Dr 563 Sales Tax Exemption Form

What is the Dr 563 Sales Tax Exemption Form

The Dr 563 Sales Tax Exemption Form is a document utilized in the United States to claim exemption from sales tax on certain purchases. This form is typically used by organizations or individuals who qualify for tax-exempt status, such as non-profit organizations, government entities, or specific educational institutions. By submitting this form, eligible parties can avoid paying sales tax on items that are necessary for their operations.

How to use the Dr 563 Sales Tax Exemption Form

Using the Dr 563 Sales Tax Exemption Form involves several key steps. First, ensure that you meet the eligibility criteria for tax exemption. Next, complete the form with accurate information, including details about your organization and the purpose of the purchase. After filling out the form, present it to the seller at the time of purchase. This allows the seller to validate your tax-exempt status and avoid charging sales tax on the transaction.

Steps to complete the Dr 563 Sales Tax Exemption Form

Completing the Dr 563 Sales Tax Exemption Form requires careful attention to detail. Follow these steps:

- Obtain the form from the appropriate state tax authority or download it from their website.

- Fill in your organization's name, address, and tax identification number.

- Indicate the type of exemption you are claiming and provide a brief explanation of the intended use of the purchased items.

- Sign and date the form to certify the information is accurate.

- Keep a copy for your records before submitting it to the seller.

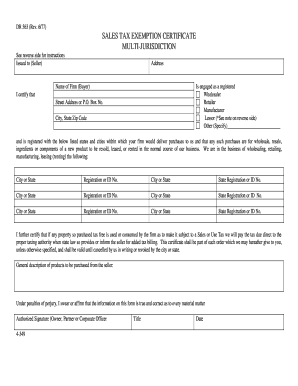

Key elements of the Dr 563 Sales Tax Exemption Form

The Dr 563 Sales Tax Exemption Form includes several important elements that must be completed accurately. Key components include:

- Organization Information: Name, address, and tax identification number of the exempt organization.

- Exemption Type: A clear indication of the reason for the exemption, such as non-profit status or government use.

- Certification: A signature from an authorized representative of the organization, affirming the truthfulness of the information provided.

Legal use of the Dr 563 Sales Tax Exemption Form

The legal use of the Dr 563 Sales Tax Exemption Form is governed by state laws regarding sales tax exemptions. It is essential to use the form correctly to ensure compliance and avoid potential penalties. Misuse of the form, such as claiming exemptions without proper eligibility, can lead to legal consequences, including fines or back taxes owed. Therefore, it is crucial to understand the specific regulations in your state and ensure that the form is used appropriately.

Eligibility Criteria

To qualify for using the Dr 563 Sales Tax Exemption Form, certain eligibility criteria must be met. Generally, eligible entities include:

- Non-profit organizations recognized under IRS guidelines.

- Government agencies at the federal, state, or local level.

- Educational institutions that meet specific requirements.

It is important to verify your organization's status and ensure that it aligns with the criteria set forth by your state’s tax authority.

Quick guide on how to complete dr 563 sales tax exemption form

Finalize Dr 563 Sales Tax Exemption Form effortlessly on any apparatus

Digital document administration has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Dr 563 Sales Tax Exemption Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to amend and eSign Dr 563 Sales Tax Exemption Form with ease

- Locate Dr 563 Sales Tax Exemption Form and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools specifically available through airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Put an end to misplaced or lost documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Dr 563 Sales Tax Exemption Form and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 563 sales tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Dr 563 Sales Tax Exemption Form?

The Dr 563 Sales Tax Exemption Form is a document used by certain entities to claim exemption from sales tax in specific situations. This form provides essential details that help both buyers and sellers ensure compliance with tax regulations while enabling tax-exempt purchases.

-

How can I complete the Dr 563 Sales Tax Exemption Form using airSlate SignNow?

airSlate SignNow offers an intuitive platform for completing the Dr 563 Sales Tax Exemption Form digitally. You can easily fill out the required fields, add signatures, and send it electronically, ensuring a hassle-free experience and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the Dr 563 Sales Tax Exemption Form?

Yes, while airSlate SignNow offers various pricing plans, users can choose one that best fits their needs for managing documents like the Dr 563 Sales Tax Exemption Form. Our pricing is designed to be cost-effective, especially for businesses that frequently handle such forms.

-

What features does airSlate SignNow offer for the Dr 563 Sales Tax Exemption Form?

With airSlate SignNow, you can eSign documents like the Dr 563 Sales Tax Exemption Form, automate workflows, and track document status in real-time. The platform also allows you to store and organize your documents securely for easy access.

-

Can I integrate other software with airSlate SignNow to manage the Dr 563 Sales Tax Exemption Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage the Dr 563 Sales Tax Exemption Form alongside your other business tools. This enhances workflow efficiency and keeps all your documents aligned.

-

How does using airSlate SignNow for the Dr 563 Sales Tax Exemption Form benefit my business?

Using airSlate SignNow for the Dr 563 Sales Tax Exemption Form can signNowly streamline your document processing. By leveraging our eSigning and automation features, businesses can reduce turnaround times, minimize errors, and improve compliance with tax requirements.

-

What types of users can benefit from using the Dr 563 Sales Tax Exemption Form with airSlate SignNow?

Various users can benefit, including small businesses, non-profits, and governmental agencies that require sales tax exemptions. By using airSlate SignNow, these organizations can efficiently manage their tax-exempt transactions through the Dr 563 Sales Tax Exemption Form.

Get more for Dr 563 Sales Tax Exemption Form

- Tutoring session self evaluation form learning assistance lap nku

- Sample customer testimonial release form business forms

- Risk assessment table ready gov ready form

- Rental agreement for self storage space mill creek self storage form

- Referral form for woodinville pediatrics pllc

- Practical examination remuneration bill gujarat technological bb form

- Paris farmers union chicks fill out ampamp sign online form

Find out other Dr 563 Sales Tax Exemption Form

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template