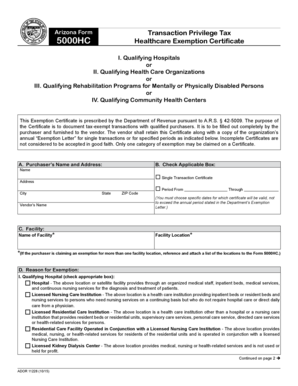

Arizona Form 5000hc

What is the Arizona Form 5000hc

The Arizona Form 5000hc is a specific document used for health care coverage reporting within the state of Arizona. This form is essential for individuals and businesses to report health insurance information to the Arizona Department of Revenue. It is particularly relevant for those who need to demonstrate compliance with health insurance mandates, ensuring that residents have access to necessary health care services.

How to use the Arizona Form 5000hc

Using the Arizona Form 5000hc involves several steps to ensure accurate reporting of health care coverage. First, gather all relevant information regarding your health insurance, including policy numbers and coverage dates. Next, fill out the form with precise details about the insured individuals and the type of coverage provided. Once completed, the form must be submitted to the appropriate state agency as part of your tax filings or health care compliance documentation.

Steps to complete the Arizona Form 5000hc

Completing the Arizona Form 5000hc requires careful attention to detail. Follow these steps:

- Collect necessary information about your health insurance coverage.

- Fill in the personal details of all insured individuals.

- Provide accurate policy numbers and coverage dates.

- Review the form for completeness and accuracy.

- Submit the form according to the specified filing methods.

Legal use of the Arizona Form 5000hc

The Arizona Form 5000hc is legally binding when completed and submitted in accordance with state regulations. To ensure its legal validity, it is important to adhere to the guidelines set forth by the Arizona Department of Revenue. This includes providing truthful information and submitting the form by the designated deadlines. Failure to comply may result in penalties or complications regarding health care coverage verification.

Key elements of the Arizona Form 5000hc

Key elements of the Arizona Form 5000hc include:

- Identification of the insured individuals.

- Details of the health insurance coverage.

- Policy numbers and coverage periods.

- Signature of the responsible party, if applicable.

These components are crucial for ensuring that the form serves its purpose in reporting health care coverage accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 5000hc are typically aligned with tax filing dates. It is important to check the Arizona Department of Revenue's official schedule for specific dates each year. Submitting the form on time is essential to avoid penalties and ensure compliance with health insurance reporting requirements.

Quick guide on how to complete arizona form 5000hc

Complete Arizona Form 5000hc effortlessly on any device

Digital document management has gained traction with businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, enabling you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without holdups. Manage Arizona Form 5000hc on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign Arizona Form 5000hc without any hassle

- Find Arizona Form 5000hc and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal authenticity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Arizona Form 5000hc and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 5000hc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 5000HC and why is it important?

The Arizona Form 5000HC is a critical document for businesses operating in Arizona, enabling them to report health care-related information. This form ensures compliance with state regulations, making it essential for proper business practices in the healthcare sector.

-

How can airSlate SignNow help with the Arizona Form 5000HC?

airSlate SignNow simplifies the process of sending, signing, and managing the Arizona Form 5000HC. With our user-friendly platform, businesses can quickly create, send, and track this important document efficiently.

-

What are the pricing options for using airSlate SignNow for the Arizona Form 5000HC?

airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes, making it cost-effective to manage the Arizona Form 5000HC. You can choose from monthly or annual subscriptions, tailored to your specific needs.

-

Is eSigning the Arizona Form 5000HC legally binding?

Yes, eSigning the Arizona Form 5000HC through airSlate SignNow is legally binding, ensuring that your signed documents are valid and enforceable. Our platform complies with all necessary legal standards and regulations for electronic signatures.

-

What features does airSlate SignNow offer for managing the Arizona Form 5000HC?

airSlate SignNow provides a range of features specifically for managing the Arizona Form 5000HC, including customizable templates, secure storage, and real-time tracking. These tools streamline the signing process and ensure that documents are well-organized.

-

Can I integrate airSlate SignNow with other software for handling the Arizona Form 5000HC?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for managing the Arizona Form 5000HC. This integration allows for better data management and reduced manual entry, saving you time and effort.

-

What are the benefits of using airSlate SignNow for the Arizona Form 5000HC?

Using airSlate SignNow for the Arizona Form 5000HC offers numerous benefits, including increased efficiency, reduced turnaround times, and improved document security. Our solution empowers businesses to streamline their processes while ensuring compliance with state requirements.

Get more for Arizona Form 5000hc

Find out other Arizona Form 5000hc

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure