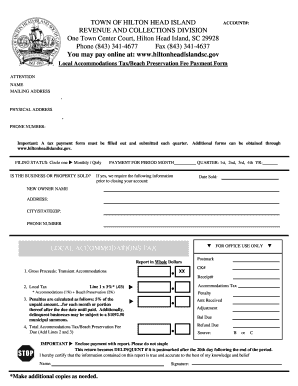

Town of Hilton Head Accommodations Tax Form

What is the Town Of Hilton Head Accommodations Tax Form

The Town of Hilton Head Accommodations Tax Form is a specific document required for reporting and remitting accommodations taxes collected by businesses that provide lodging services. This form is essential for ensuring compliance with local tax regulations and helps the town manage its revenue from tourism effectively. The accommodations tax is typically levied on short-term rentals, hotels, and other lodging facilities, making it crucial for property owners and managers to understand their obligations.

Steps to complete the Town Of Hilton Head Accommodations Tax Form

Completing the Town of Hilton Head Accommodations Tax Form involves several key steps:

- Gather necessary information, including your business details, tax identification number, and the total amount of accommodations tax collected during the reporting period.

- Access the form through the official town website or designated tax office.

- Fill out the form accurately, ensuring all required fields are completed, including any calculations related to the tax owed.

- Review the completed form for accuracy, checking for any errors or omissions.

- Submit the form by the designated deadline through the chosen submission method.

How to obtain the Town Of Hilton Head Accommodations Tax Form

The Town of Hilton Head Accommodations Tax Form can be obtained through various channels:

- Visit the official website of the Town of Hilton Head, where downloadable forms are typically available.

- Contact the local tax office directly to request a physical copy of the form.

- Check with local business associations or chambers of commerce, which may provide resources for obtaining necessary tax forms.

Legal use of the Town Of Hilton Head Accommodations Tax Form

To ensure the legal validity of the Town of Hilton Head Accommodations Tax Form, it is important to adhere to specific guidelines. The form must be completed in accordance with local laws and regulations governing accommodations taxes. Additionally, the form should be submitted within the required timeframe to avoid penalties. Utilizing electronic signature solutions can also enhance the legal standing of the submitted document, provided that they comply with relevant eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Town of Hilton Head Accommodations Tax Form are critical for compliance. Typically, these deadlines align with quarterly or monthly reporting periods, depending on the volume of accommodations tax collected. It is essential for businesses to stay informed about these dates to avoid late fees and penalties. Regularly checking the town’s official communications or tax office announcements can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Town of Hilton Head Accommodations Tax Form can be submitted through various methods, providing flexibility for businesses:

- Online submission through the town's official tax portal, if available, allows for quick and efficient processing.

- Mailing the completed form to the designated tax office address ensures a physical record of submission.

- In-person submission at the local tax office can provide immediate confirmation of receipt.

Quick guide on how to complete town of hilton head accommodations tax form

Complete Town Of Hilton Head Accommodations Tax Form seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle Town Of Hilton Head Accommodations Tax Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Town Of Hilton Head Accommodations Tax Form with ease

- Obtain Town Of Hilton Head Accommodations Tax Form and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize crucial sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Town Of Hilton Head Accommodations Tax Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the town of hilton head accommodations tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Hilton Head accommodations tax and how does it affect my stay?

The Hilton Head accommodations tax is a local tax applied to lodging and rental agreements in the area. This tax helps fund services and infrastructure that enhance the visitor experience. When booking accommodations, it’s important to consider this tax, as it can impact the total cost of your stay.

-

Are there any exemptions to the Hilton Head accommodations tax?

Yes, there are certain exemptions to the Hilton Head accommodations tax. For example, long-term rentals and some types of nonprofit organizations may be exempt. Always check with your accommodation provider to confirm whether your stay qualifies.

-

How can I calculate the Hilton Head accommodations tax on my booking?

To calculate the Hilton Head accommodations tax, simply multiply the nightly rate of your accommodation by the applicable tax rate. This total will provide a clear picture of additional costs that will be added to your final bill.

-

Does airSlate SignNow help with managing Hilton Head accommodations tax documentation?

Yes, airSlate SignNow offers features that help businesses manage Hilton Head accommodations tax documentation efficiently. By enabling users to send and e-sign necessary documents, it streamlines the process of tax reporting and compliance.

-

What are the benefits of using airSlate SignNow for managing my accommodations?

Using airSlate SignNow for managing accommodations can signNowly reduce the time spent on paperwork and enhance efficiency. Its easy-to-use platform allows you to swiftly handle important documents while ensuring compliance with local regulations, including the Hilton Head accommodations tax.

-

Can I integrate airSlate SignNow with other tools for managing Hilton Head accommodations tax?

Absolutely! airSlate SignNow offers integrations with various other software solutions, making it easier to manage your Hilton Head accommodations tax alongside other business processes. This integration capability enhances overall workflow and ensures all documents are organized.

-

Is the pricing for airSlate SignNow competitive for managing Hilton Head accommodations tax documentation?

Yes, airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes. This cost-effective solution can help you save on managing Hilton Head accommodations tax documentation without sacrificing quality or efficiency.

Get more for Town Of Hilton Head Accommodations Tax Form

Find out other Town Of Hilton Head Accommodations Tax Form

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online