Change Surs Direct Deposit Forms

What is the Change Surs Direct Deposit Forms

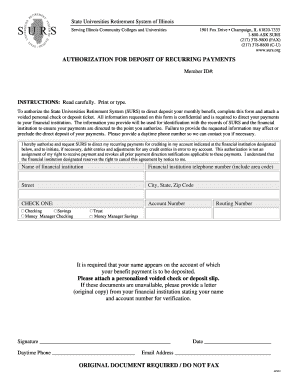

The change surs direct deposit forms are essential documents used to update or modify the bank account information for direct deposit payments. These forms are typically utilized by employees to ensure their wages, benefits, or other payments are deposited into the correct financial institution. The forms may vary depending on the organization or financial institution, but they generally require the account holder's name, account number, routing number, and possibly additional identification information.

How to use the Change Surs Direct Deposit Forms

Using the change surs direct deposit forms involves a straightforward process. First, obtain the appropriate form from your employer or financial institution. Next, fill in the required fields accurately, ensuring that all information matches your bank records. After completing the form, it is crucial to review it for any errors. Once verified, submit the form according to your employer's or institution's specified method, which may include online submission, mailing, or delivering it in person.

Steps to complete the Change Surs Direct Deposit Forms

Completing the change surs direct deposit forms requires attention to detail. Follow these steps for proper completion:

- Gather necessary information, including your bank account details and personal identification.

- Obtain the correct form from your employer or financial institution.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check your entries for any mistakes or omissions.

- Sign and date the form as required.

- Submit the form through the designated method provided by your employer or institution.

Legal use of the Change Surs Direct Deposit Forms

The change surs direct deposit forms are legally binding documents when filled out correctly and submitted according to the relevant guidelines. To ensure legal compliance, it is important to follow the specific requirements set forth by your employer or financial institution. This includes providing accurate information and obtaining the necessary signatures. Additionally, using a secure platform for submission can help protect your sensitive information and maintain compliance with applicable laws.

Key elements of the Change Surs Direct Deposit Forms

Several key elements are essential when completing the change surs direct deposit forms. These include:

- Account Holder Information: Your full name and contact information.

- Bank Account Details: The account number and routing number of the new bank account.

- Authorization Signature: Your signature to authorize the change.

- Date: The date on which the form is completed and signed.

Form Submission Methods

Submitting the change surs direct deposit forms can be done through various methods, depending on the preferences of your employer or financial institution. Common submission methods include:

- Online: Many organizations allow electronic submission through secure portals.

- Mail: You can send the completed form via postal service to the designated address.

- In-Person: Delivering the form directly to your HR department or financial institution may be an option.

Quick guide on how to complete change surs direct deposit forms

Complete Change Surs Direct Deposit Forms effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without complications. Manage Change Surs Direct Deposit Forms on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Change Surs Direct Deposit Forms without any hassle

- Find Change Surs Direct Deposit Forms and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from any device you choose. Edit and eSign Change Surs Direct Deposit Forms and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the change surs direct deposit forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can I change surs direct deposit forms using airSlate SignNow?

To change surs direct deposit forms with airSlate SignNow, simply upload your document to the platform, make the necessary edits, and send it out for eSignature. Our intuitive interface makes it easy to fill out and modify forms. You can also track the status of your document in real-time, ensuring a seamless process.

-

What are the pricing options for changing surs direct deposit forms?

airSlate SignNow offers a variety of pricing plans designed to fit the needs of businesses of all sizes. Our cost-effective solutions allow you to change surs direct deposit forms as needed, without breaking the bank. You can choose from monthly or annual subscriptions, depending on what works best for your organization.

-

What features does airSlate SignNow offer for changing surs direct deposit forms?

airSlate SignNow offers features such as customizable templates, bulk sending, and secure eSigning, making it easy to change surs direct deposit forms efficiently. Additionally, our integration capabilities with various third-party applications enhance the functionality of your document management process. This allows you to streamline workflows and improve productivity.

-

Are there any limitations when changing surs direct deposit forms?

While airSlate SignNow aims to provide maximum flexibility, certain plans may have limits on the number of documents you can change surs direct deposit forms per month. However, upgrading to a higher tier gives you access to even more features and increased limits. Always check the plan details to find the best fit for your needs.

-

How can I integrate airSlate SignNow with other applications for changing surs direct deposit forms?

airSlate SignNow seamlessly integrates with various applications such as CRMs, accounting software, and more, which can enhance your workflow when you change surs direct deposit forms. By connecting your existing tools, you can automate workflows, synchronize data, and improve overall efficiency. Check out our integration options to get started.

-

What are the benefits of using airSlate SignNow to change surs direct deposit forms?

Using airSlate SignNow to change surs direct deposit forms streamlines the document management process signNowly. Benefits include reduced turnaround time for signatures, enhanced security features, and the ability to track document status easily. This allows businesses to focus on what matters most while ensuring compliance and reducing paperwork.

-

Is there customer support available for changing surs direct deposit forms?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions or issues related to changing surs direct deposit forms. Our support team is available via chat, email, and phone to ensure you have the help you need when navigating the platform. We’re committed to providing excellent customer service.

Get more for Change Surs Direct Deposit Forms

Find out other Change Surs Direct Deposit Forms

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF