8879 K Form

What is the 8879 K

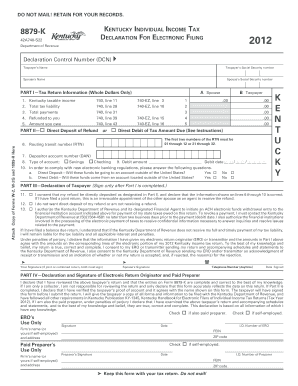

The 8879 K is a tax form used by individuals and businesses in the United States to authorize electronic filing of their Kentucky income tax returns. This form serves as a declaration that the taxpayer has reviewed their return and agrees to its submission electronically. It is essential for ensuring that the filing process is compliant with state regulations.

How to use the 8879 K

Using the 8879 K involves several steps. First, prepare your Kentucky tax return using tax preparation software or with the assistance of a tax professional. Once the return is complete, the software will generate the 8879 K form. Review the form carefully to ensure all information is accurate. After confirming the details, sign the form electronically, which will authorize the electronic filing of your tax return.

Steps to complete the 8879 K

Completing the 8879 K requires attention to detail. Follow these steps:

- Access your tax preparation software and complete your Kentucky tax return.

- Locate the option to generate the 8879 K form within the software.

- Review all the information on the form, ensuring it matches your tax return.

- Sign the form electronically, which may involve typing your name or using a digital signature.

- Submit the 8879 K along with your tax return through the software.

Legal use of the 8879 K

The 8879 K is legally binding when completed and signed according to Kentucky state regulations. The electronic signature provided on the form is recognized as valid under the Electronic Signatures in Global and National Commerce (ESIGN) Act. This means that taxpayers can confidently submit their returns electronically, knowing they meet legal requirements.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the 8879 K. Generally, the deadline for filing Kentucky state income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, if you are unable to file by the deadline, you may request an extension, but it is important to check specific dates each tax year.

IRS Guidelines

While the 8879 K is a Kentucky-specific form, it is essential to adhere to IRS guidelines when filing your federal tax return. Ensure that all income, deductions, and credits are accurately reported on both your federal and state returns. The IRS provides resources and guidelines that can help clarify any questions regarding tax filing procedures.

Quick guide on how to complete 8879 k

Complete 8879 K effortlessly on any device

Online document management has become favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, amend, and eSign your documents swiftly and without delays. Manage 8879 K on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign 8879 K with ease

- Locate 8879 K and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form: via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign 8879 K while ensuring excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8879 k

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 8879 k in the context of airSlate SignNow?

The term 8879 k refers to a specific feature or capability within airSlate SignNow that enhances document signing and management. This could involve advanced security measures or integrations that streamline the eSigning process, making it a preferred choice for businesses looking to optimize their workflow.

-

How does airSlate SignNow's pricing relate to the 8879 k feature?

When considering airSlate SignNow's pricing, the 8879 k functionality is included in various subscription tiers, providing essential tools for document management. This enables businesses to choose a plan that fits their budget while gaining access to powerful eSigning features.

-

What are the key features of airSlate SignNow associated with the 8879 k offering?

Key features of airSlate SignNow related to the 8879 k include customizable templates, real-time tracking, and secure storage solutions. These capabilities empower users to streamline their document workflows, enhance collaboration, and ensure compliance with industry regulations.

-

What benefits does the 8879 k functionality offer to businesses?

The 8879 k functionality of airSlate SignNow provides numerous benefits, including increased efficiency in document handling and reduced turnaround times for approvals. By implementing this feature, businesses can enhance productivity and improve client satisfaction.

-

How can 8879 k enhance integration with other software?

The 8879 k feature in airSlate SignNow is designed to seamlessly integrate with various software applications such as CRM and accounting tools. This integration allows businesses to automate document workflows, making it easier to manage tasks across different platforms.

-

Is there a trial available for testing the 8879 k feature in airSlate SignNow?

Yes, airSlate SignNow offers a trial period that allows potential customers to explore the 8879 k feature and assess its suitability for their business needs. During this trial, users can experience all the core functionalities and determine how it enhances their document processes.

-

What industries benefit the most from using the 8879 k functionality in airSlate SignNow?

Industries such as real estate, healthcare, and finance signNowly benefit from the 8879 k capability in airSlate SignNow. These sectors require secure and efficient document management solutions, making the features of 8879 k invaluable for their operational success.

Get more for 8879 K

Find out other 8879 K

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe