Chart of Accounts for Restaurant PDF Form

What is the accounting chart of accounts for restaurant PDF?

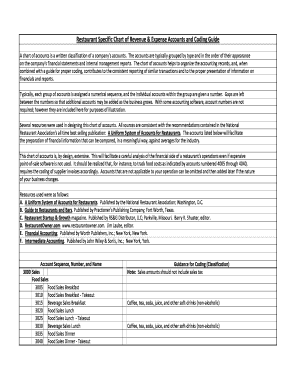

The accounting chart of accounts for restaurant PDF is a structured document that categorizes all financial transactions specific to a restaurant's operations. It serves as a foundational tool for organizing financial data, enabling restaurant owners and managers to track income, expenses, assets, and liabilities effectively. This chart typically includes various account types such as revenue from food and beverage sales, operational costs like labor and supplies, and other financial categories relevant to the restaurant industry. Utilizing this PDF format ensures easy access and sharing among stakeholders, enhancing collaboration and financial transparency.

How to use the accounting chart of accounts for restaurant PDF

To effectively use the accounting chart of accounts for restaurant PDF, start by downloading the document and reviewing its structure. Familiarize yourself with the different categories and account types included. Next, customize the chart to fit your restaurant's specific needs by adding or removing accounts as necessary. As you record transactions, consistently update the chart to reflect accurate financial information. This practice not only aids in day-to-day financial management but also simplifies the preparation of financial reports and tax filings.

Key elements of the accounting chart of accounts for restaurant PDF

Key elements of the accounting chart of accounts for restaurant PDF include:

- Revenue Accounts: Categories for tracking sales from food, beverages, and other services.

- Expense Accounts: Sections for operational costs, including payroll, utilities, and supplies.

- Asset Accounts: Listings for physical assets like equipment, inventory, and property.

- Liability Accounts: Categories for debts and obligations, such as loans and accounts payable.

- Equity Accounts: Sections detailing owner investments and retained earnings.

These elements work together to provide a comprehensive overview of a restaurant's financial health, facilitating informed decision-making.

Steps to complete the accounting chart of accounts for restaurant PDF

Completing the accounting chart of accounts for restaurant PDF involves several steps:

- Download the PDF: Obtain the latest version of the chart from a reliable source.

- Review Existing Accounts: Examine the pre-filled accounts to determine their relevance to your restaurant.

- Customize the Chart: Add or remove accounts based on your specific financial activities and reporting needs.

- Fill in Account Details: Provide necessary information for each account, including account numbers and descriptions.

- Save and Share: Save the completed document and share it with relevant team members for input and approval.

Following these steps ensures that your accounting chart of accounts is tailored to your restaurant's unique financial landscape.

Legal use of the accounting chart of accounts for restaurant PDF

The legal use of the accounting chart of accounts for restaurant PDF is crucial for maintaining compliance with financial reporting standards and tax regulations. This document must accurately reflect all financial transactions to ensure transparency and accountability. In the United States, adhering to Generally Accepted Accounting Principles (GAAP) is essential for legal compliance. Additionally, using a properly structured chart helps in audits and financial reviews, providing a clear trail of financial activities that can be scrutinized by regulatory bodies.

Examples of using the accounting chart of accounts for restaurant PDF

Examples of using the accounting chart of accounts for restaurant PDF include:

- Tracking Sales: Recording daily sales revenue from food and beverages to monitor performance.

- Managing Expenses: Documenting monthly expenses for labor, supplies, and utilities to control costs.

- Preparing Financial Statements: Utilizing the chart to generate income statements and balance sheets for stakeholders.

- Budgeting: Establishing budgets based on historical data from the chart to forecast future financial performance.

These examples illustrate how the accounting chart of accounts can enhance financial management and strategic planning in a restaurant setting.

Quick guide on how to complete chart of accounts for restaurant pdf

Effortlessly prepare Chart Of Accounts For Restaurant Pdf on any device

The management of online documents has gained traction among businesses and individuals. It serves as an ideal sustainable alternative to traditional printed and signed materials, allowing you to access the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without delays. Manage Chart Of Accounts For Restaurant Pdf on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related activity today.

How to update and electronically sign Chart Of Accounts For Restaurant Pdf with ease

- Find Chart Of Accounts For Restaurant Pdf and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Select crucial parts of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Update and electronically sign Chart Of Accounts For Restaurant Pdf and ensure excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chart of accounts for restaurant pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an accounting chart of accounts for a restaurant?

An accounting chart of accounts for a restaurant is a systematic listing of all accounts used to categorize financial transactions. It helps restaurant owners track income, expenses, and profitability effectively. This structured approach is essential for accurate financial reporting and tax compliance.

-

Why is an accounting chart of accounts important for restaurants?

An accounting chart of accounts is crucial for restaurants as it provides a clear framework for organizing financial data. This organization allows restaurant owners to analyze their financial performance, make informed decisions, and maintain control over operational costs. Ultimately, it supports business growth and sustainability.

-

How can airSlate SignNow help with managing the accounting chart of accounts for my restaurant?

airSlate SignNow simplifies document workflows, allowing you to send and eSign critical financial documents associated with your accounting chart of accounts for restaurant management. By streamlining these processes, you can ensure accuracy and efficiency in financial reporting and compliance. This integration can save time and reduce the risk of errors in your accounting practices.

-

What features should I look for in an accounting chart of accounts for restaurants?

When designing an accounting chart of accounts for restaurants, look for features that allow easy tracking of different revenue streams, food and labor costs, and overhead expenses. Additionally, consider the ability to categorize expenses by department and manage inventory efficiently. These features will enhance your financial analysis and reporting capabilities.

-

How can I customize my accounting chart of accounts for my specific restaurant needs?

Customizing your accounting chart of accounts for restaurant operations involves adjusting categories to fit your unique business model. You may want to add specific accounts for different revenue streams, such as dine-in, takeout, or catering services. Utilizing specialized accounting software can help facilitate this customization and ensure your chart meets your restaurant's financial tracking needs.

-

Are there any integrations for accounting software that support a restaurant's chart of accounts?

Yes, many accounting software solutions offer integrations that simplify the management of an accounting chart of accounts for restaurants. Software like QuickBooks or Xero can sync with your operational systems, providing real-time financial updates. This connectivity enables better oversight and reporting of your restaurant's financial health.

-

What are the cost implications of setting up an accounting chart of accounts for my restaurant?

The cost of setting up an accounting chart of accounts for your restaurant can vary depending on the complexity and the accounting software chosen. While some basic setups may be affordable, investing in advanced software and customization can enhance financial insights. It's essential to weigh the long-term benefits against initial setup costs to make an informed decision.

Get more for Chart Of Accounts For Restaurant Pdf

- Comes now plaintiff formerly doing business as and

- Internal revenue code for a certificate of discharge form

- Publication 487 rev 1 2006 internal revenue service form

- Tips on practice in federal court united states district form

- Idaho local district civil rules packet united states courts form

- Smith v union nat life ins co 187 f supp 2d justia law form

- Order granting motion to remand form

- United states 23 january 2015 federal district court texas form

Find out other Chart Of Accounts For Restaurant Pdf

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement