to ensure clarity and agreement.

- Sign the form to finalize the authorization.

Key elements of the Work Authorization Form Contractor

Several key elements must be included in the contractor work authorization form to ensure its effectiveness:

- Parties Involved: Names and contact information of both the contractor and the client.

- Scope of Work: A detailed description of the tasks to be performed.

- Payment Terms: Total cost, payment methods, and schedule.

- Timeline: Start and completion dates, along with any milestones.

- Signatures: Both parties must sign to validate the agreement.

Legal use of the Work Authorization Form Contractor

The legal use of the contractor work authorization form is essential for protecting both parties involved in a project. This form must comply with relevant state and federal laws to ensure enforceability. By clearly outlining the terms of the agreement and obtaining signatures, the form acts as a legal safeguard, enabling parties to resolve disputes and clarify responsibilities if issues arise during the project.

Examples of using the Work Authorization Form Contractor

Examples of the contractor work authorization form's use can vary across different scenarios. For instance, a homeowner may use the form to authorize a contractor to remodel their kitchen, detailing the specific tasks and payment schedule. Similarly, a business may employ the form to engage a contractor for landscaping services, specifying the work to be done and the timeline for completion. These examples highlight the form's versatility in various contracting situations.

Quick guide on how to complete work authorization contract form

Discover how to navigate the Work Authorization Form Contractor completion effortlessly with this simple guide

Online filing and form completion are gaining traction and becoming the preferred choice for numerous users. It presents numerous advantages over outdated printed documents, such as convenience, time efficiency, enhanced precision, and security.

With platforms like airSlate SignNow, you can locate, modify, validate, and streamline your Work Authorization Form Contractor without the hassle of endless printing and scanning. Follow this brief guide to begin and complete your document.

Utilize these steps to obtain and complete Work Authorization Form Contractor

- Begin by clicking the Get Form button to access your form in our editor.

- Observe the green indicator on the left that highlights essential fields so you don’t overlook them.

- Make use of our professional tools to annotate, modify, sign, secure, and refine your form.

- Protect your document or convert it into a fillable form with the appropriate tab features.

- Review the form and check for mistakes or inconsistencies.

- Click DONE to complete the editing process.

- Rename your file or leave it as is.

- Choose the storage service where you would like to save your form, send it via USPS, or click the Download Now button to save your document.

If Work Authorization Form Contractor isn’t what you were looking for, feel free to explore our extensive collection of pre-imported templates that you can complete with ease. Check out our platform today!

Create this form in 5 minutes or less

FAQs

-

What is the craziest lie a customer has come up with when calling your work to complain about you?

I was working as a Census taker for Statistics Canada during the national census of 1996 when one member of the public made a false complaint against me.To give the necessary background: Each census taker was assigned a different territory. We were each provided a detailed map of our own territory, clearly marking out its boundaries. Every residence within that territory was depicted on the map as a little square or rectangle. And for each street within our territory, it listed the relevant range of house numbers for each side of that street (e.g. one territory might end at numbers 49 and 50 Random Street, the next territory started across the intersection at numbers 51 and 52 Random Street.) If everyone got together in a huge field, they could potentially piece together a cool, giant detailed map of Canada.A big part of our job was physically delivering a census form to every separate lot within our territory with a residence on it. If the map showed a lot with a newly built home as empty, a form still needed to be delivered to that residence, and then we needed to mark the missing residence on the map of our territory. The maps were extremely accurate, and I had to mark maybe one new home on mine.The census was meant to be a snapshot of Canada on a particular day. If someone owned multiple residences, they needed to fill out the form for each property with information for that residence as of census day. So if the entire family stayed in one house on that date, the information for their second house would be that it didn’t have any residents as of census day — there was no need to fill out any of the additional data on that form. If someone’s son spent that date in the spare house? Then the form would reflect that the second home had one resident as of that date, and that son’s data would need to be entered on that form.People didn’t have to fill out the forms on the spot, but could mail it in (at no cost) by the deadline, some date following the “census date”. If they had any questions about filling out the form, I could try to answer their questions while I was at their door, or they could call the help line provided on the form itself.There was a different, and longer, census form for farms. It collected some agricultural data as well as data about the residence and its inhabitants. If someone groaned about having to fill out the longer form, I’d point out that they only needed to provide estimates for most of the extra questions (statistically, if someone slightly overestimated one figure, someone else would balance that out by underestimating). I’d also point out they could probably get all the information they required from their last income tax form. If someone hadn’t kept their income tax form and was concerned about providing any inconsistent data? I told them not to worry, because Revenue Canada is not allowed to see their census form, Stats Can is not allowed to see their income tax form (which is why they don’t just take the data from that), the data is all aggregated and, again, Estimates Are OK.This groaning was far from universal — strangely enough, I had to talk some people who had a hobby garden in their backyards out of trying to claim the longer agricultural form to fill out — but I quickly became used to having some people act reluctant about accepting the longer agricultural form.So, on with the story at hand: During one of my trips I came to one farm with clearly only one entrance to the residence, from a road well within my territory, to a home well within my territory. With agricultural form in hand, I knocked on the door and it was answered by a woman. I explained I was here to drop off a form for the census. She looked at the form then told me she will not fill it out. No explanation. She just said she would not fill it out.This wasn’t entirely unusual or unexpected (although up to that point I faced zero resistance — only, in a couple of cases, some antsy migrant workers hurriedly running off to hide in barns.Some people think they aren’t required to respond to the census and consider it to be the government being too “big brother”. So I politely explained to the woman that all the information she provides will be kept private, and won’t be shared with any other government authorities. I was about to explain there are benefits to the census, e.g., ensuring that the appropriate level of health services, police services, etc, are provided to different areas. But before I could, she again said “There is no requirement for me to fill out the form.”So I read to her from a paper we were provided politely explaining that a census form is required to be filled out by every residence in Canada.Then she says she was already given a form. I asked if someone came up to this property? (Because that would mean another census taker erroneously came into my territory). No.Finally, she explained that she had received special permission from someone in the government to not fill out the agricultural form. Taken aback, I asked her where she got that advice from, and she said she had spoken to someone from the census office, and she was told that she wouldn’t be required to fill out a form for this address because they already had a form for another part of their farm operating out of the neighbouring territory.So, I thought to myself “why the hell didn’t you tell me this to begin with instead of wasting everyone’s time?”, but instead I said to her something like “Okay, I was completely unaware of that. How about I leave a form with you, and you give my supervisor a call at this number. Then if you don’t need to complete the form, just throw it out. He can also let me know if I don’t need to get a form back from you.” She seemed very agreeable to this. So I apologized for taking up her time, and headed off.This was in the days before everyone had mobile phones. So instead of driving home, calling my supervisor, finding my way back to where I had left off (which wasn’t at a convenient intersection), and getting back to the job at hand, I decided to continue going door-to-door and following up the next morning.The next day, before I could call my supervisor, he called me.He was a former highschool principal whom I had the pleasure of working with on other contract jobs with the government (Elections Canada, specifically), so he knew me fairly well. He said to me “Hey, I got a complaint from a woman. Don’t worry about it. I know you, and I think this is completely out of character, but she complained that you were very rude and aggressive. She said you threatened to call in the police and get her fined if she didn’t take a form from you, and other things that strike me as very unlikely.” So I told him my side of the story. He said, “You did the right thing. We verified that part of her farm operation is in the next territory, she’s already received a form for it there, and Stats Can doesn’t need her to fill out a second form. The other operation doesn’t have a separate residence, so she can fill that data in on the one form. I told her she can dispose of the form you left with her, and we’ll follow up on her complaint. As far as I’m concerned, that’s the end of that. Keep up the good work.”

-

Do un-contracted workers have to fill out IRS W4 form?

I have no idea what an “un-contracted worker” is. I am not familiar with that term.Employees working in the U.S. complete a Form W-4.Independent contractors in the U.S. do not. Instead, they usually complete a Form W-9.If unclear on the difference between an employee or an independent contractor, see Independent Contractor Self Employed or Employee

-

How can I fill out the authorization form in Wipro's synergy?

By authorisation form I assume that you mean LOA. Just download the pdf and sign it with stylus or get a printout,sign it and scan the copy.Now upload it!If I my assumption is wrong please provide little clear picture!Thank you!Allah maalik!

-

Which GST form should I fill out for filing a return as a building work contractor?

You need to file GSTR 3b and GSTR 1 ,if it government contract make sure to claim INPUT for TDS deducted amount.

-

Did you fill out the form "1099 misc"? If so, for what purpose? Within the context of work, is it like a contract?

One of the most common reasons you’d receive tax form 1099-MISC is if you are self-employed or did work as an independent contractor during the previous year. The IRS refers to this as “non-employee compensation.”In most circumstances, your clients are required to issue Form 1099-MISC when they pay you $600 or more in any year.As a self employed person you are required to report your self employment income if the amount you receive from all sources totals $400 or more. In this situation, the process of filing your taxes is a little different than a taxpayer who only receives regular employment income reported on a W-2.

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

-

What does the authorization form in Wipro’s Synergy need to be filled out?

I don't exactly remember how the form was looking like in synergy portal. But I hope it is Authorizing Wipro to do background verification on all the details provided by candidate. It needs your name and signature with date.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the work authorization contract form

How to create an electronic signature for the Work Authorization Contract Form in the online mode

How to create an electronic signature for the Work Authorization Contract Form in Chrome

How to make an eSignature for putting it on the Work Authorization Contract Form in Gmail

How to generate an eSignature for the Work Authorization Contract Form straight from your mobile device

How to make an eSignature for the Work Authorization Contract Form on iOS devices

How to generate an eSignature for the Work Authorization Contract Form on Android OS

People also ask

-

What is a Work Authorization Form Contractor?

A Work Authorization Form Contractor is a document used to authorize a contractor to begin work on a specific project. This form outlines the scope of work, payment terms, and any other important details related to the project. By using airSlate SignNow to eSign your Work Authorization Form Contractor, you can streamline the process and ensure all parties are on the same page.

-

How can airSlate SignNow help with my Work Authorization Form Contractor?

airSlate SignNow simplifies the process of creating, sending, and eSigning your Work Authorization Form Contractor. With our user-friendly platform, you can quickly generate custom forms, send them to contractors for signature, and track the process in real-time. This ensures a faster turnaround and enhances communication between all parties involved.

-

Is airSlate SignNow cost-effective for managing Work Authorization Form Contractors?

Yes, airSlate SignNow offers a cost-effective solution for managing your Work Authorization Form Contractor needs. Our pricing plans are designed to fit various business sizes, ensuring you get the best value for your investment. By reducing paperwork and streamlining the signing process, you can save both time and money.

-

What features does airSlate SignNow offer for Work Authorization Form Contractors?

airSlate SignNow provides various features tailored for Work Authorization Form Contractors, including customizable templates, secure eSigning, and automated reminders. These features enhance efficiency and ensure that your documents are signed and returned promptly. Additionally, you can store and manage all your forms securely within the platform.

-

Can I integrate airSlate SignNow with other tools for my Work Authorization Form Contractor?

Absolutely! airSlate SignNow integrates seamlessly with various business tools, such as CRM systems, project management software, and cloud storage services. This means you can easily incorporate your Work Authorization Form Contractor into your existing workflows, enhancing productivity and collaboration.

-

How secure is my Work Authorization Form Contractor when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance with industry standards to protect your Work Authorization Form Contractor and other sensitive documents. You can confidently eSign and share documents, knowing they are secure and accessible only to authorized users.

-

What are the benefits of using airSlate SignNow for Work Authorization Form Contractors?

Using airSlate SignNow for your Work Authorization Form Contractor offers numerous benefits, including faster turnaround times, reduced paper usage, and improved organization. The platform’s intuitive interface allows you to manage your documents efficiently, while automated workflows minimize the risk of errors and delays, ultimately boosting your productivity.

Get more for Work Authorization Form Contractor

Find out other Work Authorization Form Contractor

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document