Business Loan Application Form IDFC Bank

What is the Business Loan Application Form IDFC Bank

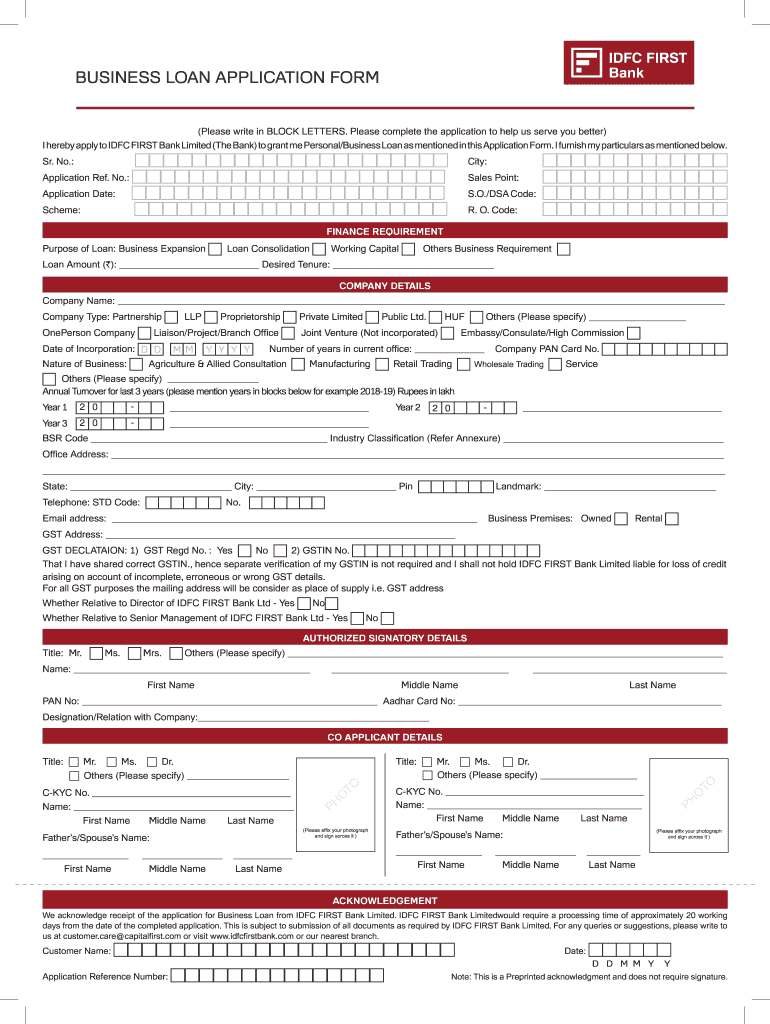

The Business Loan Application Form IDFC Bank is a formal document used by individuals or businesses seeking financial assistance from IDFC Bank. This form collects essential information about the applicant, including personal details, business information, and financial requirements. It serves as a preliminary step in the loan approval process, allowing the bank to assess the applicant's eligibility and financial needs.

Key elements of the Business Loan Application Form IDFC Bank

Understanding the key elements of the Business Loan Application Form IDFC Bank is crucial for a successful application. The form typically includes:

- Applicant Information: Personal details such as name, address, and contact information.

- Business Details: Information about the business, including its name, type, and registration details.

- Financial Information: Details regarding the loan amount requested, purpose of the loan, and existing financial obligations.

- Documentation Requirements: A checklist of documents that need to be submitted along with the application, such as tax returns and business plans.

Steps to complete the Business Loan Application Form IDFC Bank

Completing the Business Loan Application Form IDFC Bank involves several steps to ensure accuracy and completeness:

- Gather all necessary documents, including identification and financial statements.

- Fill in the applicant and business information sections accurately.

- Clearly state the loan amount requested and its intended use.

- Review the form for any errors or missing information before submission.

- Submit the completed form along with the required documentation to IDFC Bank.

How to obtain the Business Loan Application Form IDFC Bank

The Business Loan Application Form IDFC Bank can be obtained through various channels. Applicants can visit the official IDFC Bank website to download the form or visit a local branch to receive a physical copy. Additionally, customer service representatives can assist in providing the form and answering any questions regarding the application process.

Legal use of the Business Loan Application Form IDFC Bank

The Business Loan Application Form IDFC Bank is legally binding once submitted. It is essential for applicants to provide truthful and accurate information, as any discrepancies may lead to legal consequences or denial of the loan. Understanding the legal implications of the information provided is crucial for ensuring compliance with banking regulations.

Eligibility Criteria

To qualify for a business loan from IDFC Bank, applicants must meet specific eligibility criteria. These may include:

- Minimum age requirement, typically eighteen years.

- Proof of business ownership and operational history.

- Demonstrated ability to repay the loan based on financial statements.

- Compliance with any additional requirements set by IDFC Bank.

Quick guide on how to complete business loan application form idfc bank

Finish Business Loan Application Form IDFC Bank effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Business Loan Application Form IDFC Bank on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Business Loan Application Form IDFC Bank hassle-free

- Obtain Business Loan Application Form IDFC Bank and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Business Loan Application Form IDFC Bank and guarantee exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business loan application form idfc bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank loan form and how is it used?

A bank loan form is a document that individuals or businesses fill out to apply for a loan from a financial institution. It typically collects information about the applicant's financial status, loan amount, and purpose. Using airSlate SignNow, you can create, send, and eSign your bank loan form quickly and efficiently, enhancing the application process.

-

How does airSlate SignNow simplify the bank loan form process?

airSlate SignNow simplifies the bank loan form process by providing an intuitive platform for creating and managing documents. Users can easily customize templates, incorporate digital signatures, and automate workflows, resulting in faster loan processing times. This streamlined approach not only saves time but also reduces the potential for errors.

-

What features does airSlate SignNow offer for bank loan forms?

With airSlate SignNow, users have access to features such as document templates, secure eSigning, and template management for bank loan forms. Additionally, the platform offers real-time tracking of document status and reminders for signatories, which enhances the efficiency of collecting signed loan applications. These features ensure that you manage your bank loan forms seamlessly.

-

Can I integrate airSlate SignNow with other financial software for bank loan forms?

Yes, airSlate SignNow allows integration with a variety of financial software systems, making it easy to manage your bank loan forms alongside your existing tools. Partnerships with platforms like Salesforce, Google Drive, and others enable seamless data transfer and enhance your overall workflow. This connectivity ensures that your bank loan forms fit smoothly into your financial operations.

-

What are the pricing options for using airSlate SignNow for bank loan forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs when managing bank loan forms. Options range from free trials with basic features to advanced plans that include additional functionalities such as team collaboration and integration capabilities. This ensures that businesses of all sizes can effectively use airSlate SignNow for their bank loan form requirements.

-

How secure is the information in my bank loan forms on airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when handling sensitive bank loan forms. The platform is equipped with encryption, multifactor authentication, and compliance with major security standards. This guarantees that your documents and personal information remain safe and protected throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for bank loan forms?

Using airSlate SignNow for bank loan forms offers numerous benefits, including time savings, reduced paperwork, and better organization. The easy-to-use interface allows users to create and share forms quickly, while digital signatures streamline the approval process. These factors combined make airSlate SignNow an excellent choice for managing your bank loan forms.

Get more for Business Loan Application Form IDFC Bank

- Limousine form

- Analysis of impediments to fair housing choice city of saginaw form

- Piling record form 521805601

- Thetechcenter form

- Pdf royal oak dog park application downtown royal oak form

- Vp 249 affidavit of acknowlegement for a power of attorney form

- Vp 015 vehicle inspection certificate 650585839 form

- Nevada residency certification form

Find out other Business Loan Application Form IDFC Bank

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now