Mileage Log Liberty Tax Form

Key elements of the mileage log for taxes

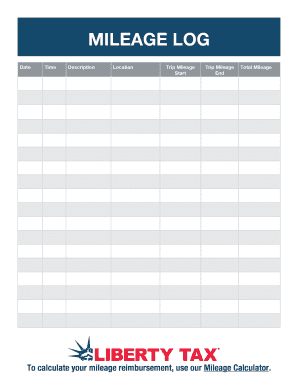

A mileage log for taxes serves as a crucial document for tracking vehicle use for business purposes. Key elements to include in your mileage log template for taxes are:

- Date: Record the date of each trip.

- Destination: Specify where you traveled.

- Purpose of the trip: Clearly state the business reason for the travel.

- Starting and ending odometer readings: Document the mileage before and after each trip.

- Total miles driven: Calculate the distance traveled for business purposes.

Incorporating these elements ensures that your sample mileage log for the IRS meets the necessary requirements for tax deductions.

Steps to complete the mileage log for taxes

Filling out a mileage log for taxes is straightforward when you follow these steps:

- Choose a format: Decide whether to use a digital mileage log template for taxes or a paper version.

- Record trips regularly: Update your log after each business trip to maintain accuracy.

- Include all required details: Ensure you capture the date, destination, purpose, odometer readings, and total miles.

- Review for completeness: Before submitting your tax return, check that all entries are complete and accurate.

Following these steps will help you maintain an organized and compliant mileage log for taxes.

IRS guidelines for mileage logs

The IRS has specific guidelines for maintaining a mileage log for tax purposes. To ensure compliance, consider the following:

- Business use only: The mileage log must only include miles driven for business purposes, excluding personal use.

- Documentation: Keep receipts or other documentation that supports the business purpose of each trip.

- Consistency: Use a consistent method for tracking mileage, whether through a digital app or a paper log.

Adhering to these IRS guidelines will strengthen your position if your mileage deductions are questioned during an audit.

Legal use of the mileage log for taxes

A mileage log for taxes is legally valid when it meets certain criteria established by the IRS. To ensure its legal standing:

- Accuracy: Entries must be truthful and reflect actual business use.

- Timeliness: Logs should be updated in real-time or shortly after each trip to ensure accuracy.

- Signature: While not always required, signing your log can add an extra layer of authenticity.

By following these legal guidelines, your mileage log for taxes will be more defensible in case of an audit.

Examples of using the mileage log for taxes

Understanding how to utilize a mileage log for taxes can be enhanced through practical examples:

- Self-employed individuals: A freelance graphic designer tracks trips to client meetings, ensuring each entry includes the necessary details.

- Real estate agents: An agent records mileage for property showings and client consultations, highlighting the business purpose of each trip.

- Small business owners: A small business owner documents travel to industry conferences, providing evidence for travel-related deductions.

These examples illustrate the diverse applications of a mileage log for taxes across different professions.

State-specific rules for mileage logs

While the IRS provides overarching guidelines, state-specific rules may also apply to mileage logs for taxes. Key considerations include:

- State tax laws: Some states may have additional requirements for documenting business mileage.

- Reimbursement policies: Employers in certain states may have specific rules regarding mileage reimbursement for employees.

- Record retention: States may require different lengths of time for maintaining mileage logs compared to federal guidelines.

Consulting state tax regulations will help ensure your mileage log complies with local laws.

Quick guide on how to complete mileage log liberty tax

Complete Mileage Log Liberty Tax effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly and without complications. Manage Mileage Log Liberty Tax on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The most efficient way to modify and eSign Mileage Log Liberty Tax without hassle

- Find Mileage Log Liberty Tax and click Get Form to begin.

- Utilize the tools we provide to submit your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Mileage Log Liberty Tax and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mileage log liberty tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mileage log for taxes template and why do I need one?

A mileage log for taxes template is a structured document designed to help individuals and businesses track vehicle mileage for tax purposes. It simplifies the process of recording trips, including date, purpose, and distance traveled, making it easier to claim deductions. Using a mileage log can ensure you maximize your tax benefits while staying compliant with IRS guidelines.

-

How does airSlate SignNow's mileage log for taxes template work?

The mileage log for taxes template in airSlate SignNow allows you to easily record and manage your mileage data. You can customize the template to suit your needs and fill it out directly within the app. Once completed, you can securely save, share, or eSign the document, streamlining your tax preparation process.

-

Is there a cost associated with using the mileage log for taxes template?

airSlate SignNow offers competitively priced plans that include access to the mileage log for taxes template. Depending on your chosen plan, you can benefit from additional features such as unlimited eSigning and document storage. This cost-effective solution can save you time and reduce hassle during tax season.

-

Can I integrate the mileage log for taxes template with other software?

Yes, airSlate SignNow allows seamless integration with various business tools and software like accounting platforms and CRM systems. This feature ensures that your mileage log for taxes template can be easily synchronized with other records, improving data accuracy and streamlining your workflow. Integration helps keep all your financial documentation in one place.

-

What features does the mileage log for taxes template include?

The mileage log for taxes template includes essential fields for recording trip details, such as date, start and end locations, and purpose of the trip. Additionally, it provides calculation features to automatically sum up total miles driven. These functionalities help ensure you have comprehensive records at your fingertips for tax reporting.

-

How can a mileage log for taxes template benefit freelancers or small business owners?

Freelancers and small business owners can greatly benefit from using a mileage log for taxes template by ensuring they accurately track deductible mileage. This can result in increased tax refunds and reduced liabilities during tax time. Furthermore, having documented proof of business-related travel enhances credibility in the event of an audit.

-

Is the mileage log for taxes template customizable?

Yes, the mileage log for taxes template is fully customizable. Users can modify the template fields, add branding elements, or change the layout to fit their specific needs. This adaptability allows you to create a mileage log that aligns with your business requirements while maintaining compliance for tax submissions.

Get more for Mileage Log Liberty Tax

Find out other Mileage Log Liberty Tax

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter