E P E No Nru Tal VAT VAT No Form TIFD Ex 01

What is the E P E No Nru Tal VAT VAT No Form TIFD Ex 01

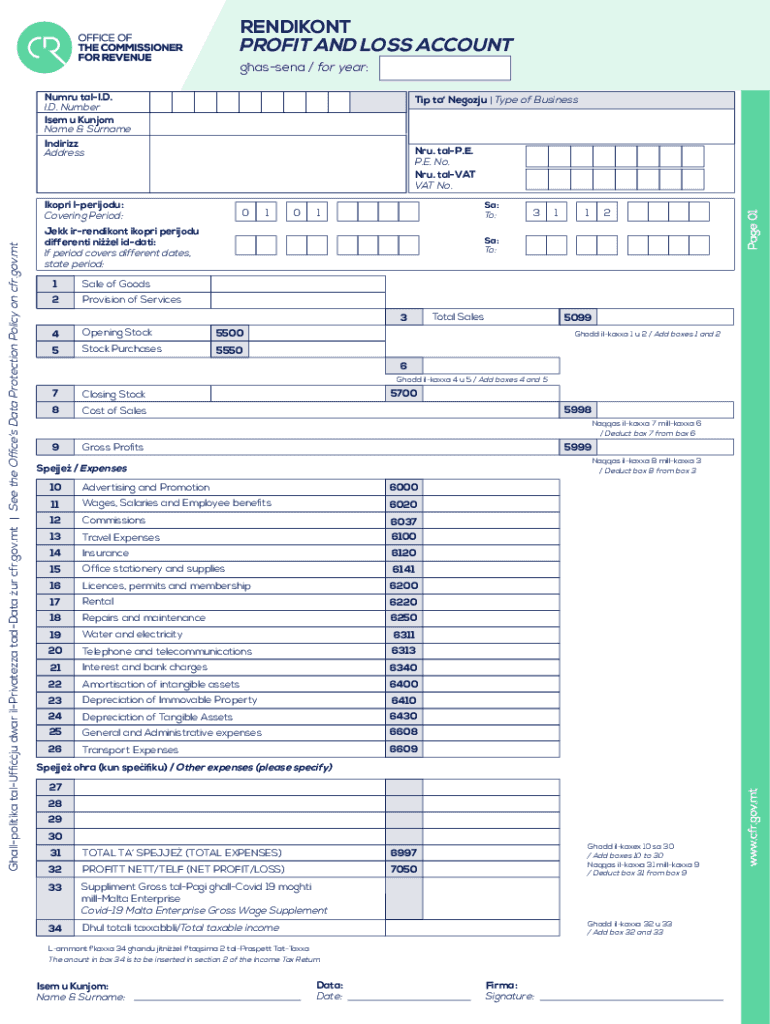

The E P E No Nru Tal VAT VAT No Form TIFD Ex 01 is a specialized form used primarily for tax reporting and compliance purposes. This form is essential for businesses and individuals who need to report VAT-related information accurately. It plays a crucial role in ensuring that all applicable taxes are reported to the relevant authorities, thereby facilitating proper tax management and compliance.

How to use the E P E No Nru Tal VAT VAT No Form TIFD Ex 01

Using the E P E No Nru Tal VAT VAT No Form TIFD Ex 01 involves several key steps. First, ensure you have the correct version of the form, which can typically be obtained from the appropriate tax authority's website or office. Next, gather all necessary documentation that supports the information you will report on the form, such as sales records and VAT invoices. Once you have completed the form, you can submit it through the designated channels, which may include online submission, mailing, or in-person delivery.

Steps to complete the E P E No Nru Tal VAT VAT No Form TIFD Ex 01

Completing the E P E No Nru Tal VAT VAT No Form TIFD Ex 01 requires careful attention to detail. Start by filling in your personal or business information accurately. Next, report your VAT-related transactions, ensuring that all figures are correct and supported by documentation. After completing all sections of the form, review it for any errors or omissions. Finally, sign and date the form before submitting it according to the specified guidelines.

Legal use of the E P E No Nru Tal VAT VAT No Form TIFD Ex 01

The legal use of the E P E No Nru Tal VAT VAT No Form TIFD Ex 01 is governed by tax regulations that require accurate reporting of VAT. Failure to use this form correctly can result in penalties or legal consequences. It is important to understand the legal obligations associated with this form to ensure compliance and avoid potential issues with tax authorities.

Key elements of the E P E No Nru Tal VAT VAT No Form TIFD Ex 01

Key elements of the E P E No Nru Tal VAT VAT No Form TIFD Ex 01 include personal or business identification details, a breakdown of VAT transactions, and any relevant deductions or credits. Each section must be completed with precision to ensure that the information is clear and accurate. Understanding these key elements is essential for effective form completion and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the E P E No Nru Tal VAT VAT No Form TIFD Ex 01 are critical to ensure timely compliance with tax regulations. Typically, these deadlines align with specific reporting periods, such as quarterly or annual tax submissions. It is advisable to keep track of these dates to avoid late fees or penalties associated with non-compliance.

Required Documents

To complete the E P E No Nru Tal VAT VAT No Form TIFD Ex 01, several documents are required. These may include sales receipts, VAT invoices, and any prior tax returns that pertain to the reporting period. Having these documents ready will facilitate a smoother completion process and help ensure that all reported information is accurate and substantiated.

Quick guide on how to complete e p e no nru tal vat vat no form tifd ex 01

Effortlessly prepare E P E No Nru Tal VAT VAT No Form TIFD Ex 01 on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage E P E No Nru Tal VAT VAT No Form TIFD Ex 01 across any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign E P E No Nru Tal VAT VAT No Form TIFD Ex 01 without difficulty

- Obtain E P E No Nru Tal VAT VAT No Form TIFD Ex 01 and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign E P E No Nru Tal VAT VAT No Form TIFD Ex 01 to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e p e no nru tal vat vat no form tifd ex 01

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the E P E No Nru Tal VAT VAT No Form TIFD Ex 01?

The E P E No Nru Tal VAT VAT No Form TIFD Ex 01 is a specialized form used for VAT registration purposes. It helps businesses comply with local tax regulations efficiently. By utilizing this form, companies can ensure their VAT information is accurate and up-to-date, which is crucial for avoiding penalties.

-

How can airSlate SignNow assist with the E P E No Nru Tal VAT VAT No Form TIFD Ex 01?

airSlate SignNow provides an easy-to-use platform for sending, eSigning, and managing the E P E No Nru Tal VAT VAT No Form TIFD Ex 01. Our solution simplifies the entire process, allowing businesses to collect necessary signatures securely and streamline document workflow. Additionally, it helps maintain compliance with relevant tax laws.

-

What are the pricing options for using airSlate SignNow to manage the E P E No Nru Tal VAT VAT No Form TIFD Ex 01?

airSlate SignNow offers flexible pricing plans tailored to different business needs, starting from a basic plan to business solutions. Users can choose a plan based on the number of documents signed or users, making it a cost-effective choice for managing the E P E No Nru Tal VAT VAT No Form TIFD Ex 01. Pricing details can be accessed on our website.

-

Are there any integrations available for managing E P E No Nru Tal VAT VAT No Form TIFD Ex 01 with other tools?

Yes, airSlate SignNow integrates seamlessly with a variety of tools, including CRM systems and cloud storage services. This allows users to manage the E P E No Nru Tal VAT VAT No Form TIFD Ex 01 alongside other important business documents. These integrations enhance workflow efficiency and ensure all relevant data is centralized.

-

What are the benefits of using airSlate SignNow for the E P E No Nru Tal VAT VAT No Form TIFD Ex 01?

Using airSlate SignNow for the E P E No Nru Tal VAT VAT No Form TIFD Ex 01 offers numerous benefits including ease of eSigning, secure storage, and compliance with legal requirements. The platform is designed to enhance productivity, allowing users to quickly send and receive signed documents. Additionally, it reduces the time spent on paperwork, allowing businesses to focus on their core operations.

-

Can I customize the E P E No Nru Tal VAT VAT No Form TIFD Ex 01 within airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize the E P E No Nru Tal VAT VAT No Form TIFD Ex 01 to meet their specific requirements. Customization options include adding fields for signatures, dates, and other essential information. This ensures that the form will meet all necessary compliance and operational needs.

-

Is airSlate SignNow secure for sensitive information related to the E P E No Nru Tal VAT VAT No Form TIFD Ex 01?

Yes, airSlate SignNow prioritizes security, employing industry-standard encryption protocols to protect sensitive information. When using the platform for the E P E No Nru Tal VAT VAT No Form TIFD Ex 01, users can be confident that their documents and personal data are secure. Regular security audits ensure that the platform remains compliant with data protection regulations.

Get more for E P E No Nru Tal VAT VAT No Form TIFD Ex 01

- Reforms affecting securitization

- Frb supervisory letter sr 09 1 on application of the market risk form

- Va form 22 5490

- To ensure your liability is released please follo form

- Fitness for dutyreturn to work form medical autho

- 21 0966 form

- Event photographer contract template form

- Event photography contract template form

Find out other E P E No Nru Tal VAT VAT No Form TIFD Ex 01

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer