Loan Guarantor Form

What is the Loan Guarantor Form

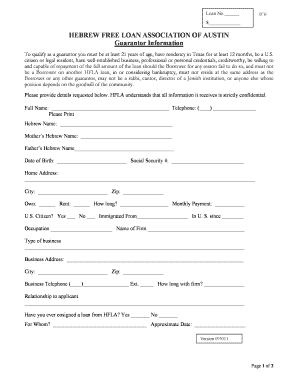

The loan guarantor form is a legal document that establishes a guarantee by an individual or entity to assume responsibility for a borrower's debt in the event of default. This form is crucial for lenders, as it provides an additional layer of security when extending credit. The guarantor agrees to repay the loan if the primary borrower fails to meet their obligations. This form typically includes details about the loan, the borrower, the guarantor, and the terms of the guarantee.

Key elements of the Loan Guarantor Form

When completing a loan guarantor form, several key elements must be included to ensure its validity. These elements typically consist of:

- Guarantor Information: Full name, address, and contact details of the guarantor.

- Borrower Information: Full name and details of the primary borrower.

- Loan Details: Amount of the loan, purpose, and repayment terms.

- Signature Section: Space for the guarantor's signature, often requiring a witness or notary.

- Legal Clauses: Terms outlining the responsibilities and rights of the guarantor.

Steps to complete the Loan Guarantor Form

Completing the loan guarantor form involves several straightforward steps to ensure accuracy and compliance. Here’s a step-by-step guide:

- Gather Information: Collect all necessary details about the borrower and the loan.

- Fill Out the Form: Enter the required information accurately in the designated fields.

- Review the Terms: Carefully read through the terms and conditions outlined in the form.

- Sign the Document: The guarantor must sign the form, possibly in the presence of a witness or notary.

- Submit the Form: Provide the completed form to the lender as per their submission guidelines.

Legal use of the Loan Guarantor Form

The loan guarantor form is legally binding when executed correctly. For it to be enforceable, it must comply with relevant laws, including the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures and documents are recognized as valid. It is essential for both the lender and the guarantor to understand their rights and obligations under the agreement to avoid any potential disputes.

How to obtain the Loan Guarantor Form

Obtaining a loan guarantor form can be done through various channels. Many financial institutions provide their own customized forms, which can often be downloaded directly from their websites. Additionally, legal document services may offer templates for a loan guarantor form that can be tailored to specific needs. It is advisable to ensure that the form complies with state regulations and lender requirements before use.

Digital vs. Paper Version

Choosing between a digital or paper version of the loan guarantor form depends on personal preference and the requirements of the lender. Digital forms offer convenience, allowing for quick completion and submission, often with eSignature capabilities that enhance security and compliance. On the other hand, paper forms may be preferred by those who are more comfortable with traditional methods or when a physical signature is required. Regardless of the format, ensuring that all information is accurately filled out is essential for legal validity.

Quick guide on how to complete sublease agreement ontario

Effortlessly manage sublease agreement ontario on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without holdups. Handle loan guarantor form on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign guarantor form for loan with ease

- Obtain loan guarantor agreement template and click Get Form to begin the process.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact confidential information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassles of lost or improperly filed documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign loan guarantor documents to ensure exceptional communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to guarantor information

Create this form in 5 minutes!

How to create an eSignature for the guarantor form sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask loan guarantor form

-

What happens to the guarantor if the borrower does not pay?

You could face legal action If the borrower is unable to pay their dues for any reason, including disability or death, the lender has the right to retrieve the payment from the borrower's guarantor. You could face legal action for refusing to comply with the lender on this matter.

-

What happens to the guarantor if the loan is not paid?

If the borrower is unable to pay their dues for any reason, including disability or death, the lender has the right to retrieve the payment from the borrower's guarantor. You could face legal action for refusing to comply with the lender on this matter.

-

What is the guarantor agreement for a loan?

The Guarantor(s) agree/s as a pre-condition of the credit facility granted by the Bank to the Borrower that in case any default is committed in the repayment of the loan/advance or in repayment of interest thereon or any of the agreed instalment of the loan on due date/s, the Bank and/or the Reserve Bank of India will ...

-

Can a guarantor remove themselves from a loan?

You can only remove yourself as a loan guarantor if the financial institution that disbursed the loan, agrees to it.

-

How do I fill out a guarantor form?

Write out your qualifications as a guarantor -- your income, assets and other personal details supporting why you would be able to take responsibility should the tenant or borrower fail to do so. You can also list your accountant to testify to your financial state, as well as other character references.

-

What is the guarantor form?

A guarantor form is a document that certifies a guarantor's decision to assume liability if a particular individual does not fulfill the terms of an agreement. It is to be completed by the guarantor who has agreed to take responsibility if an individual breaks the terms of an agreement.

-

Can a guarantor get their money back?

Being a guarantor is about offering a safety-net. It is not about giving the other person free money. If they require your assistance you still have the right to claim that money back.

-

How long does a guarantor stay on a loan?

How long Does A Guarantor Stay On A Mortgage? Usually, we find that guarantors stay anywhere from two to five years, depending on a couple of factors. The first one is how quickly you pay down the loan, and the second one is how fast your property increases in value.

Get more for guarantor form for loan

Find out other loan guarantor agreement template

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document