Uk Majesty Revenue Customs Form

What is the UK Majesty Revenue Customs?

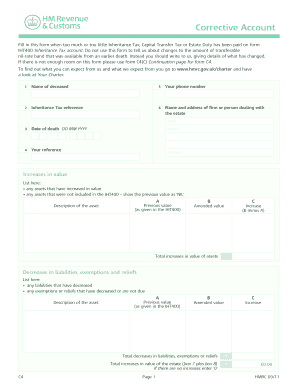

The UK Majesty Revenue Customs (HMRC) is the government department responsible for the collection of taxes, payment of some forms of welfare, and the administration of other regulatory regimes in the United Kingdom. It plays a crucial role in ensuring that individuals and businesses comply with tax laws and regulations. HMRC oversees various forms, including the HMRC corrective form, which is essential for correcting errors in tax submissions or other official documents.

Steps to Complete the HMRC Corrective Form

Completing the HMRC corrective form involves several key steps to ensure accuracy and compliance. First, gather all relevant information, including your tax identification number and details of the original submission that requires correction. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to provide a clear explanation of the corrections being made. After completing the form, review it for any errors before submitting it to HMRC. This process helps avoid delays and ensures that your corrections are processed efficiently.

Legal Use of the HMRC Corrective Form

The HMRC corrective form is legally binding when completed and submitted according to the regulations set forth by HMRC. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal repercussions. The form serves as an official request to amend previous submissions, making it vital for maintaining compliance with tax laws. Understanding the legal implications of using this form can help individuals and businesses navigate their tax obligations more effectively.

Required Documents for the HMRC Corrective Form

When completing the HMRC corrective form, certain documents may be required to support your corrections. These documents often include previous tax returns, correspondence with HMRC, and any relevant financial records that justify the changes being requested. Having these documents on hand can streamline the process and provide clarity to HMRC regarding the corrections. Ensuring that all required documentation is included can help facilitate a smoother review and approval process.

Form Submission Methods

The HMRC corrective form can be submitted through various methods, including online submission, mail, or in-person delivery. Online submission is often the most efficient option, allowing for quicker processing times. When submitting by mail, it is important to send the form to the correct address and consider using a tracked service for confirmation of receipt. In-person submissions may be possible at designated HMRC offices, providing an opportunity for direct assistance if needed.

Penalties for Non-Compliance

Failing to submit the HMRC corrective form or submitting incorrect information can result in penalties. HMRC imposes fines for late submissions, inaccuracies, or failure to comply with tax regulations. Understanding these penalties is crucial for individuals and businesses to avoid financial repercussions. It is advisable to address any errors promptly and ensure that all tax-related documents are accurate and submitted on time to maintain compliance and avoid unnecessary penalties.

Quick guide on how to complete uk majesty revenue customs

Complete Uk Majesty Revenue Customs seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary file and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Handle Uk Majesty Revenue Customs on any system using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Uk Majesty Revenue Customs effortlessly

- Locate Uk Majesty Revenue Customs and click Get Form to begin.

- Use the features we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers for this specific task.

- Create your signature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Alter and eSign Uk Majesty Revenue Customs and guarantee excellent communication throughout any part of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uk majesty revenue customs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an HMRC corrective form?

An HMRC corrective form is a document used to rectify mistakes made in previous submissions to HMRC. It allows businesses to correct errors in tax returns or other filings, ensuring compliance and preventing potential penalties. Using the airSlate SignNow platform, you can easily complete and send your HMRC corrective form with an electronic signature.

-

How does airSlate SignNow simplify the submission of HMRC corrective forms?

airSlate SignNow provides a user-friendly interface that streamlines the process of completing and submitting HMRC corrective forms. You can fill out the form digitally, apply eSignatures, and send it directly to HMRC, which saves time and reduces the likelihood of errors. This efficiency is crucial for maintaining compliance with HMRC regulations.

-

Is there a cost associated with using airSlate SignNow for HMRC corrective forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. While there may be costs involved, using this platform for HMRC corrective forms can save money in the long run by reducing errors and ensuring timely submissions. Additionally, the cost-effectiveness of airSlate SignNow makes it an appealing choice for businesses of all sizes.

-

Can I track the status of my HMRC corrective form submission with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your HMRC corrective form submission in real time. You will receive notifications about when the document is opened, signed, and completed, ensuring full transparency in your submission process.

-

What features does airSlate SignNow offer for managing HMRC corrective forms?

airSlate SignNow offers several features for managing HMRC corrective forms, including template creation, bulk sending, and automatic reminders. These features enhance efficiency and ensure that you never miss a deadline for correcting filings. The platform's integration capabilities allow you to work seamlessly with other business applications.

-

Are electronic signatures legally accepted for HMRC corrective forms?

Yes, electronic signatures are legally accepted for HMRC corrective forms as per UK law. Using airSlate SignNow, you can confidently sign and submit your documents electronically, ensuring they hold the same legal weight as traditional signatures. This streamlining of the signing process saves time and enhances document security.

-

What benefits do I gain from using airSlate SignNow for HMRC corrective forms?

Using airSlate SignNow for HMRC corrective forms streamlines the completion, signing, and submission process, reducing the likelihood of errors. It also saves time and money, allowing you to focus on more critical aspects of your business. Furthermore, the platform provides a more secure method of transmitting sensitive information to HMRC.

Get more for Uk Majesty Revenue Customs

- Swift form

- Dir certified payroll form pdf

- Dmvnm form

- 1st grade ela curriculum unit map weeks 19 24 lesson form

- Auction certificate camperships form

- Instructions for form 4684 casualties and thefts

- Personal tax credits return td1 university of new brunswick form

- Brand ambassador contract template form

Find out other Uk Majesty Revenue Customs

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free