Taraji Sacco Form

What is the Taraji Sacco

The Taraji Sacco is a financial cooperative that provides its members with various financial services, including savings and loans. It operates under the principles of mutual assistance, allowing members to pool their resources for collective benefits. The primary goal of the Taraji Sacco is to foster financial inclusion and empower its members by offering affordable credit and savings options.

How to use the Taraji Sacco

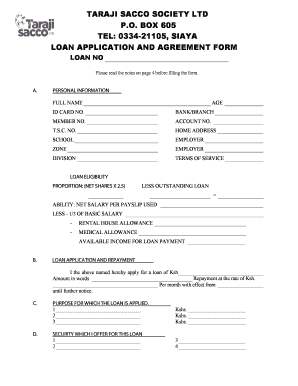

Using the Taraji Sacco involves several straightforward steps. Members can start by registering with the Sacco, which typically requires personal identification and proof of residence. Once registered, members can open a savings account and apply for loans. The application process for loans usually involves filling out the Taraji loan form, which requires details about the loan amount, purpose, and repayment plan.

Steps to complete the Taraji Sacco

Completing the Taraji Sacco forms is essential for accessing services. Here are the steps to follow:

- Gather necessary documents, including identification and proof of income.

- Fill out the Taraji loan form accurately, providing all required information.

- Review the form for completeness and accuracy.

- Submit the form either online or in person, depending on the Sacco's submission methods.

Legal use of the Taraji Sacco

The legal use of the Taraji Sacco is governed by specific regulations that ensure compliance with financial laws. Members must adhere to the terms outlined in the Taraji Sacco's bylaws and any applicable state or federal laws. This includes understanding the legal implications of borrowing and repaying loans, as well as the rights and responsibilities of members.

Key elements of the Taraji Sacco

Several key elements define the Taraji Sacco's operations. These include:

- Membership: Open to individuals who meet specific eligibility criteria.

- Savings: Members are encouraged to save regularly to build their financial security.

- Loans: Access to affordable loans based on savings and repayment capacity.

- Governance: Members have a say in the management and decision-making processes of the Sacco.

Required Documents

When applying for services through the Taraji Sacco, members typically need to provide several documents. These may include:

- Government-issued identification (e.g., driver's license or passport).

- Proof of residence (e.g., utility bill or lease agreement).

- Proof of income (e.g., pay stubs or tax returns).

- Completed Taraji loan form.

Quick guide on how to complete taraji sacco

Complete Taraji Sacco effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without unnecessary delays. Manage Taraji Sacco on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and eSign Taraji Sacco with ease

- Locate Taraji Sacco and then click Get Form to proceed.

- Use the tools available to fill out your form.

- Emphasize key sections of your documents or mask sensitive information with the tools airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to finalize your changes.

- Choose your preferred method of submitting your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Taraji Sacco to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taraji sacco

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is taraji sacco, and how can airSlate SignNow help my business?

Taraji sacco is a financial cooperative that provides various services to its members. By using airSlate SignNow, you can streamline your document signing process, making it easier to manage agreements and contracts related to taraji sacco services. This solution enhances efficiency and reduces paperwork.

-

What are the pricing options available for taraji sacco users through airSlate SignNow?

airSlate SignNow offers several pricing plans to accommodate the needs of taraji sacco users. These plans are designed to be cost-effective and provide various features suited for both small and large businesses. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer that are specifically beneficial for taraji sacco members?

airSlate SignNow provides features such as electronic signatures, document templates, and real-time tracking, all of which can greatly benefit taraji sacco members. These tools facilitate faster transactions and improve compliance with legal standards. Additionally, the user-friendly interface ensures that members can easily navigate the platform.

-

How does airSlate SignNow enhance the security of documents for taraji sacco?

Security is a top priority for airSlate SignNow, especially for sensitive documents related to taraji sacco. The platform uses advanced encryption methods and complies with global security standards to protect your documents. This means your information remains confidential and secure throughout the signing process.

-

Can airSlate SignNow integrate with other systems that taraji sacco uses?

Yes, airSlate SignNow offers seamless integrations with numerous apps and services that taraji sacco may already use. This includes CRM systems, cloud storage, and accounting software. These integrations help ensure a smooth workflow and enhance overall productivity.

-

What are the benefits of using airSlate SignNow for taraji sacco document management?

Using airSlate SignNow for taraji sacco document management simplifies the signing process, signNowly reduces the time spent on paperwork, and minimizes errors. As a cost-effective solution, it allows for better resource allocation and helps businesses stay organized. Furthermore, it enhances collaboration among team members.

-

Is training available for using airSlate SignNow within taraji sacco?

Absolutely! airSlate SignNow provides comprehensive training resources for taraji sacco users, ensuring that they can effectively utilize the platform. These resources include tutorials, webinars, and customer support to address any questions or challenges users may encounter.

Get more for Taraji Sacco

- How to frame your case during voir direbest lawyers form

- In the chancery court of madison county form

- Mississippi probate forms state specificus legal forms

- Public notices calhoun county journal form

- Marilyn newsome individually and as form

- Judgment closing estate form

- Chapter 28a administration of decedents estates article 1 form

- Pursuant to rule 34 of the mississippi rules of civil procedure form

Find out other Taraji Sacco

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document