Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1

What is the Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1

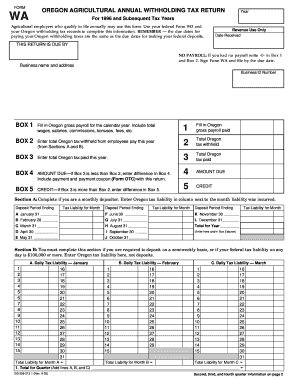

The Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1, is a tax document specifically designed for agricultural employers in Oregon. This form is utilized to report and remit withholding tax from wages paid to employees engaged in agricultural work. It provides the state with essential information regarding the amount withheld and ensures compliance with Oregon tax regulations. Understanding this form is crucial for agricultural businesses to maintain proper tax records and fulfill their legal obligations.

Steps to complete the Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1

Completing the Form WA involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your business details and employee wage data. Next, accurately calculate the total amount withheld for the year. Fill in the required sections of the form, ensuring all figures are correct. After completing the form, review it for any errors before submission. Finally, retain a copy for your records, as it may be needed for future reference or audits.

How to obtain the Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1

The Form WA can be obtained through the Oregon Department of Revenue's official website. It is typically available for download in a PDF format, allowing for easy printing and completion. Additionally, you may request a physical copy by contacting the department directly. Ensure you have the most current version of the form to avoid any compliance issues.

Legal use of the Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1

The legal use of the Form WA is governed by Oregon tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadline. It serves as an official record of tax withheld, which can be referenced in case of audits or inquiries from tax authorities. Proper use of this form helps protect your business from potential penalties associated with non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form WA are crucial for compliance. Typically, the form must be submitted annually, with specific due dates outlined by the Oregon Department of Revenue. It is important to stay informed about any changes to these deadlines to avoid late fees or penalties. Mark your calendar with these important dates to ensure timely filing.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form WA can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the implications of non-compliance is essential for agricultural employers to avoid unnecessary financial burdens. It is advisable to consult with a tax professional if you have concerns regarding compliance.

Quick guide on how to complete form wa oregon agricultural annual withholding tax return 150 206 013 1

Effortlessly prepare Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1 on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct forms and securely store them online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and seamlessly. Handle Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1 with ease

- Obtain Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1 and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1 to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form wa oregon agricultural annual withholding tax return 150 206 013 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1?

Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1 is a required document for agricultural employers in Oregon to report and remit withholding taxes for employees engaged in agricultural work. Understanding this form is crucial for compliance with state tax regulations.

-

How can airSlate SignNow help with Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1?

airSlate SignNow provides an efficient way to complete, sign, and submit Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1. Our platform streamlines the process, ensuring you can manage your withholding tax returns without the typical hassle.

-

What features does airSlate SignNow offer for managing Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1?

Our features include document templates, eSignature capabilities, and easy file sharing to optimize the handling of Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1. You can also automate reminders and track the signing process within our platform.

-

Is there a cost associated with using airSlate SignNow for Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1?

Yes, airSlate SignNow offers a cost-effective subscription model that provides access to all features necessary for managing Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1. We also offer flexible pricing plans to suit various business needs.

-

Can I integrate airSlate SignNow with other software to manage Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1?

Absolutely! airSlate SignNow integrates seamlessly with various software, including accounting and payroll systems that assist in managing Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1. This ensures that your workflow remains uninterrupted and efficient.

-

What are the benefits of using airSlate SignNow for Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1?

Utilizing airSlate SignNow for Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1 enhances accuracy and compliance through automated processes. Additionally, our platform saves time and reduces errors, providing peace of mind for your business’s tax obligations.

-

How secure is airSlate SignNow when handling Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1?

Security is a top priority at airSlate SignNow. When managing Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1, all data is encrypted and complies with industry standards to protect your sensitive information and ensure confidential handling.

Get more for Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1

- Certificate of service pdf 682104962 form

- Bright futures volunteer service work hours log revised 0330 form

- Instruction sheet chiropractic physician form

- Name of good student applicant form

- Careplus over the counter otc products mail order form

- Connecticut prison rape elimination act prea incident form

- Petition to expunge and impound criminal records fee required form

- Reactivate formpersonal ai

Find out other Form WA, Oregon Agricultural Annual Withholding Tax Return, 150 206 013 1

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile