New Mexico Ifta Login Form

Understanding the New Mexico Ifta Login

The New Mexico IFTA (International Fuel Tax Agreement) login is an essential online portal for businesses engaged in interstate commerce. This login allows users to access their account for filing fuel tax reports, managing payments, and ensuring compliance with state regulations. The portal is designed to streamline the process of submitting the New Mexico IFTA report and maintaining accurate records of fuel usage across state lines.

Steps to Complete the New Mexico Ifta Login

To successfully log in to the New Mexico IFTA portal, follow these straightforward steps:

- Visit the official New Mexico IFTA login page.

- Enter your username and password in the designated fields.

- Click the login button to access your account.

- If you forget your password, use the password recovery option to reset it.

After logging in, you can navigate to various sections to file your quarterly tax returns, view previous submissions, and update your account information as needed.

Legal Use of the New Mexico Ifta Login

Using the New Mexico IFTA login is legally binding, provided that all transactions comply with state and federal regulations. The electronic submissions made through the portal are recognized under the ESIGN Act, ensuring that eSignatures hold the same legal weight as traditional handwritten signatures. It is crucial to ensure that all information submitted is accurate and complete to avoid potential penalties.

Required Documents for New Mexico Ifta Login

When using the New Mexico IFTA login, certain documents and information are necessary to facilitate the filing process. These may include:

- Previous IFTA tax returns.

- Records of fuel purchases and usage.

- Vehicle identification numbers (VIN) for all qualified vehicles.

- Proof of payment for any taxes owed.

Having these documents ready will help ensure a smooth filing process and compliance with state regulations.

Filing Deadlines for New Mexico Ifta Reports

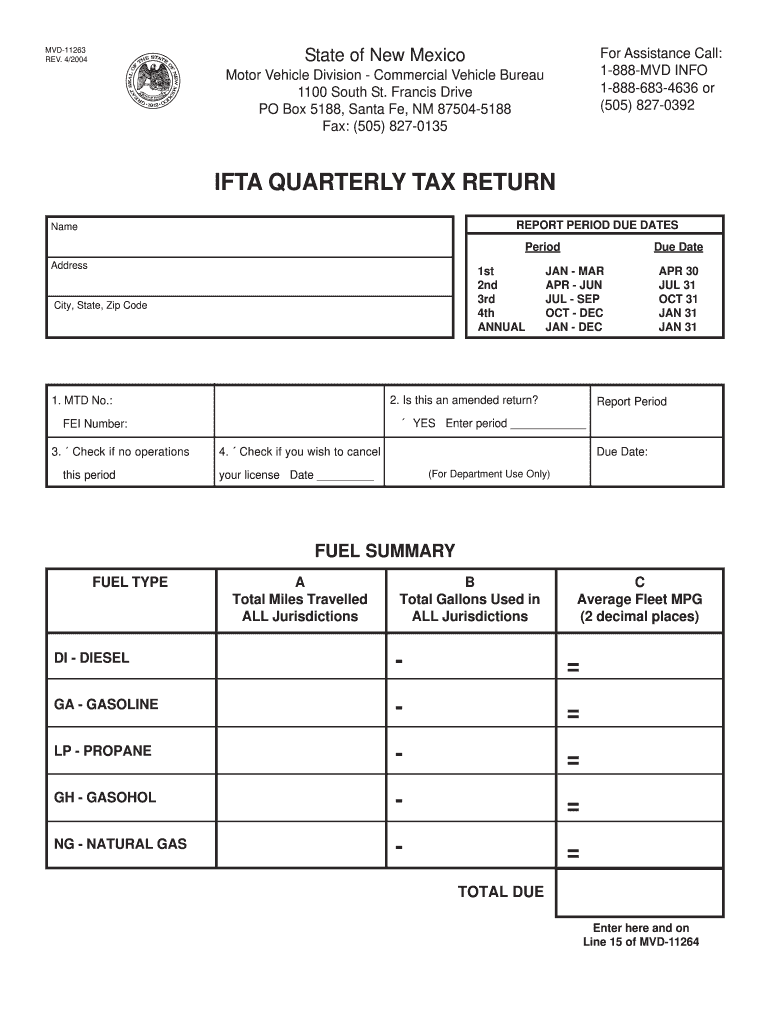

Timely filing of the New Mexico IFTA reports is crucial to avoid penalties. The deadlines for submitting quarterly tax returns are as follows:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31

It is important to mark these dates on your calendar to ensure compliance and avoid late fees.

Eligibility Criteria for New Mexico Ifta Login

To utilize the New Mexico IFTA login, businesses must meet specific eligibility criteria. These include:

- Having a valid New Mexico IFTA license.

- Operating qualified motor vehicles that travel across state lines.

- Maintaining accurate records of fuel purchases and usage.

Meeting these criteria ensures that businesses can effectively manage their fuel tax obligations through the online portal.

Quick guide on how to complete new mexico ifta login

Manage New Mexico Ifta Login effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to find the correct template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle New Mexico Ifta Login on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign New Mexico Ifta Login with ease

- Find New Mexico Ifta Login and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your document, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign New Mexico Ifta Login and ensure seamless communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new mexico ifta login

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NM IFTA Login and how can it benefit my business?

NM IFTA Login is a web portal designed to help businesses manage their International Fuel Tax Agreement reporting efficiently. By using NM IFTA Login, you can easily track fuel usage, streamline tax reporting, and ensure compliance with state regulations. This tool simplifies the process of handling fuel tax obligations and saves time for businesses.

-

How do I access the NM IFTA Login portal?

To access the NM IFTA Login portal, visit the official website and click on the login link. You will need your username and password to sign in. If you don't have an account yet, you can register to create one for quick access to all your IFTA reporting needs.

-

What features are included with NM IFTA Login?

NM IFTA Login provides various features, including fuel tax reporting, automated calculations, and easy document management. Additionally, the platform allows users to upload receipts, track fuel purchases, and generate tax reports, making it a comprehensive solution for fuel tax compliance.

-

Is NM IFTA Login secure for my business data?

Yes, NM IFTA Login employs robust security measures to protect your business data. With encryption protocols and secure user authentication, you can trust that your information is safe when using the portal. Always ensure your password is strong and updated for additional security.

-

How much does the NM IFTA Login service cost?

The cost of NM IFTA Login services can vary based on the features and subscription model you choose. Generally, it offers a cost-effective solution for businesses, with tiered pricing to accommodate different needs. Check the pricing section on the website for detailed information on subscriptions.

-

Can I integrate NM IFTA Login with my existing accounting software?

Yes, NM IFTA Login can often be integrated with popular accounting software and solutions. This integration allows for seamless data transfer, reducing manual entry and improving accuracy in your financial reporting. Consult with your software provider to ensure compatibility.

-

What benefits does NM IFTA Login offer compared to manual reporting?

NM IFTA Login offers numerous benefits over manual reporting, including increased efficiency, reduced errors, and faster tax filing. By automating many of the reporting processes, businesses can save time and minimize the risk of penalties associated with inaccuracies. Ultimately, it helps streamline your fuel tax management.

Get more for New Mexico Ifta Login

Find out other New Mexico Ifta Login

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document