Hr 12 Form

What is the HR 12 Form

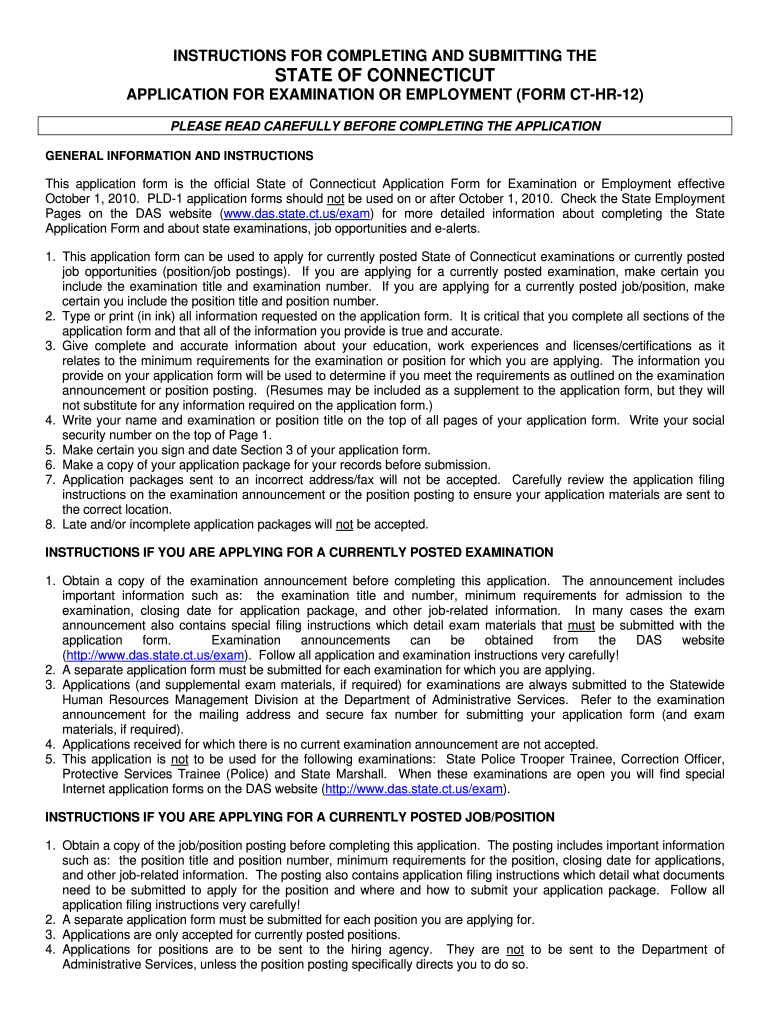

The HR 12 Form is a document used in the state of Connecticut for various human resources and employment-related purposes. It is often required for reporting employee information, tax withholding, and other compliance matters. Understanding the specifics of this form is essential for both employers and employees, as it plays a crucial role in maintaining accurate records and ensuring compliance with state regulations.

How to Use the HR 12 Form

Using the HR 12 Form involves several key steps. First, ensure you have the most current version of the form, which can typically be obtained from the Connecticut Department of Revenue Services. Next, accurately fill out the required fields, which may include employee details, tax information, and any relevant deductions. Once completed, the form should be submitted according to the guidelines provided by the state, either electronically or via mail.

Steps to Complete the HR 12 Form

Completing the HR 12 Form requires careful attention to detail. Follow these steps for a smooth process:

- Obtain the latest version of the HR 12 Form from the appropriate state agency.

- Gather necessary information, including employee names, Social Security numbers, and tax details.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the instructions provided, ensuring you meet any deadlines.

Legal Use of the HR 12 Form

The HR 12 Form must be used in compliance with state laws and regulations. It is important to understand that incorrect or incomplete submissions can lead to penalties or legal issues. The form serves as an official document that may be required for audits or other legal inquiries, making accuracy and timeliness essential for legal protection.

Key Elements of the HR 12 Form

Key elements of the HR 12 Form include:

- Employee Information: Details such as name, address, and Social Security number.

- Tax Withholding Details: Information regarding federal and state tax withholdings.

- Signature: The form typically requires a signature from the employer or authorized representative.

- Date of Submission: The date when the form is completed and submitted is crucial for compliance tracking.

Form Submission Methods

The HR 12 Form can be submitted through various methods, including:

- Online Submission: Many state agencies offer electronic submission options for convenience.

- Mail: The form can be printed and mailed to the appropriate state office.

- In-Person: Some individuals may choose to submit the form in person at designated state offices.

Quick guide on how to complete form ct hr 12

Effortlessly prepare Hr 12 Form on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Hr 12 Form on any platform with the airSlate SignNow Android or iOS apps and streamline any document-related process today.

The easiest way to modify and electronic sign Hr 12 Form effortlessly

- Obtain Hr 12 Form and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Hr 12 Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

Is it legal and ethical to fill out HR-related forms on company time?

In California, it is “actionable” to be required to do that on your _own_ time.In short, if a company requires work that’s unpaid and you’re not on salary (are an hourly employee, but not being paid that hourly rate for said work), then you could sue them and/or bring it up to your state’s labor board as a potential violation.Meaning, any company that requires this sort of work to be done without payment as such would do well to review that policy with legal counsel.Note: We (SwiftCloud ) have legal staffing firm clients and attorney clients, but are not an attorney. Laws for your state or jurisdiction will vary.

-

Why does HR block charge me extra to fill out certain forms?

H&R Block is a business. Basic Forms are easy, require less time and less expertice. Thus, they cost less. As forms increase in complexity, they require a tax pro with more education (thus more expertise) to complete, thus a higher cost. Several forms require more “Due Diligence”, meaning the tax pro must interview the client and determine if that tax credit/deduction meets the IRS rules. Those form require a comprehensive understanding of the tax law and the ability to determine what is happening with the client.Tax laws are very complex. There are volumes of books filled with tax law, court rulings and classes on handling certain transactions and situations in life. How could they all be priced the same?

-

What percentage is needed in 12 class to apply for the NDA exam?

According to the latest notification ,there is no minimum percentage required in for joining NDA, but you should be pass in all the subjects , in terms of percentage you can take it as 33% . But aim to score a minimum of 80% so you can apply for other fields in the future also.

Create this form in 5 minutes!

How to create an eSignature for the form ct hr 12

How to generate an electronic signature for the Form Ct Hr 12 in the online mode

How to create an eSignature for your Form Ct Hr 12 in Google Chrome

How to generate an electronic signature for signing the Form Ct Hr 12 in Gmail

How to make an eSignature for the Form Ct Hr 12 from your mobile device

How to make an eSignature for the Form Ct Hr 12 on iOS devices

How to make an electronic signature for the Form Ct Hr 12 on Android devices

People also ask

-

What is the Hr 12 Form and how do I use it with airSlate SignNow?

The Hr 12 Form is a crucial document for managing employee records and tax information. With airSlate SignNow, you can easily upload, customize, and send your Hr 12 Form for eSignature. Our platform streamlines the signing process, ensuring your documents are handled securely and efficiently.

-

How does airSlate SignNow ensure the security of my Hr 12 Form?

At airSlate SignNow, we prioritize the security of your documents, including the Hr 12 Form. Our platform uses advanced encryption protocols and secure cloud storage to protect sensitive information. Additionally, we comply with industry standards to guarantee that your data remains confidential and secure.

-

Can I integrate airSlate SignNow with other HR systems to manage the Hr 12 Form?

Yes, airSlate SignNow offers seamless integrations with various HR systems, allowing you to manage the Hr 12 Form effortlessly. You can connect with popular platforms like Workday, BambooHR, and others to streamline your document workflows and enhance productivity.

-

What are the pricing options for using airSlate SignNow for the Hr 12 Form?

airSlate SignNow provides competitive pricing plans tailored for businesses of all sizes. Whether you're a small startup or a large enterprise, our plans include features for managing the Hr 12 Form and other documents. Visit our pricing page to find the best option that suits your needs.

-

What features does airSlate SignNow offer for handling the Hr 12 Form?

airSlate SignNow includes a range of features for efficiently managing the Hr 12 Form, such as customizable templates, automated reminders, and real-time tracking of document status. These tools make it easy to send, sign, and store your Hr 12 Form, enhancing workflow efficiency.

-

How can airSlate SignNow speed up the process of getting my Hr 12 Form signed?

With airSlate SignNow, you can speed up the signing process of your Hr 12 Form by utilizing features such as bulk sending and in-person signing options. Our intuitive platform allows signers to complete documents quickly, reducing turnaround time and improving overall efficiency.

-

Is there a mobile app for airSlate SignNow to manage the Hr 12 Form on the go?

Yes, airSlate SignNow offers a mobile app that allows you to manage your Hr 12 Form anytime, anywhere. The app provides full access to all features, enabling you to send, sign, and track documents from your smartphone or tablet, ensuring convenience and flexibility.

Get more for Hr 12 Form

- Cremation approval form hennepin county minnesota hennepin

- Workforce analysis form

- Fmla employee handout and request form hennepin county hennepin

- Mn w 9 2011 form

- Rezoningpup application process henrico county virginia co henrico va form

- Ioniavisitingform

- Ionia parenting time affidavit form

- Long term care workforce background check application form 2011 2019

Find out other Hr 12 Form

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT