Voluntary Payroll Deduction Form

What is the voluntary payroll deduction form?

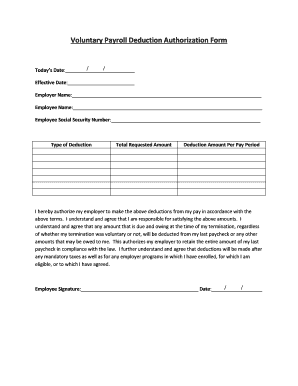

The voluntary payroll deduction authorization form is a document that allows employees to authorize their employer to deduct specific amounts from their paychecks for various purposes. This may include contributions to retirement plans, health insurance premiums, charitable donations, or other benefits. By filling out this form, employees provide consent for these deductions, ensuring that both parties are clear about the terms and amounts involved.

How to use the voluntary payroll deduction form

To effectively use the voluntary payroll deduction authorization form, employees should first review the deductions they wish to authorize. It is important to understand the implications of each deduction, including how it will affect net pay. Once the desired deductions are identified, employees can fill out the form, providing necessary personal information and specifying the amounts to be deducted. After completing the form, it should be submitted to the employer's payroll department for processing.

Key elements of the voluntary payroll deduction form

A comprehensive voluntary payroll deduction authorization form typically includes several key elements:

- Employee Information: Name, employee ID, and contact details.

- Deductions Authorized: Clear listing of each deduction type and corresponding amounts.

- Effective Date: When the deductions will begin.

- Signature: Employee's signature to confirm consent.

- Employer Acknowledgment: Space for employer verification and processing.

Steps to complete the voluntary payroll deduction form

Completing the voluntary payroll deduction authorization form involves several straightforward steps:

- Gather necessary personal information, including your employee ID and contact details.

- Identify the specific deductions you wish to authorize, such as retirement contributions or health insurance.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before signing.

- Submit the completed form to your employer's payroll department for processing.

Legal use of the voluntary payroll deduction form

The voluntary payroll deduction authorization form is legally binding once signed by the employee. To ensure its validity, the form must comply with relevant federal and state laws regarding payroll deductions. Employers should retain signed forms for record-keeping and compliance purposes. It is crucial for both employees and employers to understand the legal implications of the deductions authorized, as improper deductions can lead to disputes or legal challenges.

Form submission methods

The voluntary payroll deduction authorization form can typically be submitted through various methods, depending on the employer's policies. Common submission methods include:

- Online Submission: Many employers offer digital platforms for employees to submit forms electronically.

- Mail: Employees may send the completed form via postal service to the payroll department.

- In-Person: Submitting the form directly to the payroll office can provide immediate confirmation of receipt.

Quick guide on how to complete voluntary payroll deduction form

Handle Voluntary Payroll Deduction Form effortlessly on any device

The digital management of documents has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly solution to traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Voluntary Payroll Deduction Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-focused task today.

The easiest way to edit and electronically sign Voluntary Payroll Deduction Form seamlessly

- Locate Voluntary Payroll Deduction Form and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that are specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes moments and has the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Voluntary Payroll Deduction Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the voluntary payroll deduction form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a voluntary payroll deduction form template?

A voluntary payroll deduction form template is a document used by employers to authorize specific deductions from employees' paychecks. This template simplifies the process of collecting consent for deductions, such as insurance or retirement contributions. Using a digital solution like airSlate SignNow ensures that this process is efficient and legally compliant.

-

How can airSlate SignNow help with a voluntary payroll deduction form template?

airSlate SignNow provides an easy-to-use platform to create, send, and eSign voluntary payroll deduction form templates. You can customize these templates to meet your specific business needs, making it convenient for employees to provide their consent online. This streamlines the administration of payroll processes, saving time for both HR and employees.

-

What features does airSlate SignNow offer for handling voluntary payroll deduction form templates?

airSlate SignNow includes features such as document templates, customizable workflows, and real-time tracking to manage voluntary payroll deduction form templates effectively. The platform allows you to send reminders, collect eSignatures, and store documents securely. These features enhance the overall efficiency and compliance of payroll-related tasks.

-

Is there a cost associated with creating a voluntary payroll deduction form template on airSlate SignNow?

Yes, there is a subscription cost for using airSlate SignNow, which offers various pricing plans based on your business needs. However, the cost is often justified by the time saved and increased efficiency in managing documents like the voluntary payroll deduction form template. A free trial is available, allowing you to explore the features before committing.

-

What are the benefits of using a voluntary payroll deduction form template?

Utilizing a voluntary payroll deduction form template minimizes errors and accelerates the payroll process by ensuring all necessary authorizations are in one place. It also helps maintain compliance with legal requirements while providing transparency for employees about their deductions. Consequently, adopting such a template can improve employee satisfaction and trust.

-

Can I integrate airSlate SignNow with my existing payroll software?

Yes, airSlate SignNow can integrate seamlessly with various payroll and HR software solutions. This integration allows for automatic updates of employee data and deductions based on the voluntary payroll deduction form template. By connecting these systems, you can ensure a cohesive approach to managing payroll operations.

-

How does airSlate SignNow ensure the security of my voluntary payroll deduction form templates?

airSlate SignNow prioritizes security by using encryption and secure storage to protect your voluntary payroll deduction form templates. Additionally, it provides user authentication and permissions settings to control access to sensitive information. This commitment to security helps safeguard your employees' personal and financial data.

Get more for Voluntary Payroll Deduction Form

- Fillable online form it 607 claim for excelsior jobs

- Sale of car contract template form

- Sale of home contract template form

- Sale of house contract template form

- Sale of land contract template form

- Sale of property contract template form

- Sale of service contract template form

- Sale of used car contract template form

Find out other Voluntary Payroll Deduction Form

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free