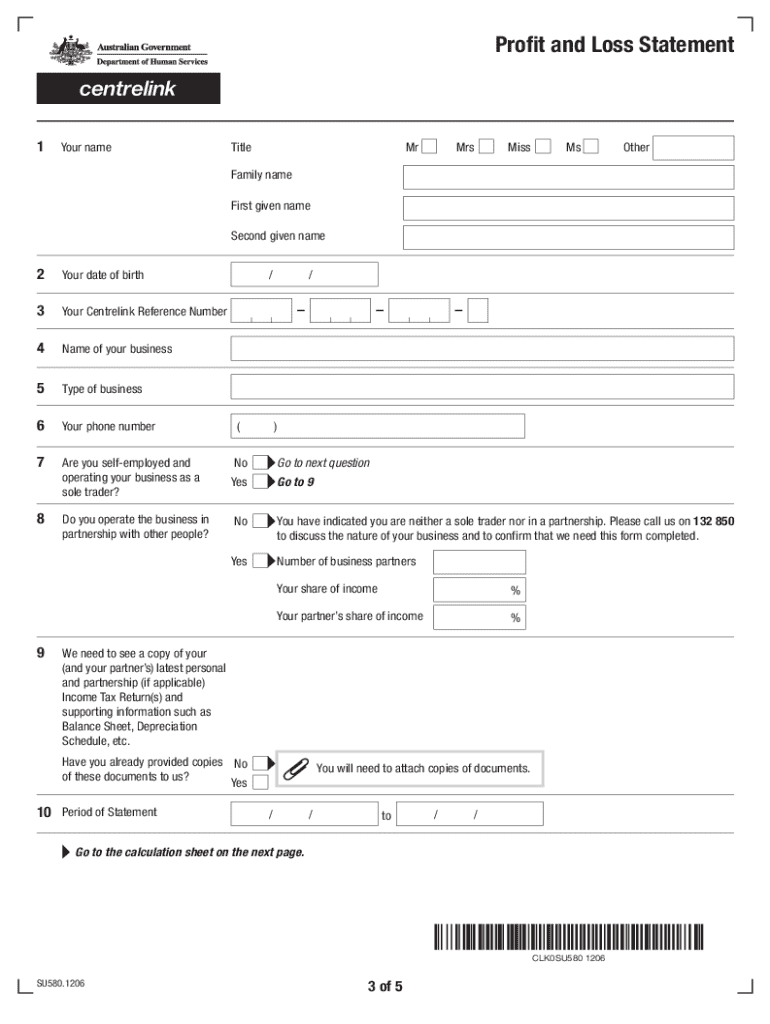

Human Services Profit and Loss Statement Form 2012

What is the Human Services Profit And Loss Statement Form

The Human Services Profit and Loss Statement Form is a financial document used by organizations within the human services sector to report their income and expenses over a specific period. This form helps organizations assess their financial performance, ensuring they remain compliant with funding requirements and regulations. It typically includes sections for revenue sources, direct and indirect expenses, and net profit or loss calculations. Accurate completion of this form is essential for maintaining transparency and accountability in financial reporting.

How to use the Human Services Profit And Loss Statement Form

Using the Human Services Profit and Loss Statement Form involves several key steps. First, gather all financial records, including income statements, expense receipts, and any relevant documentation. Next, fill out the form by entering the total income generated from services provided, followed by a detailed list of expenses incurred. This includes both fixed and variable costs. Finally, calculate the net profit or loss by subtracting total expenses from total income. Ensure that all figures are accurate and reflect the organization's financial activities during the reporting period.

Steps to complete the Human Services Profit And Loss Statement Form

Completing the Human Services Profit and Loss Statement Form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documentation, including receipts and invoices.

- Identify and categorize all sources of income, such as grants, donations, and service fees.

- List all expenses, ensuring to differentiate between fixed costs (e.g., salaries, rent) and variable costs (e.g., program supplies).

- Input the totals for income and expenses into the respective sections of the form.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Review the completed form for accuracy and completeness before submission.

Key elements of the Human Services Profit And Loss Statement Form

Several key elements must be included in the Human Services Profit and Loss Statement Form to ensure it meets legal and organizational standards. These elements include:

- Total Revenue: This section captures all income sources, including grants, fees for services, and donations.

- Total Expenses: This includes a breakdown of all costs incurred, categorized into direct and indirect expenses.

- Net Profit or Loss: The result of subtracting total expenses from total revenue, indicating the financial health of the organization.

- Reporting Period: Clearly state the time frame for which the financial data is being reported.

- Signature and Date: A designated representative must sign and date the form to validate its authenticity.

Legal use of the Human Services Profit And Loss Statement Form

The Human Services Profit and Loss Statement Form serves a legal purpose by providing a transparent account of an organization's financial activities. It is essential for compliance with federal and state regulations, particularly for organizations receiving government funding or grants. Accurate reporting on this form can help prevent legal issues related to financial mismanagement or fraud. Organizations must ensure that the information provided is truthful and complete, as discrepancies can lead to penalties or loss of funding.

Who Issues the Form

The Human Services Profit and Loss Statement Form is typically issued by state or federal agencies overseeing human services programs. These agencies establish the requirements for financial reporting to ensure accountability and transparency among organizations receiving public funds. Organizations may also create their own version of the form, provided it meets the necessary legal standards and includes all required elements for financial reporting.

Quick guide on how to complete human services profit and loss statement 2012 form

A brief manual on how to create your Human Services Profit And Loss Statement Form

Locating the appropriate template can be difficult when you must submit formal international documentation. Even when you possess the necessary form, it can be cumbersome to swiftly prepare it according to all specifications if you utilize physical copies instead of executing everything digitally. airSlate SignNow is the web-based electronic signature solution that assists you in overcoming these obstacles. It enables you to acquire your Human Services Profit And Loss Statement Form and efficiently complete and sign it on location without the need to reprint documents in case of errors.

The following are the actions you should take to create your Human Services Profit And Loss Statement Form with airSlate SignNow:

- Hit the Get Form button to immediately bring your document into our editor.

- Begin with the initial empty field, input your information, and continue with the Next button.

- Complete the vacant spaces using the Cross and Check tools from the menu above.

- Choose the Highlight or Line options to emphasize the most crucial details.

- Click on Image and upload one if your Human Services Profit And Loss Statement Form necessitates it.

- Leverage the right-side panel to add more sections for you or others to complete if needed.

- Review your responses and validate the document by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude editing the form by pressing the Done button and selecting your file-sharing preferences.

Once your Human Services Profit And Loss Statement Form is ready, you can distribute it as you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. Additionally, you can securely store all your completed documentation in your account, organized in folders according to your needs. Don’t waste time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct human services profit and loss statement 2012 form

FAQs

-

Need Help on Pnl: How to make profit and loss statement?

The main objective is to determine the company's profitability. Whether you are a lemonade stand or a billion dollar company, you likely have revenues and expenses. The profit and loss sheet lumps each revenue stream into a category. For example, product sales, advertising sales, and subscriptions might all be valid sources of revenue for a company, and the profit and loss sheet would provide an accounting for the amount of revenue generated from each of those sources over a predetermined period of time, typically month by month over the trailing twelve months. The process is generally the same for expenses, and aside from a few small nuances, once you've got a full accounting of revenue and expenses, you'll be able to define profitibility. If you want more inforomation, you can check out this comprehensive guide I recently wrote: How to Create a Profit and Loss Statement + Free Profit & Loss Template

-

How do I know which items from Balance Sheet and Profit and Loss Account forming the Cash Flow Statement?

Hi!I believe that a cash flow statement template will help you to understand how it gets formed. You can download a cash flow statement template absolutely for free from InvoiceBerry templates page. It already includes everything you should have in your cash flow statement, so you shouldn’t have any problems with understanding what you should include in it. It is available in .xlsx format and optimised for Microsoft Excel. Check it out to see if it helps!You can also download a free Balance Sheet template and a Profit and Loss Account template provided by InvoiceBerry in case you need them too.Regards,Krystsina

-

How useful is a profit and loss statement to different stakeholders?

Anyone who cares about the continued existence of a business should want to regularly review both the Profit or Loss statement and the Balance Sheet. One is not enough. The P/L will tell you if the business is making or losing money. The balance sheet will tell you if the business has enough cash to continue operating.For example, you have a business that deals with a small number of very large orders. With minimal expense you’ve just landed a huge sale that will make your business profitable for the next 12 months. Your Proft or Loss statement looks great. Unfortunately, you won’t be paid for that sale for 6 months and according to your Balance Sheet, you’ll have long since run out of cash by then.This is why stakeholders should be looking at both. And of course, they will also need to know what credit the business has available to it to cover the gaps for exactly the kind of circumstance I described above.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

What do I do when the prior years’ profit and loss statements were not closed out to retained earnings?

You have one of two options, which depend upon the magnitude of the error and a judgement call.If you are well into the current year and discover an immaterial error, I would just flush it through the current year and not disrupt the prior year.You could charge it to a non-operating expense type called “Prior Year Adjustment,” so that current period is not diluted in a non-obvious way.If the adjustment is material, you may have to re-open the books last year, book the adjusting journal entry, then re-rolled your new beginning balances (for the current calendar or fiscal year) forward. Whether you choose to do this is a senior financial management decision (CFO).If you’re a publicly-traded company in the US, you’ll have to file an amendment to your 10-K filing (10-K/A) and file amendments to any already-filed state and federal income tax returns. It’s kind a big deal, unpleasant and a whole lot of work.

-

To find out the value of a business’ assets, would the owner look at cash flow statement, balance sheet, profit and loss account, all of these?

Not exactly sure what you mean by this question - the value of business assets are listed at a Balance Sheet level, but to find out the value of the business assets you would need to examine the original purchase price (from the purchase receipts) minus any depreciation that has already been deducted from the asset’s value.If these figures are not available, then you will need to employ the services of a Quantity Surveyor to examine and calculate the current depreciated value of the assets.I hope this helps.

-

How much will it cost me per year a good accountant based in Hong Kong to take care of my bookkeeping, year audit reports, profit & losses statements, balance sheets, tax computation and filling, if I don't sell products/services to HK?

A few hundred US dollars should be plenty to make sure that you've filed the required paperwork.The other things is that if you are not doing business in HK the tax computation is going to be easy. It's zero.

-

How do you read the profit and loss statement of a company to understand from an investor’s point of view?

1 Well the first thing you have to see the sales growth or revenue growth of the company from its core business. As presently our gdp growth is 7 percent and inflation is about 5 percent,now adding up these two comes 12 percent.Hence to qualify for a good company its revenue growth should be a minimum of 12 percent.2 Net profit growth- the net profit growth of the company should increase by minimum of 15 percent year after year for qualifying it to be good company.3 Net margin-It is also a very good indicator of the pricing power of the company at the market place.Normally a good company net margin increases also year after year and it should be more in comparison to its peer.4 ROCE-that is return on capital employed. It tells us that how efficient is the company in utilizing its capital.A company with more than of 15 percent of roce is known as a good company.5 Debt-A company with no debt or low debt is known to be a good company.6 Equity capital-A company with a low equity is known to be a good company.So these are the important parameters which can be checked from profit and loss statement from an investor viewpoint of a company.Hope this helps you.

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

Create this form in 5 minutes!

How to create an eSignature for the human services profit and loss statement 2012 form

How to generate an electronic signature for your Human Services Profit And Loss Statement 2012 Form online

How to generate an electronic signature for the Human Services Profit And Loss Statement 2012 Form in Chrome

How to make an electronic signature for signing the Human Services Profit And Loss Statement 2012 Form in Gmail

How to generate an electronic signature for the Human Services Profit And Loss Statement 2012 Form straight from your smartphone

How to create an electronic signature for the Human Services Profit And Loss Statement 2012 Form on iOS

How to create an eSignature for the Human Services Profit And Loss Statement 2012 Form on Android OS

People also ask

-

What is the Human Services Profit And Loss Statement Form?

The Human Services Profit And Loss Statement Form is a specialized document designed to help businesses in the human services sector track their financial performance. This form provides a detailed overview of revenues and expenses, enabling organizations to assess profitability and make informed decisions.

-

How can I create a Human Services Profit And Loss Statement Form using airSlate SignNow?

Creating a Human Services Profit And Loss Statement Form with airSlate SignNow is simple. Users can select from customizable templates, fill in relevant information, and send it for eSignature, making the entire process efficient and seamless.

-

Is there a cost associated with using the Human Services Profit And Loss Statement Form in airSlate SignNow?

Yes, there is a subscription fee associated with accessing the Human Services Profit And Loss Statement Form through airSlate SignNow. However, our pricing model is designed to be cost-effective, ensuring you get maximum value for your investment in document management.

-

What features does the Human Services Profit And Loss Statement Form offer?

The Human Services Profit And Loss Statement Form offers features like customizable templates, electronic signatures, and real-time tracking. These features ensure that financial documentation is handled efficiently and securely, enhancing your workflow.

-

Can I integrate the Human Services Profit And Loss Statement Form with other software?

Absolutely! airSlate SignNow allows for seamless integrations with various software platforms, enabling you to incorporate your Human Services Profit And Loss Statement Form into your existing workflow. This integration simplifies data management and ensures consistency across all business operations.

-

What are the benefits of using the Human Services Profit And Loss Statement Form?

The Human Services Profit And Loss Statement Form streamlines financial reporting and provides clear insights into business performance. By utilizing this form, organizations can improve their financial planning and enhance transparency, ultimately supporting better decision-making.

-

Is the Human Services Profit And Loss Statement Form legally binding?

Yes, the Human Services Profit And Loss Statement Form created and signed via airSlate SignNow is legally binding. Our platform complies with electronic signature laws, ensuring that your documents hold the same validity as traditional paper documents.

Get more for Human Services Profit And Loss Statement Form

Find out other Human Services Profit And Loss Statement Form

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document