Mi W4 Form

What is the Mi W4

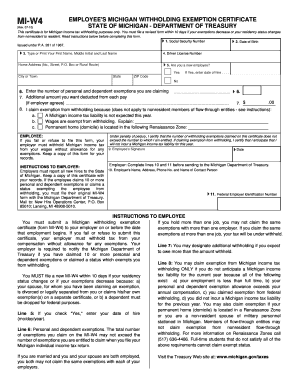

The Mi W4 is a state-specific tax form used in Michigan for employees to indicate their withholding allowances. This form is essential for determining the amount of state income tax that employers will withhold from an employee's paycheck. By completing the Mi W4, employees can ensure that their tax withholdings align with their financial situation, potentially avoiding underpayment or overpayment of taxes throughout the year.

How to use the Mi W4

Using the Mi W4 involves several straightforward steps. First, employees must obtain the form, which can be downloaded from the Michigan Department of Treasury's website or obtained from their employer. After filling out the necessary information, including personal details and the number of allowances, employees should submit the completed form to their employer. This process allows employers to adjust the withholding amount based on the information provided.

Steps to complete the Mi W4

Completing the Mi W4 requires attention to detail to ensure accuracy. Here are the steps to follow:

- Download or request the Mi W4 form from your employer.

- Fill in your personal information, including your name, address, and Social Security number.

- Determine the number of allowances you wish to claim based on your tax situation.

- Sign and date the form to certify that the information is accurate.

- Submit the completed form to your employer for processing.

Legal use of the Mi W4

The Mi W4 is legally recognized as a binding document when filled out correctly and submitted to an employer. It must comply with state tax laws to ensure that the withholding amounts are appropriate. Employers are required to keep the Mi W4 on file and use it to calculate the correct state income tax withholdings based on the employee's declarations. Failure to use the Mi W4 correctly can lead to penalties for both the employee and employer.

Key elements of the Mi W4

Several key elements are essential when filling out the Mi W4. These include:

- Personal Information: This includes your name, address, and Social Security number.

- Allowances: The number of allowances you claim affects your tax withholding.

- Signature: Your signature certifies the accuracy of the information provided.

- Date: The date indicates when the form was completed.

Filing Deadlines / Important Dates

While the Mi W4 does not have a specific filing deadline, it is crucial to submit it to your employer as soon as you start a new job or experience a significant life change that affects your tax situation. Keeping your Mi W4 updated ensures that your tax withholdings remain accurate throughout the year, helping to prevent any surprises during tax season.

Quick guide on how to complete mi w4

Effortlessly Prepare Mi W4 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any hold-ups. Manage Mi W4 seamlessly on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and eSign Mi W4 effortlessly

- Find Mi W4 and click Acquire Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize signNow sections of your documents or obscure sensitive information with the tools airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Signature tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Complete button to preserve your adjustments.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form-finding, or mistakes that require reprinting document copies. airSlate SignNow caters to all your document management needs in a few clicks from any device you choose. Edit and eSign Mi W4 to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi w4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mi w4 and how does it work with airSlate SignNow?

The mi w4 is a crucial tax form that helps employees provide their withholding preferences to employers. With airSlate SignNow, you can easily fill out, send, and eSign your mi w4 form online, ensuring quick processing and compliance.

-

Is there a cost associated with using airSlate SignNow for mi w4 forms?

Yes, airSlate SignNow offers various pricing plans tailored to your business needs. These plans include cost-effective options for eSigning documents, including the mi w4, which help streamline your HR processes.

-

What features does airSlate SignNow provide for managing mi w4 documents?

airSlate SignNow offers features like template creation, bulk sending, and secure storage for your mi w4 documents. These tools simplify the process and ensure that your form is filled out correctly and stored securely.

-

Can I integrate airSlate SignNow with other software to manage mi w4 forms?

Absolutely! airSlate SignNow supports integrations with various HR and payroll software, allowing you to effortlessly manage your mi w4 forms alongside your existing systems and improve workflow efficiency.

-

How does airSlate SignNow ensure the security of my mi w4 documents?

airSlate SignNow employs state-of-the-art encryption and compliance protocols to safeguard your mi w4 documents. This ensures that your sensitive information remains secure during transmission and storage.

-

Can multiple users collaborate on a mi w4 form using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the same mi w4 form. This feature is perfect for HR teams, ensuring everyone can contribute and review the form before it is finalized.

-

What are the benefits of using airSlate SignNow for mi w4 forms?

Using airSlate SignNow to manage your mi w4 forms can save time, reduce errors, and enhance compliance. Its intuitive platform also provides a seamless signing experience for both employees and employers.

Get more for Mi W4

Find out other Mi W4

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online