Connecticut Fair Plan Form

What is the Connecticut Fair Plan

The Connecticut Fair Plan is a state-sponsored insurance program designed to provide coverage for properties that are unable to obtain insurance through the standard market. This plan primarily targets homeowners who face challenges in securing insurance due to factors such as location, property condition, or other risk-related issues. The Fair Plan offers essential coverage options, including dwelling protection, personal property coverage, and liability insurance, ensuring that residents have access to necessary financial protection.

How to use the Connecticut Fair Plan

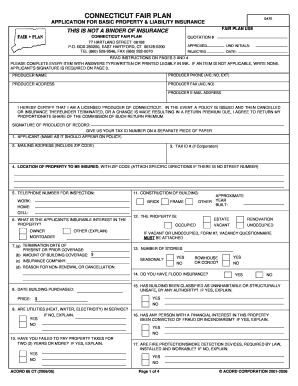

Utilizing the Connecticut Fair Plan involves several steps to ensure that applicants receive the appropriate coverage for their properties. First, individuals must assess their eligibility by reviewing the specific criteria set forth by the program. Once eligibility is confirmed, applicants can fill out the necessary forms, which include detailed information about the property and its occupants. After submitting the application, it undergoes a review process, and applicants are notified of their coverage options. It is important to maintain communication with the Fair Plan representatives throughout this process for any required documentation or clarification.

Steps to complete the Connecticut Fair Plan

Completing the Connecticut Fair Plan application requires careful attention to detail. The following steps outline the process:

- Gather necessary documentation, including property details and personal identification.

- Visit the official Connecticut Fair Plan website or contact a representative to obtain the application form.

- Fill out the application form accurately, ensuring all required fields are completed.

- Submit the application via the designated method, which may include online submission or mailing the form.

- Follow up with the Fair Plan office to confirm receipt of the application and inquire about the review timeline.

Legal use of the Connecticut Fair Plan

The legal use of the Connecticut Fair Plan is governed by state regulations that ensure compliance with insurance laws. To be considered valid, the application process must adhere to the guidelines established by the Connecticut Insurance Department. This includes providing truthful information and fulfilling any additional requirements set forth by the Fair Plan. The plan is designed to protect both the insurer and the insured, ensuring that all parties involved understand their rights and responsibilities under the coverage provided.

Eligibility Criteria

Eligibility for the Connecticut Fair Plan is determined based on several factors. Applicants must demonstrate that they have been unable to secure insurance through traditional means due to specific risks associated with their property. This may include properties located in high-risk areas or those with certain structural issues. Additionally, applicants must provide proof of prior insurance attempts and any relevant documentation that supports their need for coverage through the Fair Plan. Meeting these criteria is essential for a successful application.

Application Process & Approval Time

The application process for the Connecticut Fair Plan typically involves several stages, from initial submission to final approval. After submitting the application, it usually takes a few weeks for the review process to be completed. The timeline may vary based on the volume of applications and the complexity of individual cases. Applicants are encouraged to remain proactive by checking in with the Fair Plan office for updates and providing any additional information requested during the review period.

Quick guide on how to complete ct fair plan

Effortlessly Prepare ct fair plan on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, as it allows you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage ct fair plan on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to Modify and eSign connecticut fair plan with Ease

- Obtain fillabe ct fair plan application and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or black out sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign fair insurance and ensure efficient communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut fair plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask fair insurance

-

What is the Connecticut Fair Plan?

The Connecticut Fair Plan is a state-sponsored insurance program designed to provide coverage for homeowners who are unable to obtain insurance through the standard market. It aims to offer protection against property loss for residents in areas deemed high-risk. Understanding the Connecticut Fair Plan can help you find the right insurance solution.

-

How does the Connecticut Fair Plan work?

The Connecticut Fair Plan operates by pooling resources from various insurers to provide coverage for homeowners in high-risk areas. If you are unable to secure insurance through traditional providers, you can apply for the Connecticut Fair Plan. It ensures that homeowners can find adequate coverage despite their circumstances.

-

What are the eligibility requirements for the Connecticut Fair Plan?

To qualify for the Connecticut Fair Plan, homeowners must prove that they have attempted to obtain insurance through the standard market but were denied. Additionally, properties must be located in designated high-risk areas. Meeting these criteria allows homeowners to access much-needed protection.

-

What types of coverage does the Connecticut Fair Plan provide?

The Connecticut Fair Plan offers various types of property insurance coverage, including dwelling coverage, personal property protection, and liability coverage. These policies are designed to safeguard against common risks faced by homeowners in high-risk regions. Understanding these options is essential for effective risk management.

-

How much does the Connecticut Fair Plan cost?

The cost of the Connecticut Fair Plan varies based on several factors, including location, type of coverage, and property characteristics. Generally, rates may be higher than standard insurance due to the high-risk nature of the insured properties. It's crucial to compare quotes and understand the pricing structure before making a decision.

-

How can I apply for the Connecticut Fair Plan?

Applying for the Connecticut Fair Plan typically involves contacting a participating insurance agent or company that offers this program. You'll need to provide information about your property and any previous attempts to obtain insurance. Once your application is submitted, the insurer will assist you with the next steps.

-

Are there any benefits of using the Connecticut Fair Plan?

Yes, the Connecticut Fair Plan provides signNow benefits by ensuring that residents have access to essential insurance coverage that might otherwise be unavailable. It helps protect property investments and provides peace of mind, knowing that you have financial support in case of a loss. This plan is crucial for high-risk homeowners.

Get more for ct fair plan

- Delhi college of technology state university of new york campus form

- Professional employee39s performance plan

- Office of human resources and affirmative action form

- Print form student employment student assistant request form spring date amount requested department supervisor contact 1 delhi

- Application to request registration form

- Application application downstate form

- Director of patient safety amp patient safety officer form

- Contract training suny downstate medical center downstate form

Find out other connecticut fair plan

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe