Payday Loan Application 2016-2026

What is the Payday Loan Application

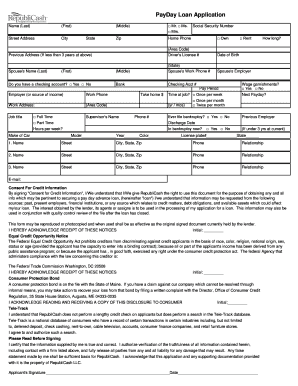

The payday loan application is a formal document used to request a short-term loan, typically due on the borrower’s next payday. This type of loan is designed to provide quick access to cash for individuals facing unexpected expenses or emergencies. The application usually requires personal information, employment details, and financial information to assess eligibility. Understanding the purpose and structure of this application is crucial for ensuring a smooth borrowing process.

Steps to Complete the Payday Loan Application

Completing the payday loan application involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary information: Collect personal identification, income details, and banking information.

- Fill out the application: Provide accurate information in all required fields, including your name, address, and employment status.

- Review the application: Double-check all entries for accuracy to avoid delays in processing.

- Submit the application: Choose your preferred submission method, whether online, by mail, or in person.

Following these steps helps ensure that your application is complete and increases the likelihood of approval.

Legal Use of the Payday Loan Application

The payday loan application must comply with federal and state regulations to be considered legally valid. In the United States, lenders are required to adhere to the Truth in Lending Act, which mandates clear disclosure of loan terms, fees, and interest rates. Additionally, many states have specific laws regulating payday loans, including limits on loan amounts and repayment terms. Understanding these legal requirements is essential for both borrowers and lenders to ensure fair practices and protect consumer rights.

Eligibility Criteria

To qualify for a payday loan, applicants must meet certain eligibility criteria, which typically include:

- Being at least eighteen years old.

- Having a valid government-issued ID.

- Providing proof of income, such as pay stubs or bank statements.

- Having an active checking account.

Meeting these criteria is crucial for the approval of the payday loan application, as lenders assess the ability to repay the loan based on this information.

Required Documents

When applying for a payday loan, several documents are generally required to verify your identity and financial status. Commonly required documents include:

- A government-issued photo ID, such as a driver's license or passport.

- Proof of income, which may include recent pay stubs or tax returns.

- Bank statements that demonstrate your financial activity.

- Social Security number for identity verification.

Having these documents ready can streamline the application process and improve the chances of quick approval.

Application Process & Approval Time

The application process for a payday loan typically involves submitting your completed application along with the required documents. Once submitted, lenders usually review applications promptly. Approval times can vary, but many lenders provide decisions within a few hours or by the next business day. If approved, funds are often deposited directly into the borrower’s bank account, making it essential to provide accurate banking information on the application.

Quick guide on how to complete payday loan application

Effortlessly Prepare Payday Loan Application on Any Device

Web-based document management has become increasingly favored among businesses and individuals. It offers a superb eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle Payday Loan Application on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Modify and Electronically Sign Payday Loan Application Seamlessly

- Obtain Payday Loan Application and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Payday Loan Application to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payday loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ASA loan application form?

The ASA loan application form is a streamlined document designed to collect essential applicant information efficiently. This form helps you quickly submit your application and reduces paperwork while ensuring all necessary data is captured for loan processing.

-

How does the airSlate SignNow platform enhance the ASA loan application process?

AirSlate SignNow enhances the ASA loan application process by providing a secure and user-friendly platform for eSigning and document management. You can easily send, sign, and track your ASA loan application form, making the entire submission process faster and more efficient.

-

What are the benefits of using the ASA loan application form on airSlate SignNow?

Using the ASA loan application form on airSlate SignNow offers benefits like reduced processing time and enhanced security for sensitive data. Moreover, it integrates seamlessly with other tools, allowing for a streamlined workflow that saves time and improves accuracy.

-

Are there any costs involved in using the ASA loan application form with airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, including options suitable for those using the ASA loan application form. By subscribing, you access a cost-effective solution that maximizes the value of your document management processes.

-

Can I customize the ASA loan application form on airSlate SignNow?

Yes, airSlate SignNow allows you to customize the ASA loan application form to fit your unique requirements. You can add fields, adjust branding elements, and modify the layout to ensure it meets your specific needs while maintaining a professional appearance.

-

What integrations are available for the ASA loan application form on airSlate SignNow?

AirSlate SignNow offers various integrations that enhance the functionality of the ASA loan application form. You can connect it with popular CRM systems, payment processors, and cloud storage platforms to create a seamless workflow for managing your loan applications.

-

Is the ASA loan application form secure on airSlate SignNow?

Absolutely! The ASA loan application form is very secure on airSlate SignNow, employing robust encryption and compliance with industry standards. Your sensitive information is protected, ensuring peace of mind as you navigate your loan application process.

Get more for Payday Loan Application

- Car sale contract template form

- Generic student employee timesheet orchid orchid hosts jhmi form

- Florida notice to owner form hubspot

- Civil grand jury application and nomination form

- Please read at least one grand jury report before applying form

- Notice of lis pendens form

- In the superior court of clayton county state of g form

- Proof of financial responsibility statement agri ohio form

Find out other Payday Loan Application

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF