Application Form for Mobile Banking Assam Gramin Vikash

Key elements of the Application Form For Mobile Banking Assam Gramin Vikash

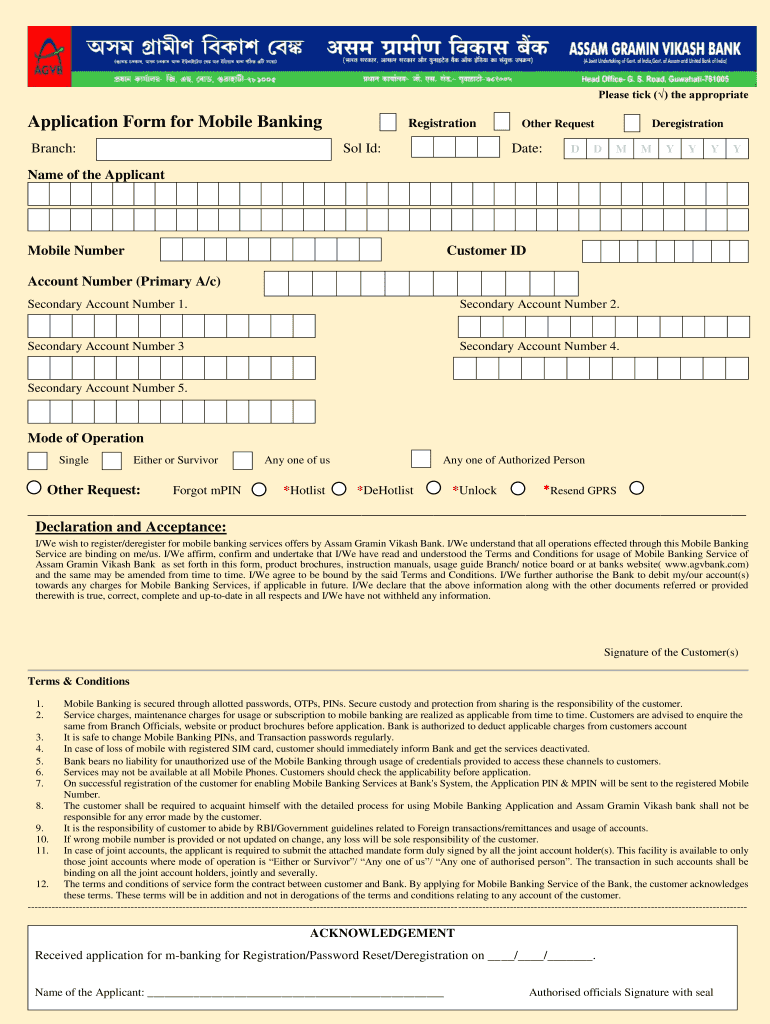

The Application Form for Mobile Banking with Assam Gramin Vikash Bank includes several important elements that ensure the application is processed smoothly. Key components typically include:

- Personal Information: This section requires the applicant's name, address, contact number, and email address.

- Account Details: Applicants must provide their existing account number and branch details to link the mobile banking service.

- Identification Proof: A valid form of identification, such as an Aadhaar card or driver's license, must be submitted.

- Signature: A signature is required to authenticate the application and confirm consent.

- Mobile Number: The mobile number provided will be used for all banking notifications and transactions.

Steps to complete the Application Form For Mobile Banking Assam Gramin Vikash

Completing the Application Form for Mobile Banking with Assam Gramin Vikash Bank involves a straightforward process. Follow these steps to ensure a successful application:

- Download the application form from the official Assam Gramin Vikash Bank website or obtain a physical copy from your local branch.

- Fill in your personal information accurately, ensuring all details match your identification documents.

- Provide your existing account details and attach a copy of your identification proof.

- Sign the form to validate your application.

- Submit the completed form at your nearest Assam Gramin Vikash Bank branch or through the designated online portal.

Legal use of the Application Form For Mobile Banking Assam Gramin Vikash

The Application Form for Mobile Banking is legally binding once it is filled out and submitted. To ensure its validity, the following legal aspects must be considered:

- Compliance with Banking Regulations: The form must adhere to regulations set by the Reserve Bank of India and other relevant authorities.

- Signature Verification: The signature provided on the form must match the one on file with the bank to prevent fraud.

- Data Protection: Personal information provided in the form is protected under data privacy laws, ensuring confidentiality.

How to obtain the Application Form For Mobile Banking Assam Gramin Vikash

Obtaining the Application Form for Mobile Banking with Assam Gramin Vikash Bank can be done through several convenient methods:

- Online Download: Visit the official Assam Gramin Vikash Bank website to download the form in PDF format.

- In-Branch Request: Visit any Assam Gramin Vikash Bank branch and request a physical copy of the application form from a bank representative.

- Customer Service: Contact customer service for assistance in obtaining the form, either via phone or email.

Eligibility Criteria for the Application Form For Mobile Banking Assam Gramin Vikash

Before filling out the Application Form for Mobile Banking, applicants should ensure they meet the eligibility criteria set by Assam Gramin Vikash Bank. Common requirements include:

- The applicant must hold a valid account with Assam Gramin Vikash Bank.

- Applicants must be of legal age, typically eighteen years or older.

- Proof of identity and address must be provided to verify the applicant’s details.

Examples of using the Application Form For Mobile Banking Assam Gramin Vikash

The Application Form for Mobile Banking can be utilized in various scenarios to enhance banking convenience. Examples include:

- New Account Holders: Individuals opening a new account can use the form to set up mobile banking services immediately.

- Existing Customers: Current account holders wishing to access mobile banking features can fill out the form to activate their services.

- Service Upgrades: Customers looking to upgrade their banking services, such as adding mobile banking, can use this form for a seamless transition.

Quick guide on how to complete application form for mobile banking assam gramin vikash

Complete Application Form For Mobile Banking Assam Gramin Vikash effortlessly on any gadget

Digital document management has gained signNow traction with businesses and individuals alike. It serves as an excellent environment-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents promptly without delays. Manage Application Form For Mobile Banking Assam Gramin Vikash on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign Application Form For Mobile Banking Assam Gramin Vikash effortlessly

- Find Application Form For Mobile Banking Assam Gramin Vikash and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Alter and eSign Application Form For Mobile Banking Assam Gramin Vikash and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application form for mobile banking assam gramin vikash

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Assam Gramin Vikash Bank KYC Form?

The Assam Gramin Vikash Bank KYC form is a mandatory document required by the bank to verify a customer's identity and ensure compliance with Know Your Customer (KYC) regulations. This form collects essential information such as personal details, proof of identity, and address verification to maintain legal and regulatory standards.

-

How can I complete the Assam Gramin Vikash Bank KYC Form?

You can complete the Assam Gramin Vikash Bank KYC form either online through the bank's website or by visiting a branch in person. The online process typically requires you to fill out the form and upload necessary documents, making it convenient and efficient.

-

What documents are required for the Assam Gramin Vikash Bank KYC Form?

To successfully fill out the Assam Gramin Vikash Bank KYC form, you typically need to provide a government-issued photo ID, proof of address, and a passport-sized photograph. It's best to check with the bank for any specific document requirements or updates.

-

Is there a fee associated with the Assam Gramin Vikash Bank KYC Form?

Generally, there is no fee associated with submitting the Assam Gramin Vikash Bank KYC form. However, if you are using certain premium services or need expedited processing, fees may apply, so it’s advisable to verify with the bank.

-

Can I submit the Assam Gramin Vikash Bank KYC Form online?

Yes, you can submit the Assam Gramin Vikash Bank KYC form online through the bank's official website. This digital submission process is designed to be straightforward, allowing customers to complete the form quickly without visiting a physical branch.

-

How long does it take for the Assam Gramin Vikash Bank KYC Form to be processed?

The processing time for the Assam Gramin Vikash Bank KYC form can vary based on submission method and completeness of the documents. Typically, online submissions may be processed faster; however, it's advisable to allow some time for the verification to be completed.

-

What should I do if my Assam Gramin Vikash Bank KYC Form is rejected?

If your Assam Gramin Vikash Bank KYC form is rejected, you should carefully check the reasons provided by the bank and rectify any issues. Common reasons for rejection include incomplete information or missing documents. Once corrected, you can resubmit the form.

Get more for Application Form For Mobile Banking Assam Gramin Vikash

- Hm forces application form gov uk

- Patient assessment emt form

- Nrcas roofing contractor qualification statement national nrca form

- Subpoena ad testificandum form myfloridalicense com

- Flood zone determination form and elevation certificate

- 954 567 1441 or email to credit report for state licensing form

- Discover pbcgov orgwaterutilitiespageswater utilities startstopchange service palm beach county form

- Application for demolition permit application for demolition permit form

Find out other Application Form For Mobile Banking Assam Gramin Vikash

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online