Appraisal Waiver Form

What is the appraisal waiver form

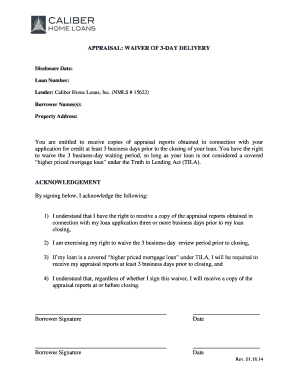

The appraisal waiver form is a document that allows borrowers to waive the requirement for a formal appraisal during the mortgage process. This form is typically used in situations where the lender determines that an appraisal is unnecessary, often due to the availability of sufficient data to assess the property's value. By signing this form, borrowers acknowledge that they understand the implications of waiving the appraisal and agree to proceed without it.

How to use the appraisal waiver form

Using the appraisal waiver form involves several key steps. First, borrowers should consult with their lender to confirm eligibility for an appraisal waiver. Once eligibility is established, the lender will provide the form for completion. Borrowers will need to fill out the required information, including personal details and property specifics. After reviewing the form for accuracy, borrowers can sign it digitally or in print, depending on the lender's requirements. Submitting the completed form to the lender is the final step in the process.

Steps to complete the appraisal waiver form

Completing the appraisal waiver form involves a straightforward process. Begin by gathering necessary information, such as the property address and loan details. Next, fill out the form carefully, ensuring all fields are completed accurately. It is essential to read any accompanying instructions or disclosures related to the waiver. After completing the form, review it for any errors or omissions. Finally, sign the form using a secure electronic signature solution, ensuring compliance with legal standards.

Key elements of the appraisal waiver form

Several key elements are essential to the appraisal waiver form. These include:

- Borrower Information: Personal details of the borrower, including name, address, and contact information.

- Property Details: Information about the property, including address and type of property.

- Loan Information: Details regarding the mortgage, such as loan amount and purpose.

- Waiver Acknowledgment: A statement confirming that the borrower understands the implications of waiving the appraisal.

- Signature: The borrower’s signature, which may be electronic, indicating consent to the terms of the waiver.

Legal use of the appraisal waiver form

The appraisal waiver form is legally binding when completed according to the relevant laws and regulations. It must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA), which govern the use of electronic signatures. To ensure legal validity, borrowers should ensure that the form is signed by all parties involved and that all information is accurate. Lenders are responsible for maintaining compliance with applicable laws when processing the waiver.

Examples of using the appraisal waiver form

There are various scenarios in which the appraisal waiver form may be utilized. For instance, a borrower purchasing a home may qualify for an appraisal waiver if the property has recently been appraised or if there is sufficient market data available. Additionally, homeowners refinancing their mortgage may also opt for an appraisal waiver if their lender determines that the property value is stable based on recent sales in the area. Each case should be evaluated individually to ensure that waiving the appraisal is a sound decision.

Eligibility criteria

To qualify for the appraisal waiver, borrowers must meet specific eligibility criteria set by their lender. Common factors include:

- Credit Score: A minimum credit score may be required.

- Loan Type: Certain loan types, such as conventional loans, may be more likely to offer waivers.

- Property Type: The property must meet specific criteria, such as being a single-family home or a condo.

- Loan-to-Value Ratio: A favorable loan-to-value ratio can enhance eligibility.

Quick guide on how to complete appraisal waiver form

Complete Appraisal Waiver Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documentation, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Appraisal Waiver Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Appraisal Waiver Form effortlessly

- Find Appraisal Waiver Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate issues with missing or lost documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Appraisal Waiver Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the appraisal waiver form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an appraisal waiver?

An appraisal waiver is a program that allows certain mortgage applicants to bypass the traditional appraisal process, speeding up the loan approval and closing timeline. This option can save you both time and money when securing a mortgage, making it an attractive feature for many applicants.

-

How does the appraisal waiver benefit mortgage applicants?

An appraisal waiver can signNowly benefit mortgage applicants by reducing fees and eliminating the wait time associated with standard appraisals. This feature allows for a quicker approval process, facilitating faster home purchases and refinancing for eligible borrowers.

-

What are the eligibility requirements for an appraisal waiver?

Eligibility for an appraisal waiver typically depends on borrower qualifications, loan type, and property value. Lenders will assess factors such as your credit score and the loan-to-value ratio to determine if you qualify for this streamlined process.

-

Does airSlate SignNow support appraisal waiver documents?

Yes, airSlate SignNow supports the electronic signing of all types of documents, including those related to appraisal waivers. By offering an easy-to-use platform, airSlate SignNow ensures that your appraisal waiver documents can be signed and sent quickly and efficiently.

-

Are there any fees associated with appraisal waivers?

While appraisal waivers eliminate the need for traditional appraisal fees, there may still be costs related to the overall loan process. It's important to discuss any potential fees with your lender to understand your complete borrowing costs.

-

How can airSlate SignNow help streamline the appraisal waiver process?

airSlate SignNow can help streamline the appraisal waiver process by providing a user-friendly platform for eSigning and managing necessary documents. With our organized workflows, you can ensure that your appraisal waiver forms are handled efficiently and securely.

-

Can appraisal waivers be used for refinancing?

Yes, appraisal waivers can be utilized for refinancing options, making it easier for homeowners to access lower interest rates and better loan terms without the hassle of a traditional appraisal. This can be particularly beneficial for those looking to streamline their refinancing process.

Get more for Appraisal Waiver Form

- Trianos 300 shot individual workout form

- Clinical abstract form

- Pudra nhs form

- Ahcccs des combined application spanish final docx scorm azahcccs form

- Ch2opd2 form

- Sandf online application form

- Lassen community college transcripts 458340040 form

- Learn how to track your delaware state tax refund status form

Find out other Appraisal Waiver Form

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy