Traditional Ira Withdrawal Instruction Form 2306t

What is the Traditional Ira Withdrawal Instruction Form 2306t

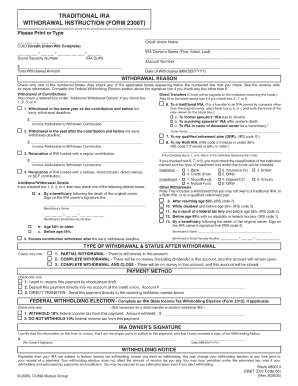

The Traditional IRA Withdrawal Instruction Form 2306t is a specific document used by individuals to request withdrawals from their Traditional Individual Retirement Accounts (IRAs). This form is crucial for ensuring that the withdrawal process complies with IRS regulations and that the account holder's instructions are clearly communicated to the financial institution managing the IRA. By filling out this form, individuals can specify the amount they wish to withdraw, the purpose of the withdrawal, and any tax withholding preferences.

How to use the Traditional Ira Withdrawal Instruction Form 2306t

Using the Traditional IRA Withdrawal Instruction Form 2306t involves several straightforward steps. First, download the form from a reliable source or request it from your financial institution. Once you have the form, fill in your personal information, including your name, address, and IRA account number. Next, indicate the amount you wish to withdraw and the reason for the withdrawal. After completing the form, review it for accuracy and sign where required. Finally, submit the form according to your financial institution's guidelines, which may include online submission, mailing, or delivering it in person.

Steps to complete the Traditional Ira Withdrawal Instruction Form 2306t

Completing the Traditional IRA Withdrawal Instruction Form 2306t requires careful attention to detail. Follow these steps:

- Obtain the form from your financial institution or a trusted source.

- Fill in your personal details, including your full name and IRA account number.

- Specify the amount you wish to withdraw and the reason for the withdrawal.

- Indicate any tax withholding preferences, if applicable.

- Sign and date the form to validate your request.

- Submit the form as per your institution's instructions.

Legal use of the Traditional Ira Withdrawal Instruction Form 2306t

The Traditional IRA Withdrawal Instruction Form 2306t is legally binding when completed correctly. To ensure its legal standing, the form must be signed by the account holder, and all information provided must be accurate and truthful. The use of this form complies with IRS regulations, which govern withdrawals from retirement accounts. It is essential to keep a copy of the submitted form for your records, as it may be required for tax reporting purposes.

Key elements of the Traditional Ira Withdrawal Instruction Form 2306t

Several key elements are essential for the Traditional IRA Withdrawal Instruction Form 2306t to be effective:

- Account Information: Ensure your IRA account number and personal details are accurate.

- Withdrawal Amount: Clearly state the amount you wish to withdraw.

- Reason for Withdrawal: Specify the purpose of the withdrawal, as this may affect tax implications.

- Tax Withholding Preferences: Indicate if you want any taxes withheld from your withdrawal.

- Signature: Your signature is required to authorize the transaction.

Form Submission Methods

The Traditional IRA Withdrawal Instruction Form 2306t can typically be submitted through various methods, depending on the policies of your financial institution. Common submission methods include:

- Online Submission: Many institutions allow you to upload the completed form through their secure portal.

- Mail: You can send the form via postal service to the address provided by your institution.

- In-Person: Delivering the form directly to a branch may be an option for those who prefer face-to-face interaction.

Quick guide on how to complete traditional ira withdrawal instruction form 2306t

Complete Traditional Ira Withdrawal Instruction Form 2306t effortlessly on any gadget

Online document administration has gained traction among companies and individuals alike. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to locate the desired form and securely store it online. airSlate SignNow provides you with all the tools needed to produce, modify, and eSign your files swiftly without delays. Handle Traditional Ira Withdrawal Instruction Form 2306t on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centered task today.

The simplest method to modify and eSign Traditional Ira Withdrawal Instruction Form 2306t without hassle

- Obtain Traditional Ira Withdrawal Instruction Form 2306t and hit Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that objective.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you choose. Edit and eSign Traditional Ira Withdrawal Instruction Form 2306t to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the traditional ira withdrawal instruction form 2306t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Traditional Ira Withdrawal Instruction Form 2306t?

The Traditional Ira Withdrawal Instruction Form 2306t is a document used to request funds from your Traditional IRA account. This form ensures that your withdrawal is processed accurately, allowing you to access your retirement funds securely and efficiently.

-

How do I complete the Traditional Ira Withdrawal Instruction Form 2306t?

Completing the Traditional Ira Withdrawal Instruction Form 2306t involves providing your personal information, account details, and specifying the withdrawal amount. Ensure that all fields are filled accurately to avoid delays in processing your request.

-

Is there a fee associated with using the Traditional Ira Withdrawal Instruction Form 2306t?

Many financial institutions do not charge a fee for processing the Traditional Ira Withdrawal Instruction Form 2306t, but it is always best to check with your IRA provider. Understanding potential fees helps you anticipate any expenses related to your withdrawal.

-

What are the benefits of using airSlate SignNow for the Traditional Ira Withdrawal Instruction Form 2306t?

Using airSlate SignNow to handle the Traditional Ira Withdrawal Instruction Form 2306t streamlines the eSigning process, greatly enhancing efficiency. Its cost-effective, user-friendly platform ensures your documents are signed quickly and securely, reducing waiting times.

-

Can I integrate airSlate SignNow with other financial software for processing the Traditional Ira Withdrawal Instruction Form 2306t?

Yes, airSlate SignNow offers integrations with various financial software solutions, enabling seamless processing of the Traditional Ira Withdrawal Instruction Form 2306t. This compatibility helps synchronize your data across platforms, improving overall workflow efficiency.

-

What features does airSlate SignNow offer for the Traditional Ira Withdrawal Instruction Form 2306t?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure sharing specifically for processing the Traditional Ira Withdrawal Instruction Form 2306t. These features save time and ensure that your forms are handled with the utmost security.

-

How long does it take to process the Traditional Ira Withdrawal Instruction Form 2306t?

The processing time for the Traditional Ira Withdrawal Instruction Form 2306t can vary by institution, but typically it takes approximately 5 to 10 business days. Utilizing airSlate SignNow can expedite this process, as electronic submissions often lead to faster processing.

Get more for Traditional Ira Withdrawal Instruction Form 2306t

- Soc serv law 384 b form tpr 1 fca614 new york state

- Court order template form

- In the court of common pleas franklin county ohi form

- Circuit court for maryland citycounty located at case form

- Fee agreement and authority to represent flat fee form

- Motion for speedy trial form 495579142

- Sos 428 enh19 documents needed for enhanced license or id form

- Dtmb 1104 claim against the state of michigan for personal losses less than 1000 dtmb forms

Find out other Traditional Ira Withdrawal Instruction Form 2306t

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document