Fincen Form 49342g

What is the Fincen Form 49342g

The Fincen Form 49342g is a document utilized by financial institutions and certain businesses to report suspicious activities that may indicate money laundering, fraud, or other financial crimes. This form is part of the Bank Secrecy Act (BSA) requirements and is crucial for maintaining compliance with federal regulations aimed at preventing financial misconduct. Organizations that are required to file this form include banks, credit unions, and other entities that engage in financial transactions.

How to use the Fincen Form 49342g

To effectively use the Fincen Form 49342g, organizations must first determine if they have a reportable suspicious activity. Once identified, the form should be completed with accurate and detailed information regarding the activity, including the nature of the suspicious behavior, the individuals involved, and any relevant transaction details. After filling out the form, it must be submitted to the Financial Crimes Enforcement Network (FinCEN) within the required timeframe to ensure compliance with federal regulations.

Steps to complete the Fincen Form 49342g

Completing the Fincen Form 49342g involves several key steps:

- Identify the suspicious activity that necessitates reporting.

- Gather all relevant information, including transaction details and personal information of involved parties.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for accuracy and completeness before submission.

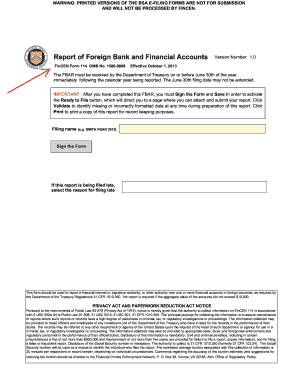

- Submit the form electronically through the FinCEN's BSA E-Filing System or by mail if necessary.

Legal use of the Fincen Form 49342g

The legal use of the Fincen Form 49342g is governed by federal laws that mandate financial institutions to report suspicious activities. Compliance with these regulations is essential for avoiding legal penalties and maintaining the integrity of the financial system. Organizations must ensure that they are familiar with the specific legal requirements surrounding the form, including the types of activities that must be reported and the timelines for submission.

Form Submission Methods

The Fincen Form 49342g can be submitted through various methods, primarily focusing on electronic filing. The preferred method is via the BSA E-Filing System, which allows for secure and efficient submission. Alternatively, organizations may submit the form by mail, although this method may lead to longer processing times. It is important to choose the method that best fits the organization's operational capabilities while ensuring compliance with submission deadlines.

Penalties for Non-Compliance

Failure to comply with the reporting requirements associated with the Fincen Form 49342g can result in significant penalties. Organizations may face fines, legal action, or other regulatory consequences if they neglect to report suspicious activities or submit the form inaccurately. It is crucial for businesses to understand these risks and implement proper procedures to ensure compliance with all applicable laws and regulations.

Quick guide on how to complete fincen form 49342g

Manage Fincen Form 49342g effortlessly on any device

The management of online documents has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Fincen Form 49342g on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign Fincen Form 49342g with ease

- Obtain Fincen Form 49342g and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Edit and eSign Fincen Form 49342g and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fincen form 49342g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fincen form 49342g and why is it important?

The fincen form 49342g is a document used for reporting certain financial transactions. It is crucial for ensuring compliance with federal regulations and helps businesses avoid potential penalties. Familiarity with this form aids in maintaining good standing with the Financial Crimes Enforcement Network (FinCEN).

-

How can airSlate SignNow assist with the fincen form 49342g?

airSlate SignNow streamlines the process of completing and signing the fincen form 49342g. Our platform provides a user-friendly interface that simplifies document management and ensures compliance with eSignature laws. With our tool, businesses can efficiently prepare and submit their forms electronically.

-

What are the pricing options for using airSlate SignNow for the fincen form 49342g?

airSlate SignNow offers a range of pricing plans to accommodate various business needs. Depending on the features you require for handling the fincen form 49342g, you can choose from a monthly or annual subscription. Our pricing is competitive and designed to deliver maximum value for document signing and management.

-

Are there any specific features in airSlate SignNow for the fincen form 49342g?

Yes, airSlate SignNow includes features that specifically benefit the completion of the fincen form 49342g. These features include customizable templates, advanced tracking, and automatic reminders for deadlines. Additionally, our platform supports secure cloud storage for easy access and compliance.

-

Can I integrate airSlate SignNow with other applications when managing the fincen form 49342g?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications, enhancing your workflow when dealing with the fincen form 49342g. Whether you use CRM systems, cloud storage solutions, or accounting software, our integrations help to automate processes and improve efficiency.

-

What benefits does airSlate SignNow offer for businesses handling the fincen form 49342g?

Using airSlate SignNow for the fincen form 49342g provides several benefits, including time savings and enhanced accuracy. Our platform reduces the time spent on document preparation and signing, allowing your team to focus on core tasks. Moreover, digital signatures ensure that your data remains secure and compliant.

-

Is training available for using airSlate SignNow with the fincen form 49342g?

Yes, airSlate SignNow offers comprehensive training resources to help users understand how to efficiently handle the fincen form 49342g. We provide tutorials, user guides, and customer support to ensure a smooth onboarding process. Our goal is to empower your team to maximize the use of our platform.

Get more for Fincen Form 49342g

Find out other Fincen Form 49342g

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract