Form 89 350 Torrance Payroll

What is the Form 89-350 Torrance Payroll

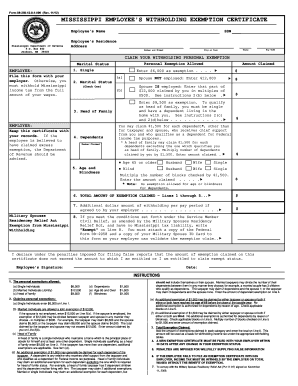

The Form 89-350 Torrance Payroll is a crucial document used by businesses in Torrance, California, to report payroll information to the appropriate authorities. This form captures essential details about employee wages, taxes withheld, and other payroll-related data. It is vital for ensuring compliance with local, state, and federal regulations regarding employee compensation and taxation. Understanding this form is essential for employers to maintain accurate records and fulfill their legal obligations.

How to Use the Form 89-350 Torrance Payroll

Using the Form 89-350 Torrance Payroll involves several steps to ensure accuracy and compliance. First, gather all necessary employee information, including names, Social Security numbers, and wage details. Next, accurately fill out the form, ensuring that all calculations for taxes withheld and total wages are correct. Once completed, the form should be submitted to the appropriate local or state tax authority by the specified deadline. It is important to keep a copy of the submitted form for your records.

Steps to Complete the Form 89-350 Torrance Payroll

Completing the Form 89-350 Torrance Payroll requires attention to detail. Follow these steps:

- Collect employee information, including full names and Social Security numbers.

- Calculate total wages paid for the reporting period.

- Determine the amount of federal and state taxes withheld.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors before submission.

- Submit the form to the appropriate tax authority by the deadline.

Legal Use of the Form 89-350 Torrance Payroll

The legal use of the Form 89-350 Torrance Payroll is governed by various regulations. It is essential for businesses to ensure that the information reported is accurate and submitted on time to avoid penalties. The form serves as a legal record of payroll transactions and is used by tax authorities to verify compliance with tax laws. Employers must retain copies of submitted forms for a specified period, as they may be required for audits or other legal inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Form 89-350 Torrance Payroll are critical for maintaining compliance. Employers must be aware of the specific dates for submitting the form to avoid late penalties. Typically, the form is due on a quarterly basis, with specific dates set by local tax authorities. It is advisable to check the latest guidelines from the Torrance tax office to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Form 89-350 Torrance Payroll can be submitted through various methods, providing flexibility for employers. Common submission methods include:

- Online submission via the official tax authority portal.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Employers should choose the method that best suits their needs while ensuring compliance with submission guidelines.

Quick guide on how to complete form 89 350 torrance payroll

Complete Form 89 350 Torrance Payroll effortlessly on any gadget

Virtual document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without holdups. Manage Form 89 350 Torrance Payroll on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Form 89 350 Torrance Payroll with minimal effort

- Find Form 89 350 Torrance Payroll and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 89 350 Torrance Payroll and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 89 350 torrance payroll

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Torrance Payroll and how does it relate to airSlate SignNow?

Torrance Payroll refers to a payroll solution that helps businesses manage their employee compensation and tax obligations. airSlate SignNow integrates seamlessly with Torrance Payroll, allowing for easy document signing and management related to payroll processes, ensuring that all necessary forms are executed efficiently.

-

How does airSlate SignNow enhance the Torrance Payroll experience?

airSlate SignNow enhances the Torrance Payroll experience by providing a user-friendly platform for sending and eSigning payroll documents. This eliminates the hassle of physical paperwork, speeds up the payroll process, and ensures compliance with legal requirements.

-

What are the pricing options for using airSlate SignNow with Torrance Payroll?

airSlate SignNow offers flexible pricing plans tailored to fit various business sizes and needs. By integrating with Torrance Payroll, businesses can choose a pricing plan that allows for efficient document management at a cost-effective rate.

-

Can airSlate SignNow be integrated with other payroll systems in addition to Torrance Payroll?

Yes, airSlate SignNow supports integration with multiple payroll systems beyond Torrance Payroll. This versatility ensures that businesses can streamline their document signing processes, regardless of the payroll system they choose.

-

What features does airSlate SignNow provide specifically for payroll processing?

AirSlate SignNow offers features such as customizable templates, status tracking, and automated reminders that are crucial for payroll processing. These features enhance the Torrance Payroll workflow by ensuring that documents are promptly signed and processed, reducing delays.

-

How secure is airSlate SignNow for handling payroll documents with Torrance Payroll?

AirSlate SignNow prioritizes security by employing advanced encryption and authentication measures. This ensures that all payroll documents managed through Torrance Payroll are safe from unauthorized access and comply with industry standards.

-

What benefits does airSlate SignNow provide to businesses using Torrance Payroll?

Businesses using Torrance Payroll can signNowly benefit from airSlate SignNow by streamlining document handling, reducing costs related to paper usage, and improving overall efficiency. This ensures payroll processes are quicker, making it easier for businesses to focus on growth.

Get more for Form 89 350 Torrance Payroll

- Construction security procedures tool management plan form

- Charter agreement form for master gardener associations

- County service request form

- Conditional use permit application polk county community form

- Ohio open burning permit application form

- North ridgeville city schools 34620 bainbridge roa form

- New york auto body form

- Readbeauty cominformacin detallada del sitio web y la empresa

Find out other Form 89 350 Torrance Payroll

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile