Ifta 9 Form

What is the Ifta 9 Form

The Ifta 9 Form is a crucial document used by motor carriers to report and pay fuel taxes across multiple jurisdictions. It is part of the International Fuel Tax Agreement (IFTA), which simplifies the reporting process for fuel taxes for interstate carriers. The form allows carriers to calculate their fuel use tax based on the miles driven and fuel consumed in each state or province. This ensures that taxes are fairly distributed to the jurisdictions where the fuel was consumed.

How to use the Ifta 9 Form

To effectively use the Ifta 9 Form, carriers must first gather all necessary data regarding fuel purchases and mileage for the reporting period. This includes detailed records of fuel receipts and the total miles driven in each jurisdiction. Once the data is compiled, the carrier can fill out the form by entering the required information, such as total miles traveled, gallons of fuel purchased, and the tax rates for each jurisdiction. After completing the form, it should be submitted to the appropriate state authority along with any tax payments due.

Steps to complete the Ifta 9 Form

Completing the Ifta 9 Form involves several key steps:

- Collect all relevant data, including fuel purchase receipts and mileage records.

- Fill in the total miles traveled and gallons of fuel purchased for each jurisdiction.

- Calculate the total tax owed based on the jurisdiction's tax rates.

- Review the form for accuracy and completeness.

- Submit the completed form to your state’s IFTA office, along with any payment due.

Legal use of the Ifta 9 Form

The Ifta 9 Form is legally binding when completed accurately and submitted in compliance with state regulations. It must be filed by the due date to avoid penalties. The form serves as a formal declaration of the fuel taxes owed and is used by state authorities to ensure compliance with IFTA requirements. Proper use of the form helps maintain transparency and accountability in fuel tax reporting.

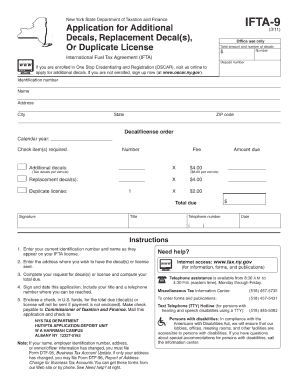

Key elements of the Ifta 9 Form

Key elements of the Ifta 9 Form include:

- Carrier Information: Name, address, and IFTA account number.

- Fuel Data: Total gallons of fuel purchased and total miles driven in each jurisdiction.

- Tax Calculations: Detailed calculations of taxes owed based on fuel consumption.

- Signatures: Signature of the authorized representative certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Ifta 9 Form typically occur quarterly. Carriers must submit their forms by the last day of the month following the end of each quarter. Important dates include:

- First quarter: Due by April 30

- Second quarter: Due by July 31

- Third quarter: Due by October 31

- Fourth quarter: Due by January 31

Form Submission Methods (Online / Mail / In-Person)

The Ifta 9 Form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online: Many states offer electronic filing options through their tax department websites.

- Mail: Carriers can print the completed form and send it to their state’s IFTA office via postal service.

- In-Person: Some jurisdictions allow carriers to submit the form in person at designated tax offices.

Quick guide on how to complete ifta 9 form

Effortlessly Prepare Ifta 9 Form on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Ifta 9 Form across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign Ifta 9 Form effortlessly

- Locate Ifta 9 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or mistakes requiring new document prints. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Edit and electronically sign Ifta 9 Form while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta 9 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ifta 9 Form and why is it important?

The Ifta 9 Form is a crucial document required for businesses that operate commercial vehicles across state lines. It helps in reporting fuel use and calculating taxes owed, ensuring compliance with interstate fuel tax regulations. Filing this form accurately is essential to avoid penalties and maintain operational efficiency.

-

How can airSlate SignNow help with the Ifta 9 Form process?

airSlate SignNow streamlines the process of completing and signing the Ifta 9 Form by providing a user-friendly electronic solution. Users can easily fill out the form, gather necessary signatures, and send it securely—all from one platform. This reduces paperwork and speeds up the submission process.

-

Is there a cost associated with using airSlate SignNow for the Ifta 9 Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. The cost-effective solutions provide access to features that simplify the completion and submission of the Ifta 9 Form. By investing in our platform, you can save time and resources in managing your documents.

-

What features does airSlate SignNow offer for the Ifta 9 Form?

airSlate SignNow offers features such as templates, collaboration tools, and secure cloud storage—specifically designed to enhance the Ifta 9 Form completion process. Users can leverage eSignature capabilities to ensure prompt approvals and maintain a digital record of the submission. These features ensure a seamless experience.

-

Can I store my completed Ifta 9 Forms in airSlate SignNow?

Absolutely! airSlate SignNow allows users to securely store completed Ifta 9 Forms in a cloud-based environment. This ensures easy access to your documents whenever needed, maintaining compliance and organization. You’ll never lose track of your important tax-related filings.

-

Does airSlate SignNow integrate with other software for managing the Ifta 9 Form?

Yes, airSlate SignNow integrates with various third-party software to enhance your Ifta 9 Form management. Whether it's accounting software or vehicle tracking systems, these integrations help streamline workflows and ensure consistency. This compatibility provides a comprehensive approach to document management.

-

What are the benefits of using airSlate SignNow for the Ifta 9 Form?

Using airSlate SignNow for the Ifta 9 Form provides benefits such as improved efficiency, reduced errors, and enhanced security. The platform simplifies the paperwork involved, allowing businesses to focus on core operations. With the ability to access and manage documents digitally, you can ensure timely submissions.

Get more for Ifta 9 Form

- Dmv ct application for waiver of registration fee active service in us armed forces form

- Form b230

- Form ct hr 12

- Make check payable to deep ct form

- Delaware certificate of public review november 2008 2009 form

- Bbl ez form

- Reforestation tax creditmississippi forestry commission form

- Mississippi installment agreement form

Find out other Ifta 9 Form

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney