In Kind Contributions in Tn Form

What is the In Kind Contributions In Tn Form

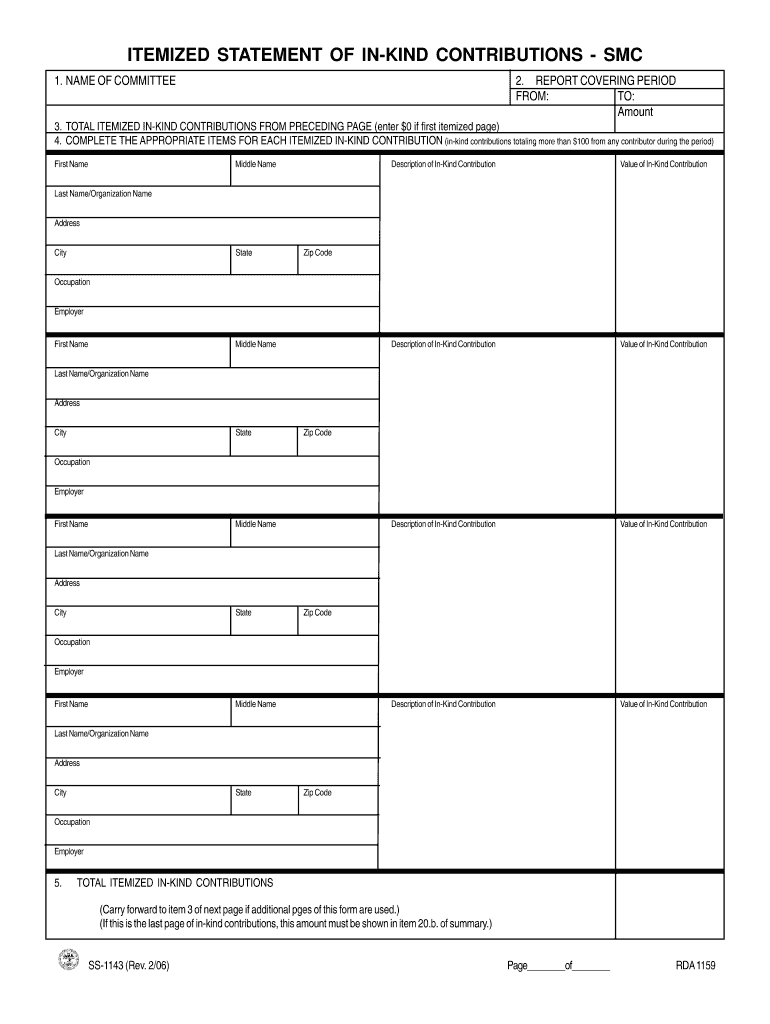

The In Kind Contributions In Tn Form is a document used primarily by organizations and individuals to report non-cash donations made to charitable entities in Tennessee. This form helps to quantify the value of goods or services provided, which can be essential for tax deductions and compliance with state regulations. In-kind contributions may include items such as food, clothing, equipment, or professional services. Properly documenting these contributions ensures transparency and accountability for both the donor and the recipient organization.

How to use the In Kind Contributions In Tn Form

Using the In Kind Contributions In Tn Form involves several straightforward steps. First, gather all necessary information regarding the items or services being donated, including descriptions, estimated values, and the recipient organization’s details. Next, accurately fill out the form, ensuring that all fields are completed to avoid any processing delays. Once the form is completed, it should be submitted to the appropriate organization or agency as specified in the instructions. Keeping a copy for personal records is also recommended for future reference.

Steps to complete the In Kind Contributions In Tn Form

Completing the In Kind Contributions In Tn Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant information about the contributions, including item descriptions and values.

- Obtain the latest version of the form from a reliable source.

- Fill out the form, ensuring accuracy in all sections.

- Sign and date the form to validate your submission.

- Submit the form according to the guidelines provided, whether online, by mail, or in person.

Legal use of the In Kind Contributions In Tn Form

The In Kind Contributions In Tn Form is legally binding when completed and submitted according to state laws. It serves as an official record of the contributions made, which can be crucial for tax purposes and compliance with the Tennessee Department of Revenue regulations. To ensure legal validity, it is essential to maintain accurate records and provide truthful information on the form. Any discrepancies or false information could lead to penalties or legal issues.

IRS Guidelines

When filing the In Kind Contributions In Tn Form, it is important to adhere to IRS guidelines regarding charitable contributions. The IRS allows taxpayers to deduct the fair market value of in-kind donations, provided they are properly documented. Donors should keep detailed records, including receipts and the form itself, to substantiate their claims during tax filing. Familiarizing oneself with IRS Publication 526 can provide additional insights into the requirements and benefits of reporting in-kind contributions.

Form Submission Methods

The In Kind Contributions In Tn Form can be submitted through various methods, depending on the recipient organization’s preferences. Common submission methods include:

- Online submission via the organization’s website or designated portal.

- Mailing the completed form to the organization’s address.

- Delivering the form in person to the organization’s office.

Always check the specific submission requirements of the organization to ensure compliance and timely processing.

Quick guide on how to complete in kind contributions in tn form

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly popular with companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

As a Canadian working in the US on a TN-1 visa should I fill out the IRS Form W-8BEN or W9?

Use the W-9. The W-8BEN is used for cases where you are not working in the U.S., but receiving income relating to a U.S. Corporation, Trust or Partnership.

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out a form to become a pilot in Nepal?

Obtain the forms. Read the forms. Add correct information.

-

Which one is correct, "fill in a form" or "fill out a form"?

In terms of outcome, they mean the same thing. Usage, at least in my Canadian neighbourhood, varies depending on how specific the circumstance is.[Clerk hands you a blank form.]Here, fill in this form.Here, fill this out.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

How can I repeat the HSC Maharashtra board 2019? Which kind of form should I have to fill and when?

If you have passed HSC but not satisfied due to less marks and wants to appear again then you can go for HSC improvement exam. Just contact your Institute and fill out form of it and appear exam again.You can also apply online through site https://mahahsscboard.maharashtra.gov.in/ select class improvement and fill the form.

Related searches to In Kind Contributions In Tn Form

Create this form in 5 minutes!

How to create an eSignature for the in kind contributions in tn form

How to generate an electronic signature for your In Kind Contributions In Tn Form online

How to create an electronic signature for the In Kind Contributions In Tn Form in Google Chrome

How to create an eSignature for putting it on the In Kind Contributions In Tn Form in Gmail

How to create an eSignature for the In Kind Contributions In Tn Form from your smart phone

How to make an electronic signature for the In Kind Contributions In Tn Form on iOS devices

How to create an eSignature for the In Kind Contributions In Tn Form on Android OS

People also ask

-

What are In Kind Contributions In Tn Form and how do they work?

In Kind Contributions In Tn Form refer to non-cash donations that are given to support programs, often in the form of goods or services. These contributions are documented using specific forms to ensure compliance with local regulations. Understanding how to correctly use these forms can streamline the donation process and enhance transparency.

-

How can airSlate SignNow assist with managing In Kind Contributions In Tn Form?

airSlate SignNow provides an efficient platform for managing In Kind Contributions In Tn Form by allowing you to easily create, sign, and send documents digitally. This not only saves time but also minimizes paperwork and reduces the risk of errors. With its user-friendly interface, organizations can quickly adapt to using the platform for their donation processes.

-

What are the pricing options for using airSlate SignNow for In Kind Contributions In Tn Form?

airSlate SignNow offers flexible pricing plans tailored to different business needs, starting with a free trial to explore its features. For ongoing usage related to In Kind Contributions In Tn Form, you can choose from monthly or annual subscriptions that allow unlimited document signing and management. This cost-effective solution is designed to fit various budget levels.

-

Which features are included with airSlate SignNow for processing In Kind Contributions In Tn Form?

airSlate SignNow includes multiple features such as customizable templates, secure eSignature options, and real-time tracking of document status. These features enhance the workflow for In Kind Contributions In Tn Form and make the entire process smoother. Additionally, users can utilize automated reminders to ensure timely submissions.

-

What benefits does airSlate SignNow provide for organizations handling In Kind Contributions In Tn Form?

Using airSlate SignNow for In Kind Contributions In Tn Form streamlines the donation process, enhances compliance, and improves record-keeping. This digital solution reduces the time spent on paperwork, enabling organizations to focus more on their mission rather than administrative tasks. Furthermore, having all documents in one place increases organizational efficiency.

-

Can airSlate SignNow integrate with other software for managing In Kind Contributions In Tn Form?

Yes, airSlate SignNow offers various integrations with popular software solutions, including CRM and accounting platforms. This capability allows for seamless data flow between applications, simplifying the handling of In Kind Contributions In Tn Form. Integrations enhance productivity and ensure that all records are accurately maintained across systems.

-

Is it secure to use airSlate SignNow for In Kind Contributions In Tn Form?

Absolutely, airSlate SignNow prioritizes security by employing industry-standard encryption protocols to protect your data. All In Kind Contributions In Tn Form and related documents are stored securely, ensuring confidentiality and compliance with regulations. Users can have peace of mind knowing that their information is safeguarded.

Get more for In Kind Contributions In Tn Form

- Cancellationwithdrawal request form algonquin residence

- Hawaiian air medical waiver form

- High school emergency contact form

- Rcmp 5589e form

- Goal form templatepdffillercom

- Care home communication form nhs cumbria

- 3850 motion fill in the blank form

- Has the federal government changed your taxable income for any prior year which has not yet been reported to massachusetts mass form

Find out other In Kind Contributions In Tn Form

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word