Nevada Modified Business Tax Return Form

What is the Nevada Modified Business Tax Return

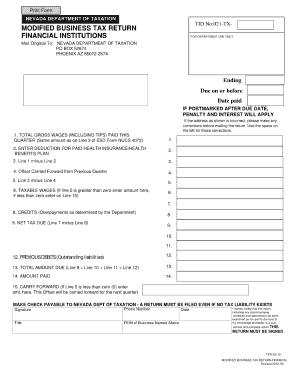

The Nevada Modified Business Tax Return is a tax form that businesses in Nevada must file to report their modified business tax obligations. This tax is based on the gross wages paid to employees and is applicable to most businesses operating within the state. The return helps the Nevada Department of Taxation assess the amount owed by each business, ensuring compliance with state tax laws. Understanding the specifics of this return is crucial for proper tax management and to avoid penalties.

How to use the Nevada Modified Business Tax Return

Using the Nevada Modified Business Tax Return involves several steps. First, businesses must gather necessary financial information, including total gross wages paid and any applicable deductions. Next, they should accurately fill out the required sections of the return, ensuring all figures are correct. After completing the form, businesses can submit it electronically or via mail, depending on their preference. It's important to retain a copy for their records and ensure timely submission to avoid late fees.

Steps to complete the Nevada Modified Business Tax Return

Completing the Nevada Modified Business Tax Return involves a systematic approach:

- Gather all relevant financial documents, including payroll records.

- Calculate total gross wages paid to employees for the reporting period.

- Determine any allowable deductions, such as health care costs.

- Fill out the return form accurately, ensuring all required fields are completed.

- Review the form for accuracy before submission.

- Submit the completed return electronically or by mail to the Nevada Department of Taxation.

Legal use of the Nevada Modified Business Tax Return

The Nevada Modified Business Tax Return is legally binding when completed and submitted according to state regulations. To ensure its legality, businesses must adhere to the guidelines set forth by the Nevada Department of Taxation. This includes accurate reporting of wages and compliance with filing deadlines. Electronic submissions are considered valid, provided they meet the requirements of eSignature laws, ensuring that the return is recognized by the state as a legitimate document.

Required Documents

When preparing to file the Nevada Modified Business Tax Return, certain documents are essential:

- Payroll records detailing gross wages paid to employees.

- Documentation of any deductions claimed, such as health benefits.

- Previous tax returns, if applicable, for reference.

- Any correspondence from the Nevada Department of Taxation related to tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Nevada Modified Business Tax Return are crucial for compliance. Generally, businesses must submit their returns quarterly, with specific due dates depending on the end of the reporting period. It is important to stay informed about these deadlines to avoid penalties. Businesses should mark their calendars and prepare their returns in advance to ensure timely submission.

Quick guide on how to complete nevada modified business tax return

Effortlessly Prepare Nevada Modified Business Tax Return on Any Device

The online management of documents has become widely embraced by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documentation, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly and without delays. Handle Nevada Modified Business Tax Return on any device with the airSlate SignNow applications for Android or iOS and enhance any document-oriented process today.

How to Edit and Electronically Sign Nevada Modified Business Tax Return with Ease

- Find Nevada Modified Business Tax Return and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Nevada Modified Business Tax Return and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nevada modified business tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is modified business tax?

Modified business tax refers to a tax imposed on businesses that is typically adjusted based on various factors, including employee payroll and revenue. Understanding this tax is crucial for businesses to maintain compliance and optimize their financial strategies.

-

How can airSlate SignNow assist with modified business tax documentation?

airSlate SignNow streamlines the process of creating and managing documents related to modified business tax. Our solution allows businesses to generate, send, and eSign tax-related forms quickly, ensuring that all necessary paperwork is completed accurately and efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing tiers designed to fit different business needs, making it a cost-effective solution for managing modified business tax documents. We provide flexible subscription plans that can accommodate everything from small businesses to large enterprises, ensuring that everyone can find the right fit.

-

What features does airSlate SignNow offer for tax-related processes?

With airSlate SignNow, you get features like template creation, automated workflows, and robust eSigning capabilities that are tailored for handling modified business tax documents. These features help save time, reduce errors, and ensure compliance with tax regulations.

-

How does airSlate SignNow ensure the security of sensitive tax information?

Security is our top priority at airSlate SignNow, especially when it comes to sensitive information like modified business tax documents. We utilize advanced encryption and authentication protocols to safeguard all data, ensuring that your business information remains confidential and secure.

-

Can airSlate SignNow integrate with other financial software for tax management?

Yes, airSlate SignNow offers seamless integrations with various accounting and financial software that help manage modified business tax more effectively. This interconnectivity allows businesses to automate data transfers and maintain accurate records without the hassle of manual entry.

-

What are the benefits of using airSlate SignNow for modified business tax filings?

Using airSlate SignNow for modified business tax filings enhances efficiency and accuracy. Our platform automates the signing process, reduces turnaround times, and ensures that all documents are stored securely, making tax filing less stressful and more organized.

Get more for Nevada Modified Business Tax Return

- Home occupational application henry bcountyb co henry ga form

- Terry l basin clayton county tax commissioner 121 form

- Motor bus ad valorem tax report general instructionsvehicle taxestitle ad valorem tax tavt and annual admotor bus ad valorem form

- Tn tangible personal property form

- Organization phone no form

- Application for service or early retirement benefits form

- Tangible personal property tax form

- 1500010263 kentucky department of revenue form

Find out other Nevada Modified Business Tax Return

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template