Forma Unica PDF Fillable

What is the Forma Unica Pdf Fillable

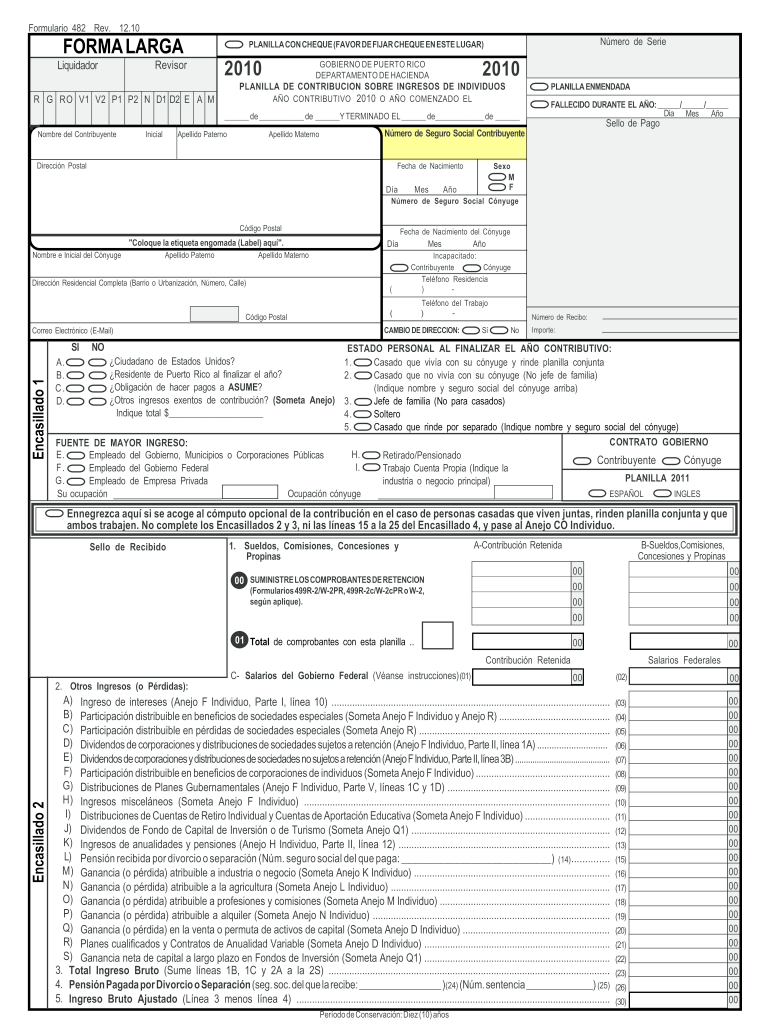

The Forma Unica Pdf Fillable, commonly known as form 482, is an essential document used in Puerto Rico for various tax and financial purposes. This form allows individuals and businesses to report income and expenses accurately. It is designed to be filled out electronically, making the process more efficient and accessible. The fillable format ensures that users can easily enter their information, save their progress, and submit the form as needed.

How to use the Forma Unica Pdf Fillable

Using the Forma Unica Pdf Fillable is straightforward. First, download the form from a reliable source. Once downloaded, open the PDF using a compatible reader that supports fillable forms. Begin by entering the required information in the designated fields. Ensure that all entries are accurate to avoid any issues during submission. After completing the form, save it and follow the submission guidelines to ensure it reaches the appropriate authorities.

Steps to complete the Forma Unica Pdf Fillable

Completing the Forma Unica Pdf Fillable involves several key steps:

- Download the form from a trusted source.

- Open the PDF in a fillable PDF reader.

- Fill in personal and financial information as required.

- Review all entries for accuracy.

- Save the completed form.

- Submit the form according to local regulations, either online or by mail.

Legal use of the Forma Unica Pdf Fillable

The Forma Unica Pdf Fillable is legally recognized in Puerto Rico, provided it is completed and submitted in compliance with local tax laws. Electronic submissions are accepted, and the form must be filled out accurately to ensure legal validity. It is crucial to keep a copy of the submitted form for personal records, as it may be required for future reference or audits.

Required Documents

When completing the Forma Unica Pdf Fillable, certain documents may be required to support the information provided. Commonly required documents include:

- Proof of income, such as pay stubs or tax returns.

- Receipts for deductible expenses.

- Identification documents, like a driver's license or Social Security number.

Form Submission Methods (Online / Mail / In-Person)

The Forma Unica Pdf Fillable can be submitted through various methods, depending on local regulations. Options typically include:

- Online submission through the official tax authority website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, where available.

Quick guide on how to complete formulario 482 2015

Complete Forma Unica Pdf Fillable effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Forma Unica Pdf Fillable on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign Forma Unica Pdf Fillable with ease

- Obtain Forma Unica Pdf Fillable and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your alterations.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Forma Unica Pdf Fillable to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out an ITR for year 2015-16?

Try ClearTax, the easiest e-filing platform in India

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

I received Worker's Compensation in 2015, how could I find out how much I received in payments for filling out the FAFSA?

US workers compensation insurance carriers, third party claims administrators and self insureds all keep detailed records on how much they have paid on a given claim. It is broken down into medical payments and indemnity payments and claim expenses.For FAFSA's purposes , you want the indemnity payments which consists of lost time benefits and any settlement or award for your wage loss or disability.If you received a settlement or an award that was paid in a lump sum, it may have been a blend of medical and indemnity which makes it harder to break into accurate components. If there was a settlement, the document itself may recite how much was allocated to disability , disputed lost time, etc.Usually when a person has a lawyer, the carrier will not ( is ethically prohibited , actually) from talking directly to the claimant. However, for administrative things, the claim adjuster should be willing to give you the information needed. If the case is being litigated, your lawyers office needs to make the call. Regardless, it is simple and easy to retrieve on the carrier's end.There will not be a 1099 or W2. Also, worker's compensation benefits are not considered income under the Internal Revenue Code, so look carefully at the way FAFSA asks the question- you may not need this after all.

-

What is the procedure to apply for the AFCAT 2015 besides filling out an online application?

Hie dear.Get the full details here...How to Apply and fill AFCAT 2015 online Application form?

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

How does one get invited to the Quora Partner Program? What criteria do they use, or is it completely random?

I live in Germany. I got an invite to the Quora partner program the day I landed in USA for a business trip. So from what I understand, irrespective of the number of views on your answers, there is some additional eligibility criteria for you to even get an email invite.If you read the terms of service, point 1 states:Eligibility. You must be located in the United States to participate in this Program. If you are a Quora employee, you are eligible to participate and earn up to a maximum of $200 USD a month. You also agree to be bound by the Platform Terms (https://www.quora.com/about/tos) as a condition of participation.Again, if you check the FAQ section:How can other people I know .participate?The program is invite-only at this time, but we intend to open it up to more people as time goes on.So my guess is that Quora is currently targeting people based out of USA, who are active on Quora, may or may not be answering questions frequently ( I have not answered questions frequently in the past year or so) and have a certain number of consistent answer views.Edit 1: Thanks to @Anita Scotch, I got to know that the Quora partner program is now available for other countries too. Copying Anuta’s comment here:If you reside in one of the Countries, The Quora Partner Program is active in, you are eligible to participate in the program.” ( I read more will be added, at some point, but here are the countries, currently eligible at this writing,) U.S., Japan, Germany, Spain, France, United Kingdom, Italy and Australia.11/14/2018Edit 2 : Here is the latest list of countries with 3 new additions eligible for the Quora Partner program:U.S., Japan, Germany, Spain, France, United Kingdom, Italy, Canada, Australia, Indonesia, India and Brazil.Thanks to Monoswita Rez for informing me about this update.

Create this form in 5 minutes!

How to create an eSignature for the formulario 482 2015

How to create an eSignature for the Formulario 482 2015 online

How to create an eSignature for your Formulario 482 2015 in Google Chrome

How to make an electronic signature for putting it on the Formulario 482 2015 in Gmail

How to create an electronic signature for the Formulario 482 2015 right from your mobile device

How to generate an electronic signature for the Formulario 482 2015 on iOS

How to generate an electronic signature for the Formulario 482 2015 on Android OS

People also ask

-

What is Form 482 and how does it work with airSlate SignNow?

Form 482 is a specific document type that can be easily managed using airSlate SignNow. It allows users to create, send, and eSign legally binding documents quickly and efficiently, enhancing the overall document workflow.

-

Is there a cost associated with using airSlate SignNow for Form 482?

airSlate SignNow offers various pricing plans that cater to different business needs. The cost for managing Form 482 is competitive and reflects the high-quality features provided, making it a cost-effective solution for eSigning documents.

-

What features does airSlate SignNow offer for Form 482?

airSlate SignNow provides a range of features for Form 482, including customizable templates, secure eSigning, and real-time status tracking. These tools streamline the process and enhance collaboration, making it easier to manage important documents.

-

How can airSlate SignNow improve my workflow with Form 482?

By utilizing airSlate SignNow for Form 482, you can automate repetitive tasks, reduce processing times, and eliminate paperwork. The intuitive interface helps users save time and ensures that documents are completed efficiently and accurately.

-

Can I integrate airSlate SignNow with other tools for Form 482 management?

Yes, airSlate SignNow supports integrations with various third-party applications, allowing for seamless management of Form 482. This helps you centralize your workflow and leverage existing tools to enhance productivity.

-

Is airSlate SignNow compliant with legal standards for Form 482?

Absolutely! airSlate SignNow complies with all necessary legal standards for electronic signatures, ensuring that Form 482 is signed and stored securely. This compliance gives users peace of mind that their documents are legally binding.

-

What types of businesses can benefit from using airSlate SignNow for Form 482?

Any business that requires efficient document signing can benefit from airSlate SignNow and its features tailored for Form 482. Whether you're a startup, small business, or large enterprise, our solution meets diverse needs and scales as you grow.

Get more for Forma Unica Pdf Fillable

- Short blessed test form

- Work restrictions letter from doctor form

- Make salary certificate online form

- Adding and subtracting complex numbers worksheet form

- La quinta credit card authorization form 264082460

- Teacher service commission form

- Pre lien information request form

- Federal registervol 87 no 213friday november 4 form

Find out other Forma Unica Pdf Fillable

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement