1023 Ez Eligibility Worksheet Form

What is the 1023 EZ Eligibility Worksheet

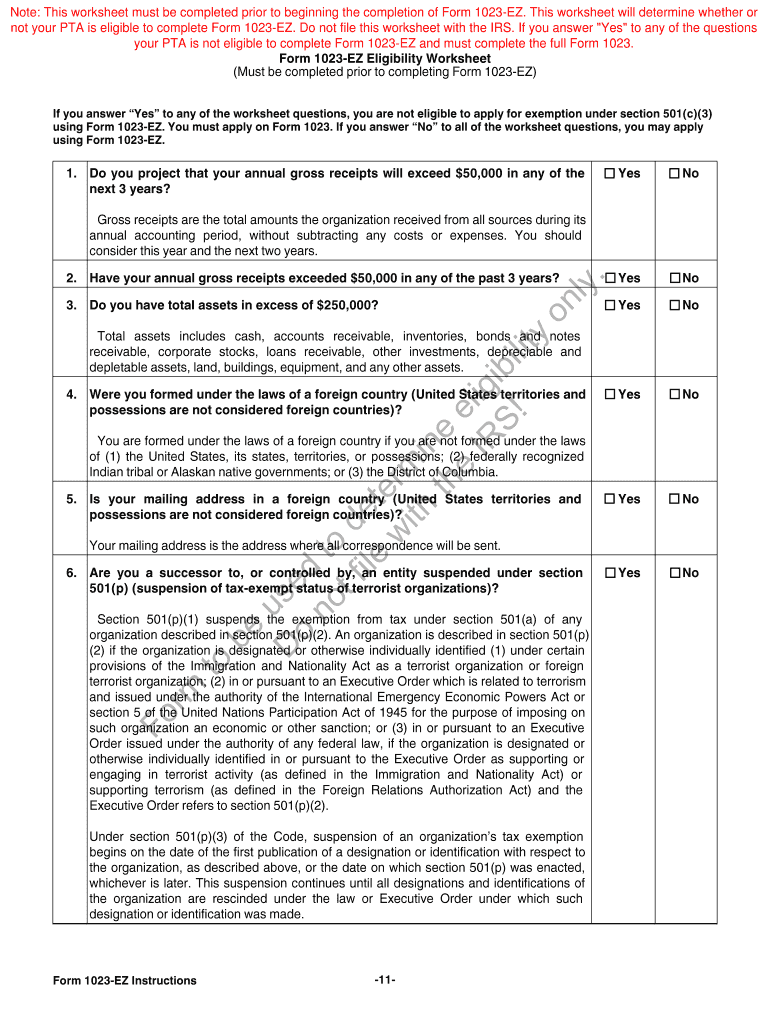

The 1023 EZ Eligibility Worksheet is a crucial document for organizations seeking to apply for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This worksheet helps determine if an organization qualifies to use the streamlined Form 1023 EZ instead of the longer Form 1023. By completing the worksheet, applicants can assess their eligibility based on specific criteria set forth by the IRS, ensuring a more efficient application process.

How to use the 1023 EZ Eligibility Worksheet

Using the 1023 EZ Eligibility Worksheet involves several straightforward steps. First, gather all relevant information about your organization, including its purpose, activities, and financial data. Next, carefully answer each question on the worksheet, which focuses on eligibility criteria such as annual gross receipts, asset limits, and the nature of the organization’s activities. After completing the worksheet, review your answers to ensure accuracy before proceeding with your application.

Steps to complete the 1023 EZ Eligibility Worksheet

Completing the 1023 EZ Eligibility Worksheet requires a methodical approach. Follow these steps:

- Gather necessary documents, including your organization’s formation documents and financial statements.

- Review the eligibility criteria outlined by the IRS to confirm that your organization meets the requirements.

- Fill out the worksheet, ensuring that you provide accurate and complete information for each question.

- Double-check your responses for any errors or omissions.

- Save a copy of the completed worksheet for your records before submitting your application.

Key elements of the 1023 EZ Eligibility Worksheet

The 1023 EZ Eligibility Worksheet includes several key elements that applicants must address. These elements typically cover:

- Organization type and structure, ensuring it aligns with IRS requirements.

- Financial information, including projected revenue and expenses.

- Details about the organization’s mission and planned activities.

- Confirmation of compliance with specific IRS rules, such as limitations on lobbying and political activities.

IRS Guidelines

The IRS provides specific guidelines for completing the 1023 EZ Eligibility Worksheet. These guidelines outline the eligibility criteria, required documentation, and the overall process for applying for tax-exempt status. Familiarizing yourself with these guidelines is essential to ensure that your application is complete and adheres to IRS standards. This preparation can significantly reduce the chances of delays or rejections in the application process.

Required Documents

When completing the 1023 EZ Eligibility Worksheet, several documents are necessary to support your application. These may include:

- Articles of incorporation or organization.

- Bylaws or governing documents.

- Financial statements or budgets for the upcoming year.

- Any additional documentation that demonstrates your organization’s charitable purpose.

Application Process & Approval Time

The application process for obtaining tax-exempt status using the 1023 EZ form generally involves submitting the completed form along with the 1023 EZ Eligibility Worksheet and required documents to the IRS. After submission, the approval time can vary, typically ranging from two to six months. It is essential to monitor the application status and respond promptly to any requests for additional information from the IRS to expedite the process.

Quick guide on how to complete form 1023 ez eligibility worksheet national pta pta

Complete 1023 Ez Eligibility Worksheet seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your papers swiftly without delays. Manage 1023 Ez Eligibility Worksheet on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign 1023 Ez Eligibility Worksheet effortlessly

- Locate 1023 Ez Eligibility Worksheet and then click Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign 1023 Ez Eligibility Worksheet and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1023 ez eligibility worksheet national pta pta

How to generate an electronic signature for the Form 1023 Ez Eligibility Worksheet National Pta Pta online

How to create an eSignature for your Form 1023 Ez Eligibility Worksheet National Pta Pta in Chrome

How to generate an electronic signature for putting it on the Form 1023 Ez Eligibility Worksheet National Pta Pta in Gmail

How to create an electronic signature for the Form 1023 Ez Eligibility Worksheet National Pta Pta right from your smartphone

How to generate an electronic signature for the Form 1023 Ez Eligibility Worksheet National Pta Pta on iOS

How to make an eSignature for the Form 1023 Ez Eligibility Worksheet National Pta Pta on Android

People also ask

-

What is the 1023 Ez Eligibility Worksheet and why is it important?

The 1023 Ez Eligibility Worksheet is a crucial tool for organizations seeking tax-exempt status under Section 501(c)(3). It helps determine eligibility for filing the streamlined Form 1023-EZ, reducing the complexity and time involved in the application process. By utilizing the worksheet, organizations can quickly identify their qualifications, making it easier to secure tax-exempt status.

-

How can airSlate SignNow assist with the 1023 Ez Eligibility Worksheet?

airSlate SignNow offers an intuitive platform for creating, signing, and managing documents, including the 1023 Ez Eligibility Worksheet. With our easy-to-use eSignature solution, users can fill out and send the worksheet for signatures seamlessly. This streamlines the process, ensuring that your application for tax-exempt status is as efficient as possible.

-

Is there a cost associated with using airSlate SignNow for the 1023 Ez Eligibility Worksheet?

Yes, airSlate SignNow offers various pricing plans suitable for different business needs. Our cost-effective solutions provide access to features that simplify document management, including the 1023 Ez Eligibility Worksheet. Choose the plan that fits your organization's size and requirements, starting with a free trial to test our services.

-

What features does airSlate SignNow offer for the 1023 Ez Eligibility Worksheet?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the 1023 Ez Eligibility Worksheet. These tools enhance your workflow, allowing for easy collaboration and efficient completion of your tax-exemption application. Plus, all documents are securely stored for your peace of mind.

-

Can I integrate airSlate SignNow with other tools for processing the 1023 Ez Eligibility Worksheet?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and Salesforce. This allows you to easily store and manage your 1023 Ez Eligibility Worksheet alongside other critical documents, ensuring that your workflow remains organized and efficient.

-

What benefits does using airSlate SignNow provide for submitting the 1023 Ez Eligibility Worksheet?

Using airSlate SignNow for your 1023 Ez Eligibility Worksheet provides numerous benefits, including faster turnaround times and improved accuracy in document handling. Our platform reduces the chances of errors during the signing process, allowing for a smoother submission of your tax-exempt application. Additionally, the convenience of electronic signatures saves both time and resources.

-

Is airSlate SignNow user-friendly for completing the 1023 Ez Eligibility Worksheet?

Yes, airSlate SignNow is designed with user experience in mind, making it easy to complete the 1023 Ez Eligibility Worksheet. Our platform features a straightforward interface that guides users through the document creation and signing process. Whether you're tech-savvy or a beginner, our solution simplifies the entire experience.

Get more for 1023 Ez Eligibility Worksheet

- Past simple regular and irregular verbs language worksheets form

- Residential lease for unit in condominium or cooperative form

- Dummit and foote solutions chapter 4 form

- Letter of direction template rbc form

- Tire retailer information sheet state of nevada

- Nsu self report form

- Module 2 wellness plan form

- Private elementaryhigh school tuition form

Find out other 1023 Ez Eligibility Worksheet

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist