Delaware Division of Revenue Gross Receipts Forms Lq2 9501

What is the Delaware Division Of Revenue Gross Receipts Forms Lq2 9501

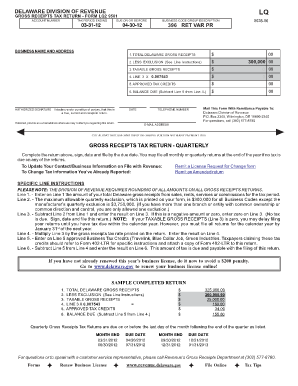

The Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 is a specific document used for reporting gross receipts for businesses operating in Delaware. This form is essential for compliance with state tax regulations, as it helps the state assess the revenue generated by businesses. The form captures various financial data, including total sales and specific deductions, ensuring that businesses fulfill their tax obligations accurately. Understanding this form is crucial for any business entity operating within Delaware's jurisdiction.

How to use the Delaware Division Of Revenue Gross Receipts Forms Lq2 9501

Using the Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 involves several steps. First, businesses must gather all relevant financial information, including sales records and any applicable deductions. Next, the form should be filled out accurately, ensuring all required fields are completed. Once the form is filled, it can be submitted electronically or via traditional mail, depending on the chosen submission method. Utilizing electronic signature tools can streamline the process and enhance the form's compliance with legal standards.

Steps to complete the Delaware Division Of Revenue Gross Receipts Forms Lq2 9501

Completing the Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including sales records and receipts.

- Access the form through the Delaware Division of Revenue website or other official sources.

- Fill out the form, ensuring all fields are completed accurately.

- Review the information for accuracy, checking for any errors or omissions.

- Submit the completed form electronically or by mail, according to your preference.

Key elements of the Delaware Division Of Revenue Gross Receipts Forms Lq2 9501

The key elements of the Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 include essential data fields such as:

- Business name and address

- Gross receipts amount

- Applicable deductions

- Tax period for which the form is being submitted

- Signature of the authorized representative

Each of these elements plays a critical role in ensuring that the form is processed correctly and that the business complies with state tax requirements.

Legal use of the Delaware Division Of Revenue Gross Receipts Forms Lq2 9501

The legal use of the Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 is governed by state tax laws. To be considered legally binding, the form must be completed accurately and submitted within the designated deadlines. Electronic signatures are recognized under U.S. law, provided they meet specific legal standards. This makes it essential for businesses to utilize reputable electronic signature solutions to ensure compliance and validity.

Filing Deadlines / Important Dates

Filing deadlines for the Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 are crucial for businesses to avoid penalties. Typically, the form must be submitted quarterly, with specific due dates depending on the tax period. Businesses should stay informed about these deadlines to ensure timely submission and compliance with state regulations. Missing these deadlines can result in fines and interest on unpaid taxes.

Quick guide on how to complete delaware division of revenue gross receipts forms lq2 9501

Effortlessly Prepare Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents promptly without delay. Manage Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related task today.

The Easiest Way to Edit and eSign Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 with Ease

- Locate Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all details and click the Done button to save your changes.

- Choose how you wish to share your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the delaware division of revenue gross receipts forms lq2 9501

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Delaware Division Of Revenue Gross Receipts Forms Lq2 9501?

The Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 are official documents required for reporting gross receipts to the state of Delaware. These forms help businesses calculate their gross receipts tax and ensure compliance with Delaware tax laws. Understanding how to complete these forms accurately is essential for avoiding penalties and ensuring timely reporting.

-

How can airSlate SignNow assist with Delaware Division Of Revenue Gross Receipts Forms Lq2 9501?

airSlate SignNow streamlines the process of completing and submitting Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 by enabling users to eSign and manage documents digitally. This reduces manual errors and accelerates document processing. With an easy-to-use interface, SignNow ensures that businesses can focus on compliance rather than paperwork.

-

What are the pricing options for using airSlate SignNow with Delaware Division Of Revenue Gross Receipts Forms Lq2 9501?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes, making it cost-effective for managing documents like the Delaware Division Of Revenue Gross Receipts Forms Lq2 9501. Plans typically include features such as unlimited document signing and templates. You can choose a plan that best fits your needs based on your document volume and required features.

-

Are there any integration options available with airSlate SignNow for handling Delaware Division Of Revenue Gross Receipts Forms Lq2 9501?

Yes, airSlate SignNow supports various integrations with popular applications and platforms, allowing you to seamlessly send and manage Delaware Division Of Revenue Gross Receipts Forms Lq2 9501. Integrating with tools like CRM systems or accounting software enhances efficiency by automating document workflows. This results in streamlined processes for businesses looking to maintain compliance.

-

What benefits does airSlate SignNow provide for businesses handling Delaware Division Of Revenue Gross Receipts Forms Lq2 9501?

By using airSlate SignNow for Delaware Division Of Revenue Gross Receipts Forms Lq2 9501, businesses can save time and reduce paperwork hassle. The electronic signing process increases turnaround times, while secure storage ensures documents are easily accessible. Additionally, automated reminders help businesses meet their tax deadlines, ensuring compliance with state regulations.

-

Can airSlate SignNow help in tracking the submission of Delaware Division Of Revenue Gross Receipts Forms Lq2 9501?

Absolutely! airSlate SignNow offers tracking features that allow you to monitor the status of your Delaware Division Of Revenue Gross Receipts Forms Lq2 9501 submissions. You will receive notifications whenever a document is viewed, signed, or completed. This transparency helps businesses manage their compliance responsibilities more effectively.

-

Is it easy to use airSlate SignNow for completing Delaware Division Of Revenue Gross Receipts Forms Lq2 9501?

Yes, airSlate SignNow is designed for user-friendliness, making it simple to complete Delaware Division Of Revenue Gross Receipts Forms Lq2 9501. The platform provides intuitive tools for editing and signing documents without requiring extensive technical knowledge. This accessibility empowers users to manage their documents efficiently and confidently.

Get more for Delaware Division Of Revenue Gross Receipts Forms Lq2 9501

Find out other Delaware Division Of Revenue Gross Receipts Forms Lq2 9501

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation