Sba Form 4

What is the SBA Form 4?

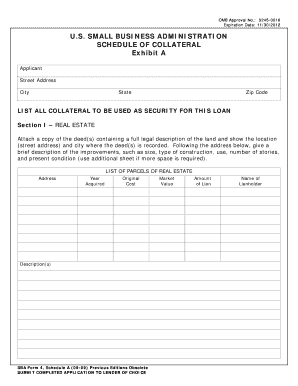

The SBA Form 4, officially known as the Schedule of Collateral, is a crucial document used in the application process for a business loan through the U.S. Small Business Administration (SBA). This form is designed to provide a detailed account of the collateral that a borrower is offering to secure their loan. Collateral can include various assets, such as real estate, equipment, or inventory, which can be claimed by the lender in case of default. Understanding the purpose and requirements of the SBA Form 4 is essential for any business seeking financial assistance from the SBA.

Steps to Complete the SBA Form 4

Completing the SBA Form 4 involves several key steps to ensure accuracy and compliance. Here is a straightforward approach:

- Gather Information: Collect details about all collateral assets, including descriptions, values, and ownership documentation.

- Fill Out the Form: Enter the required information in the designated fields, ensuring clarity and precision.

- Review for Accuracy: Double-check all entries for correctness, particularly asset valuations and descriptions.

- Sign and Date: Ensure that the form is signed by the authorized representative of the business, along with the date of signing.

- Submit the Form: Follow the appropriate submission method as outlined by the SBA, whether online or via mail.

Legal Use of the SBA Form 4

The SBA Form 4 serves a legal purpose in the context of securing a loan. It is vital that the information provided is truthful and complete, as discrepancies can lead to legal repercussions, including loan denial or fraud charges. The form must comply with the legal standards set forth by the SBA and relevant federal regulations. Additionally, when electronically signed, the form must adhere to the Electronic Signatures in Global and National Commerce Act (ESIGN) to ensure that the digital signature holds the same legal weight as a handwritten one.

Key Elements of the SBA Form 4

Understanding the key elements of the SBA Form 4 is important for accurate completion. The main components include:

- Borrower Information: Details about the business applying for the loan.

- Collateral Description: A thorough description of each asset being offered as collateral.

- Value of Collateral: An estimated market value for each asset, which supports the loan amount requested.

- Ownership Details: Information about who owns the collateral, including any co-owners or liens.

How to Obtain the SBA Form 4

The SBA Form 4 can be obtained directly from the official SBA website or through your lender. It is often available as a downloadable PDF, which can be filled out electronically or printed for manual completion. Ensure that you are using the most current version of the form, as outdated versions may not be accepted by lenders. If assistance is needed, many local SBA offices provide support in accessing and completing the form.

Form Submission Methods

Submitting the SBA Form 4 can be done through various methods, depending on the lender's requirements. Common submission methods include:

- Online Submission: Many lenders allow for electronic submission through their secure portals.

- Mail: The form can be printed and mailed to the lender or SBA office as specified in the loan application guidelines.

- In-Person Submission: Some applicants may prefer to deliver the form in person, especially when seeking immediate feedback or assistance.

Quick guide on how to complete sba form 4

Complete Sba Form 4 effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documentation, allowing you to obtain the necessary form and safely archive it online. airSlate SignNow provides you with all the features required to create, modify, and eSign your documents quickly without delays. Manage Sba Form 4 on any platform using airSlate SignNow's Android or iOS applications and simplify your document-centric processes today.

The easiest method to alter and eSign Sba Form 4 without hassle

- Find Sba Form 4 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then select the Done button to preserve your changes.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Alter and eSign Sba Form 4 while ensuring outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba form 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SBA Form 4 and how do I use it with airSlate SignNow?

SBA Form 4 is a crucial document used in the SBA loan process. With airSlate SignNow, you can easily upload, edit, and eSign the SBA Form 4, ensuring compliance and efficiency in your loan applications. Our platform simplifies the form-filling process, allowing you to complete it remotely and securely.

-

Is airSlate SignNow suitable for small businesses needing SBA Form 4?

Yes, airSlate SignNow is an excellent choice for small businesses that need to manage SBA Form 4. Our platform is designed to be user-friendly and cost-effective, making it easy for small organizations to navigate the eSigning process without overwhelming expenses. You can streamline your documentation process with our tailored solutions.

-

What features does airSlate SignNow offer for handling SBA Form 4?

airSlate SignNow provides a range of features for managing SBA Form 4, including secure eSigning, document templates, and real-time tracking. Our intuitive interface allows users to fill out and send forms quickly. Additionally, you can collaborate with team members effortlessly to ensure all signatures are obtained efficiently.

-

How much does it cost to use airSlate SignNow for SBA Form 4?

The pricing for airSlate SignNow is competitive and designed to accommodate various business sizes. We offer flexible subscription plans, ensuring that you can eSign SBA Form 4 without incurring excessive costs. You can select a plan that fits your business needs and budget, with options for both monthly and annual payments.

-

Can I integrate airSlate SignNow with other tools while using SBA Form 4?

Absolutely! airSlate SignNow offers seamless integrations with various software, enhancing your efficiency when working with SBA Form 4. You can connect with popular platforms like Google Drive, Dropbox, and CRM systems to optimize document management and streamline your workflows effortlessly.

-

What are the benefits of using airSlate SignNow for SBA Form 4 submissions?

Using airSlate SignNow for your SBA Form 4 submissions brings numerous benefits, including faster processing times and improved accuracy. Our electronic signature capabilities expedite the approval process signNowly. Additionally, your documents are securely stored and easily accessible, giving you peace of mind throughout your loan application journey.

-

Is airSlate SignNow compliant with regulations for SBA Form 4?

Yes, airSlate SignNow adheres to industry standards and regulations, ensuring that your SBA Form 4 submissions are fully compliant. We implement robust security measures and electronic signature laws that protect both your documents and data. You can trust our platform for safe and legitimate eSigning.

Get more for Sba Form 4

- Mortgage legal form

- Stop payment request form hacla hacla

- Clerk code enforcement form

- School nurse documentation forms

- Cn 1486 special use permit application tennessee state parks form

- Infertility authorization form insemination cycles ai or iui

- Independent contract form

- Fact information sheet st lucie county clerk

Find out other Sba Form 4

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free