Form 4506 T

What is the Form 4506 T

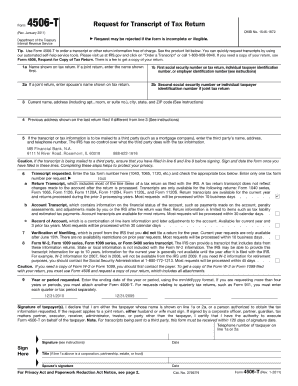

The Form 4506 T, officially known as the Request for Transcript of Tax Return, is a document used by taxpayers in the United States to request a transcript of their tax return information from the Internal Revenue Service (IRS). This form is particularly useful for individuals and businesses who need to verify income for loan applications, mortgage approvals, or other financial purposes. It allows taxpayers to obtain various types of transcripts, including tax return transcripts, account transcripts, and wage and income transcripts, which contain essential information for financial assessments.

How to use the Form 4506 T

Using the Form 4506 T involves several straightforward steps. First, complete the form by providing your personal information, including your name, Social Security number, and address. Specify the type of transcript you need and the tax years for which you are requesting information. Once the form is filled out, you can submit it to the IRS either by mail or electronically, depending on your preference. It is important to ensure that the information provided is accurate to avoid delays in processing your request.

Steps to complete the Form 4506 T

Completing the Form 4506 T requires attention to detail. Start by entering your name and Social Security number in the designated fields. Next, provide your current address and any previous addresses if applicable. Indicate the type of transcript you wish to receive by checking the appropriate box. Specify the tax years for which you need the transcripts. Finally, sign and date the form, and include your phone number for any follow-up. Review the completed form for accuracy before submission to ensure a smooth process.

Legal use of the Form 4506 T

The Form 4506 T is legally binding when completed correctly and submitted to the IRS. It serves as an official request for tax information and must be signed by the taxpayer or their authorized representative. The IRS uses this form to verify the identity of the requester and to ensure that the information is released only to authorized individuals. Compliance with IRS guidelines is essential for the form to be considered valid and legally enforceable.

Form Submission Methods

The Form 4506 T can be submitted to the IRS using various methods. Taxpayers can mail the completed form to the appropriate address listed on the IRS website, which varies based on the state of residence. Additionally, for those who prefer a digital approach, the form can be submitted electronically through authorized e-file providers. This method often results in faster processing times. Ensure that you follow the specific submission guidelines to avoid any issues.

Required Documents

When submitting the Form 4506 T, it is important to have certain documents ready to support your request. Typically, you will need to provide a valid form of identification, such as a driver's license or state ID, to verify your identity. If you are requesting transcripts on behalf of someone else, you may need to include a power of attorney or other legal documentation that authorizes you to make the request. Having these documents prepared can streamline the process and help ensure that your request is processed without delays.

Quick guide on how to complete form 4506 t

Complete Form 4506 T effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 4506 T on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Form 4506 T with ease

- Find Form 4506 T and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form—via email, SMS, or invitation link—or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Modify and electronically sign Form 4506 T and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4506 t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4506 T, and why do I need it?

Form 4506 T is a request form used to obtain a transcript of your tax return from the IRS. Businesses and individuals may need it to verify income, apply for loans, or for tax purposes. Using airSlate SignNow simplifies this process by allowing you to eSign and send Form 4506 T electronically, making it a hassle-free experience.

-

How does airSlate SignNow help with Form 4506 T?

airSlate SignNow provides a streamlined process to fill, eSign, and send Form 4506 T efficiently. With templates and an intuitive interface, you can quickly prepare the document and ensure it is delivered securely. This saves you time and reduces the risk of errors typically associated with handling paper forms.

-

Is there a cost associated with using airSlate SignNow for Form 4506 T?

Yes, there is a pricing structure for using airSlate SignNow, which varies based on the features you need. However, it is considered a cost-effective solution compared to traditional methods. The pricing includes access to eSigning features that can enhance your workflow for documents like Form 4506 T.

-

Can I integrate airSlate SignNow with other applications when using Form 4506 T?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow when handling Form 4506 T. You can connect it to CRM systems, document management tools, and more, ensuring a seamless experience from document creation to eSigning.

-

What features does airSlate SignNow offer for submitting Form 4506 T?

airSlate SignNow includes several features to assist with Form 4506 T, such as customizable templates, automated workflows, and real-time tracking. The platform allows you to manage who signs the document and sends reminders, ensuring that everyone involved is kept in the loop. This enhances the efficiency and accuracy of your document processing.

-

How secure is the eSigning process for Form 4506 T with airSlate SignNow?

Security is a priority for airSlate SignNow. When you eSign Form 4506 T, all data is encrypted, and the signing process complies with legal standards to ensure document integrity. You can trust that your sensitive information remains confidential throughout the process.

-

How long does it take to complete and send Form 4506 T using airSlate SignNow?

Using airSlate SignNow, you can complete and send Form 4506 T in a matter of minutes. The user-friendly interface allows for quick filling, and eSigning is instantaneous. This efficient process helps you meet deadlines and streamline your workflow.

Get more for Form 4506 T

- Periodic table of elements on mars answer key form

- M 61 jury service request be disqualified postponed or form

- Case management conference request form

- Petition for change of name form

- Jury service request to be disqualified postponed or excused form

- Domestic violence family offensenycourts gov form

- Jury service request to be disqualified postponed or excused 765399023 form

- Petition to determine parental relationship form

Find out other Form 4506 T

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online