Non Obligor Form

What is the Non Obligor Form

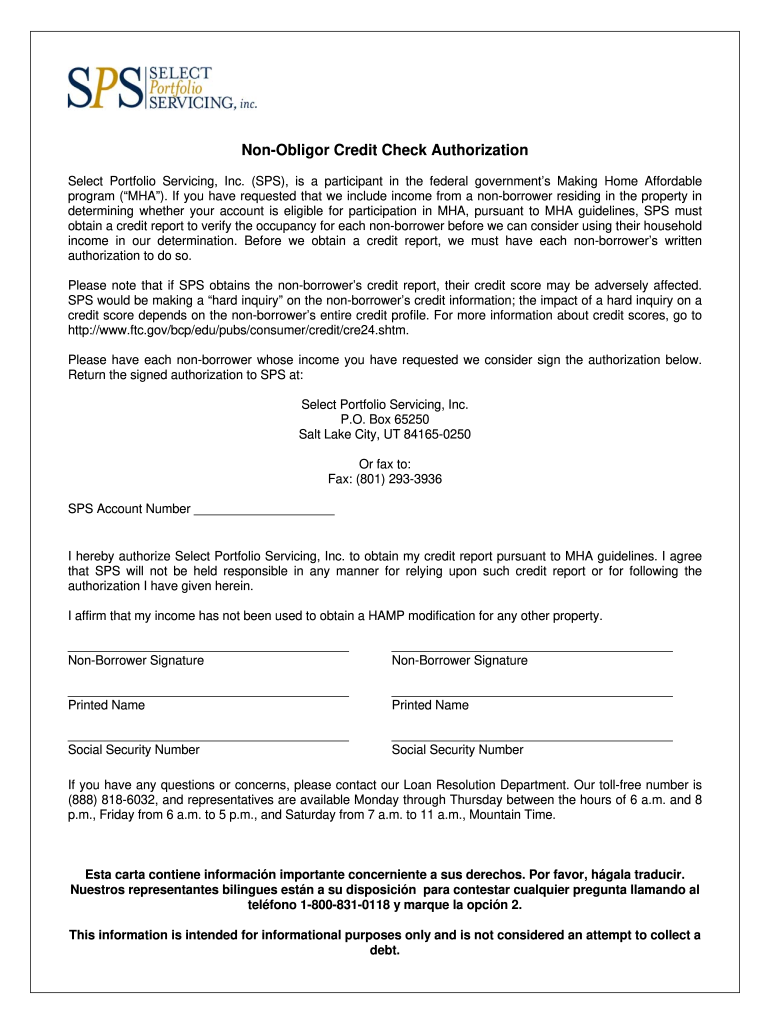

The non obligor form is a document used in various financial and legal contexts to clarify the roles and responsibilities of parties involved in a transaction. Specifically, it identifies individuals or entities that are not responsible for fulfilling obligations related to a loan or financial agreement. This form is crucial for ensuring transparency and protecting the rights of all parties by clearly delineating who is accountable and who is not.

How to use the Non Obligor Form

Using the non obligor form involves several key steps. First, gather all necessary information about the transaction and the parties involved. Next, accurately fill out the form, ensuring that all required fields are completed. It is essential to clearly indicate the non obligor's details and their relationship to the obligor. Once the form is filled out, all parties should review it for accuracy before signing. Finally, retain a copy for your records and distribute copies to all relevant parties to ensure everyone is informed of their responsibilities.

Key elements of the Non Obligor Form

Several key elements must be included in the non obligor form to ensure its validity and effectiveness. These elements typically include:

- Identifying Information: Names and addresses of all parties involved, including the obligor and the non obligor.

- Transaction Details: A clear description of the financial agreement or obligation being addressed.

- Signature Section: Spaces for all parties to sign, indicating their acknowledgment and acceptance of the terms.

- Date: The date on which the form is completed and signed.

Steps to complete the Non Obligor Form

Completing the non obligor form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary documents and information related to the transaction.

- Download or obtain the non obligor form from a reliable source.

- Fill in the required fields, including the names and roles of all parties.

- Review the form for any errors or omissions.

- Have all parties sign the form in the designated areas.

- Make copies for all parties involved and store the original securely.

Legal use of the Non Obligor Form

The non obligor form serves a legal purpose by documenting the non-obligor's status in relation to a financial agreement. It is essential for protecting the rights of all parties involved, as it provides a clear record that can be referenced in case of disputes. The form must be completed accurately and signed by all relevant parties to ensure its legal standing. Adhering to state-specific regulations and compliance standards is also critical to maintain the form's validity.

Examples of using the Non Obligor Form

There are various scenarios where the non obligor form may be utilized, including:

- In real estate transactions, where a co-signer may not be responsible for mortgage payments.

- In loan agreements, where a guarantor is not liable for repayment.

- In business partnerships, where certain members may not be responsible for specific debts.

These examples illustrate the versatility of the non obligor form in different contexts, providing clarity and legal protection for all parties involved.

Quick guide on how to complete non obligor form

The simplest method to locate and authorize Non Obligor Form

At the level of an entire organization, ineffective procedures related to paper approvals can take up a signNow amount of working hours. Approving documents such as Non Obligor Form is an inherent part of operations across all sectors, which is why the effectiveness of each agreement’s lifecycle has a substantial impact on the overall productivity of the organization. With airSlate SignNow, authorizing your Non Obligor Form is as straightforward and rapid as possible. This platform provides you with the latest version of nearly every form. Even better, you can authorize it instantly without the need to install external software on your device or printing out physical copies.

Steps to obtain and authorize your Non Obligor Form

- Browse our collection by category or use the search bar to locate the form you require.

- Review the form preview by selecting Learn more to confirm it’s the correct one.

- Click Get form to begin editing right away.

- Fill out your form and include any necessary information using the toolbar.

- Once completed, click the Sign tool to authorize your Non Obligor Form.

- Choose the signature method that is most suitable for you: Sketch, Create initials, or upload an image of your handwritten signature.

- Click Done to complete the editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you possess everything you need to handle your documentation efficiently. You can find, fill in, modify, and even send your Non Obligor Form in one tab without any difficulties. Optimize your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

How do I find out whether I belong to the OBC creamy or non-creamy layer while filling out a form?

Please go to the caste census of 2011 to find out whether you are a backward caste . Then find out from the website of Backward Classes Commission whether you fall in OBC list .Having found that , the criteria is as under -You will be in non-creamy layer if your parents’ total annual income is not more than Rs.8 lakh . Your own income , if any , is not included . Any agricultural income of your parents is also not included .

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the non obligor form

How to generate an electronic signature for your Non Obligor Form in the online mode

How to make an electronic signature for your Non Obligor Form in Google Chrome

How to create an eSignature for signing the Non Obligor Form in Gmail

How to make an eSignature for the Non Obligor Form straight from your smartphone

How to make an eSignature for the Non Obligor Form on iOS

How to create an eSignature for the Non Obligor Form on Android

People also ask

-

What is a Non Obligor Form and how is it used?

A Non Obligor Form is a document that allows parties to acknowledge their intentions without creating binding obligations. With airSlate SignNow, users can easily create, send, and eSign Non Obligor Forms, making it ideal for businesses that need flexibility in their agreements.

-

How does airSlate SignNow simplify the process of creating a Non Obligor Form?

airSlate SignNow provides a user-friendly interface that streamlines the creation of Non Obligor Forms. Users can customize templates, add fields, and quickly send documents for signing, ensuring a smooth and efficient workflow.

-

Is there a cost associated with using the Non Obligor Form feature on airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing plans that include access to the Non Obligor Form feature. With a range of subscription options, businesses can choose a plan that suits their needs and budget, ensuring cost-effectiveness in document management.

-

What are the key benefits of using a Non Obligor Form in business transactions?

Using a Non Obligor Form allows businesses to clarify intentions without committing to legal obligations. This flexibility can foster trust and open communication between parties, making it an essential tool for negotiations and preliminary discussions.

-

Can I integrate airSlate SignNow with other applications while using the Non Obligor Form feature?

Absolutely! airSlate SignNow supports various integrations with popular applications, allowing users to incorporate the Non Obligor Form feature into their existing workflows. This enhances productivity and ensures seamless document management across platforms.

-

Is it secure to send and eSign a Non Obligor Form with airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. The platform employs advanced encryption and authentication measures to ensure that all documents, including Non Obligor Forms, are securely transmitted and stored.

-

What types of businesses can benefit from using Non Obligor Forms?

Non Obligor Forms are beneficial for a wide range of businesses, including startups, freelancers, and established corporations. Any organization that engages in negotiations or preliminary agreements can effectively utilize the Non Obligor Form feature on airSlate SignNow.

Get more for Non Obligor Form

Find out other Non Obligor Form

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile