Ctca 047 Form

What is the Ctca 047 Form

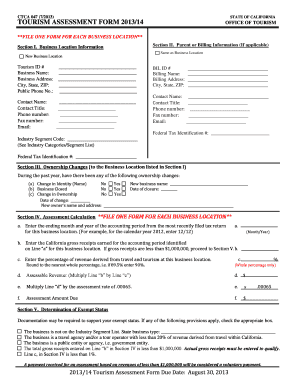

The Ctca 047 form is a specific document used in various administrative processes within the United States. It serves as an official record for particular transactions or declarations, ensuring compliance with regulatory requirements. Understanding the purpose and function of this form is crucial for individuals and businesses alike, as it can impact legal standing and operational efficiency.

How to use the Ctca 047 Form

Using the Ctca 047 form involves several steps to ensure it is completed correctly. First, gather all necessary information and documentation required to fill out the form accurately. Next, carefully follow the instructions provided with the form, ensuring that each section is completed as per the guidelines. Once the form is filled out, review it for accuracy before submission to avoid delays or complications.

Steps to complete the Ctca 047 Form

Completing the Ctca 047 form involves a systematic approach:

- Obtain the latest version of the Ctca 047 form from a reliable source.

- Read the instructions thoroughly to understand the requirements.

- Fill in the form with accurate and complete information.

- Double-check all entries for errors or omissions.

- Sign and date the form where required.

- Submit the form according to the specified submission methods.

Legal use of the Ctca 047 Form

The Ctca 047 form holds legal significance in various contexts. When filled out and submitted correctly, it can serve as a binding document in legal proceedings or administrative processes. It is essential to ensure that all legal requirements are met when using this form, including proper signatures and adherence to relevant laws and regulations.

Form Submission Methods

There are multiple ways to submit the Ctca 047 form, depending on the specific requirements of the issuing authority. Common submission methods include:

- Online submission through designated portals.

- Mailing the completed form to the appropriate address.

- In-person delivery at specified locations.

Choosing the right submission method can affect processing times and the overall efficiency of your application.

Required Documents

When completing the Ctca 047 form, certain documents may be required to support your application. These can include:

- Identification documents, such as a driver's license or passport.

- Proof of residency or business registration.

- Financial statements or tax documents, if applicable.

Gathering these documents in advance can streamline the completion process and help avoid delays.

Quick guide on how to complete ctca 047 form

Prepare Ctca 047 Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly replacement for traditional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage Ctca 047 Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Ctca 047 Form without hassle

- Obtain Ctca 047 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or redact sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional pen-and-ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ctca 047 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ctca 047 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ctca 047 form used for?

The ctca 047 form is commonly used in various business processes, particularly for document management and compliance purposes. It allows users to collect important information and signatures in a streamlined manner. Utilizing airSlate SignNow for the ctca 047 form enhances efficiency and accuracy in document handling.

-

How can airSlate SignNow help with the ctca 047 form?

airSlate SignNow offers an intuitive platform for creating, sending, and signing the ctca 047 form electronically. The platform ensures security and compliance, making it ideal for businesses needing to manage important documents. With airSlate SignNow, you can easily integrate the ctca 047 form into your workflows.

-

What pricing plans are available for airSlate SignNow when using the ctca 047 form?

airSlate SignNow offers flexible pricing plans suitable for various business sizes and needs, including those who frequently utilize the ctca 047 form. Each plan includes essential features like unlimited signing and templates, all at competitive rates. You can choose a plan that fits your budget while optimizing your document processes.

-

Are there any benefits to using airSlate SignNow for the ctca 047 form?

Using airSlate SignNow for the ctca 047 form provides several benefits, including improved turnaround time and enhanced document security. The platform's easy-to-use interface allows for quick completion of the form, reducing delays. Additionally, it helps maintain compliance with regulations.

-

Can I integrate airSlate SignNow with other applications for the ctca 047 form?

Yes, airSlate SignNow offers seamless integrations with numerous applications, which can enhance the efficiency of processing the ctca 047 form. You can connect it with popular tools like Google Drive, Salesforce, and more to streamline your workflows. This integration capability ensures that your data remains centralized and easily accessible.

-

Is airSlate SignNow secure for handling the ctca 047 form?

Absolutely, airSlate SignNow prioritizes security, making it a reliable choice for handling the ctca 047 form. The platform employs advanced encryption and complies with regulatory standards to protect sensitive information. You can have peace of mind knowing that your documents are safeguarded.

-

How easy is it to send the ctca 047 form with airSlate SignNow?

Sending the ctca 047 form with airSlate SignNow is incredibly easy. The platform's user-friendly interface allows you to upload the form, add recipients, and send it for signature in just a few clicks. This ease of use enhances operational efficiency for businesses.

Get more for Ctca 047 Form

Find out other Ctca 047 Form

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney