Borrower Certify Form

What is the Borrower Certify

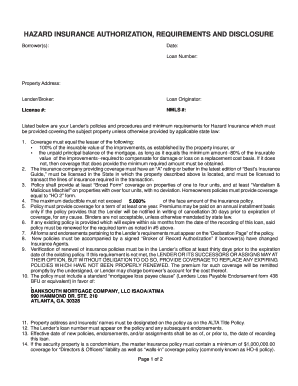

The Borrower Certify is a crucial document in the loan application process, particularly for hazard insurance authorization. It serves as a declaration from the borrower, affirming their understanding of the insurance requirements related to the property being financed. This certification typically includes details about the borrower's acknowledgment of the necessity for hazard insurance, which protects the lender's investment against potential property damage.

Key elements of the Borrower Certify

Understanding the key elements of the Borrower Certify is essential for both borrowers and lenders. The document generally includes the following components:

- Borrower Information: Personal details of the borrower, including name, address, and contact information.

- Property Details: Information about the property being financed, such as the address and type of property.

- Insurance Acknowledgment: A statement confirming the borrower’s understanding of the hazard insurance requirements.

- Signature: The borrower's signature, which validates the document and confirms their agreement.

Steps to complete the Borrower Certify

Completing the Borrower Certify involves several straightforward steps. Follow these guidelines to ensure accuracy:

- Gather necessary information, including personal and property details.

- Review the hazard insurance requirements specific to your loan agreement.

- Fill out the Borrower Certify form, ensuring all sections are completed accurately.

- Sign the document to validate your acknowledgment and understanding.

- Submit the completed form to your lender as part of the loan application process.

Disclosure Requirements

Disclosure requirements for the Borrower Certify are vital to ensure transparency and compliance. Borrowers must be informed of the following:

- The necessity of maintaining hazard insurance throughout the loan term.

- Consequences of failing to obtain or maintain adequate insurance coverage.

- Details about the lender's rights regarding insurance claims and property protection.

Legal use of the Borrower Certify

The legal use of the Borrower Certify is governed by various regulations that ensure its validity in the loan process. To be legally binding, the document must:

- Be signed by the borrower, indicating their consent and understanding.

- Comply with state-specific laws regarding hazard insurance and loan disclosures.

- Be stored securely by the lender as part of the loan documentation.

Who Issues the Form

The Borrower Certify is typically issued by the lender or financial institution involved in the loan process. It is an integral part of the loan application package and must be completed by the borrower as a condition for loan approval. Lenders may provide this form directly or include it as part of their standard documentation for hazard insurance authorization.

Quick guide on how to complete borrower certify

Complete Borrower Certify effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without delays. Handle Borrower Certify on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Borrower Certify easily

- Obtain Borrower Certify and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you want to share your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Borrower Certify to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borrower certify

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are hazard insurance authorization requirements and disclosure?

Hazard insurance authorization requirements and disclosure refer to the necessary information and conditions that must be met for insurance coverage to be effective. This usually includes details about the property, the type of insurance needed, and any specific documentation required by the insurer. It's essential to understand these requirements to ensure your assets are adequately protected.

-

How can airSlate SignNow help with hazard insurance authorization requirements and disclosure?

airSlate SignNow streamlines the process of managing hazard insurance authorization requirements and disclosure by allowing businesses to electronically sign and send necessary documents quickly. This reduces the time spent on paperwork and helps ensure compliance with all necessary regulations. By utilizing our platform, you can keep your projects moving forward without unnecessary delays.

-

What is the cost of using airSlate SignNow for hazard insurance documentation?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our plans include various features aimed at simplifying the management of hazard insurance authorization requirements and disclosure. You can choose a plan that fits your budget while ensuring you have access to all the necessary tools to streamline your documentation process.

-

Are there any features specifically for managing hazard insurance documents?

Yes, airSlate SignNow includes features designed specifically for managing hazard insurance documents, such as customizable templates and real-time tracking. These tools help you manage hazard insurance authorization requirements and disclosure efficiently, ensuring that all necessary documents are accurately completed and submitted. Our platform is designed to enhance your workflow and reduce errors.

-

Can airSlate SignNow integrate with other tools for better document management?

Absolutely! airSlate SignNow offers multiple integrations with popular tools and software that enhance your ability to manage hazard insurance authorization requirements and disclosure. These integrations allow seamless data transfer and document management across platforms, making it easier to maintain organized records and streamline your processes.

-

What benefits can I expect from using airSlate SignNow for hazard insurance?

Using airSlate SignNow for hazard insurance provides several benefits, including increased efficiency, reduced paperwork, and enhanced compliance with authorization requirements and disclosures. The electronic signature feature speeds up the approval process, while your documents are securely stored for easy access. With airSlate SignNow, you can focus on your business while we handle the complexities of documentation.

-

How secure is my data when handling hazard insurance documents on airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement robust encryption and security measures to protect all documents, including those related to hazard insurance authorization requirements and disclosure. You can trust that your sensitive information will be safeguarded from unauthorized access.

Get more for Borrower Certify

Find out other Borrower Certify

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast