Form St 9 2018

What is the Form ST-9?

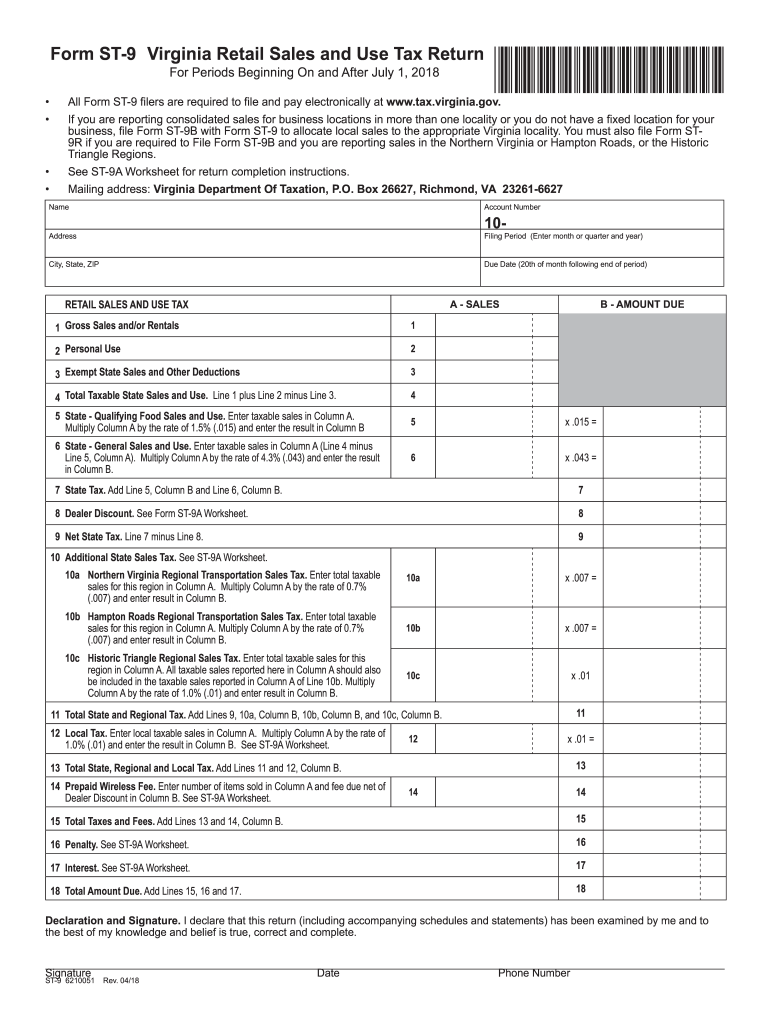

The Form ST-9 is a Virginia retail sales tax form used by businesses to report and remit sales tax collected from customers. This form is essential for compliance with state tax regulations and ensures that businesses fulfill their tax obligations accurately. The ST-9 form is specifically designed for retailers and service providers who are required to collect sales tax on taxable sales made within the Commonwealth of Virginia.

How to Use the Form ST-9

To use the Form ST-9, businesses must first gather all relevant sales data for the reporting period. This includes total sales, exempt sales, and the amount of sales tax collected. After collecting this information, businesses can fill out the form by entering the required details, such as the business name, address, and sales figures. Once completed, the form can be submitted either electronically or via mail, depending on the preferred submission method.

Steps to Complete the Form ST-9

Completing the Form ST-9 involves several key steps:

- Gather sales records for the reporting period.

- Determine the total sales amount, including taxable and exempt sales.

- Calculate the total sales tax collected based on applicable rates.

- Fill in the business information, including name and address.

- Enter the total sales and sales tax amounts on the form.

- Review the form for accuracy before submission.

Following these steps ensures the form is filled out correctly, minimizing the risk of errors that could lead to penalties.

Legal Use of the Form ST-9

The legal use of the Form ST-9 is governed by Virginia state tax laws. Businesses are required to use this form to report sales tax accurately and on time. Failure to use the correct form or to report sales tax can result in penalties and interest charges. It is important for businesses to understand their obligations under Virginia tax law to maintain compliance and avoid legal issues.

Form Submission Methods

The Form ST-9 can be submitted through various methods, providing flexibility for businesses. The available submission methods include:

- Online submission through the Virginia Department of Taxation's e-file system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can streamline the filing process and ensure timely compliance with tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form ST-9 are crucial for businesses to avoid penalties. Generally, the form is due on the twentieth day of the month following the end of the reporting period. For example, sales made in January must be reported by February 20. Businesses should keep track of these deadlines to ensure timely submission and compliance with state regulations.

Quick guide on how to complete st 9 2018 2019 form

Your assistance manual on how to prepare your Form St 9

If you’re wondering how to fill out and submit your Form St 9, here are some quick tips on how to simplify tax processing.

To begin, all you need to do is create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that allows you to modify, draft, and finalize your tax documents with ease. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and return to amend information as needed. Streamline your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to finish your Form St 9 in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Browse our library to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Form St 9 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if needed).

- Double-check your document and correct any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Keep in mind that filing on paper can lead to return errors and postpone refunds. Certainly, prior to e-filing your taxes, consult the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct st 9 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

Create this form in 5 minutes!

How to create an eSignature for the st 9 2018 2019 form

How to create an electronic signature for the St 9 2018 2019 Form in the online mode

How to make an eSignature for your St 9 2018 2019 Form in Chrome

How to generate an electronic signature for signing the St 9 2018 2019 Form in Gmail

How to create an eSignature for the St 9 2018 2019 Form straight from your mobile device

How to generate an eSignature for the St 9 2018 2019 Form on iOS

How to generate an eSignature for the St 9 2018 2019 Form on Android devices

People also ask

-

What is Form St 9 and why do I need it?

Form St 9 is a tax exemption certificate used in various states to confirm an entity's tax-exempt status. Businesses often need Form St 9 to avoid paying sales tax on purchases related to their exempt activities. Using airSlate SignNow, you can easily create, manage, and eSign this form, streamlining your tax exemption processes.

-

How can airSlate SignNow help with completing Form St 9?

airSlate SignNow simplifies the process of completing Form St 9 by providing templates that can be easily filled out and customized. The platform allows users to eSign the form electronically, ensuring a more efficient and secure submission process. With airSlate SignNow, you can manage all your document workflows, including Form St 9, from a single dashboard.

-

Is there a cost associated with using airSlate SignNow for Form St 9?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that can help you manage Form St 9 and other documents effectively. You can choose the plan that best fits your requirements and budget to ensure you can eSign and manage Form St 9 without hassle.

-

Can I integrate airSlate SignNow with other tools for handling Form St 9?

Absolutely! airSlate SignNow offers integrations with popular tools such as Google Drive, Dropbox, and CRM systems, allowing you to streamline your document management process. By integrating these tools, you can easily access and manage Form St 9 alongside your other important documents, enhancing productivity and collaboration.

-

What features does airSlate SignNow offer for managing Form St 9?

airSlate SignNow offers a range of features for managing Form St 9, including customizable templates, electronic signatures, and document tracking. These features ensure that you can complete your Form St 9 quickly and securely, while also keeping track of who has signed and when. This enhances compliance and reduces the risk of errors.

-

How secure is airSlate SignNow when handling sensitive documents like Form St 9?

airSlate SignNow prioritizes security, employing bank-grade encryption and secure authentication protocols to protect your documents, including Form St 9. You can rest assured that your sensitive information is safe and secure when using our platform. Additionally, we comply with various industry standards and regulations to ensure your data integrity.

-

Can I access my Form St 9 from any device using airSlate SignNow?

Yes, airSlate SignNow is a cloud-based platform, which means you can access your Form St 9 from any device with an internet connection. Whether you're using a desktop, tablet, or smartphone, you can easily manage and eSign your forms on the go. This flexibility helps you stay productive and responsive to your business needs.

Get more for Form St 9

- Comcheck software version 394 mechanical compliance form

- New patient package middlesex hospital primary care mhprimarycare form

- Application for bemploymentb lidestri foods form

- Salat the islamic prayer from a to z pdf form

- Vehicle check in customer experience report form

- Maryland 15 dllr form

- National certification career association ncca certifications form

- Employment offer letter template edit fill print ampamp download best form

Find out other Form St 9

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF