Tsd Withholding Licdorgagov Form

What is the Tsd Withholding Licdorgagov Form

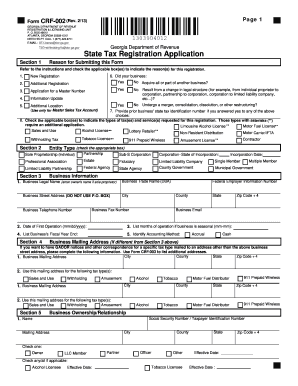

The Tsd Withholding Licdorgagov Form is a crucial document used primarily for tax withholding purposes. It serves as a declaration for individuals or entities to report their withholding tax obligations to the appropriate authorities. This form is essential for ensuring compliance with federal and state tax regulations, allowing taxpayers to accurately calculate the amount of tax to be withheld from their income. Understanding the purpose of this form is vital for anyone involved in employment or business operations within the United States.

How to use the Tsd Withholding Licdorgagov Form

Using the Tsd Withholding Licdorgagov Form involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from the official government website. Next, fill out the required fields accurately, including personal information and tax identification numbers. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements outlined by the issuing authority.

Steps to complete the Tsd Withholding Licdorgagov Form

Completing the Tsd Withholding Licdorgagov Form requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the form from an official source.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your income and the amount of tax to be withheld.

- Review the form for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form according to the guidelines provided, either online or by mail.

Legal use of the Tsd Withholding Licdorgagov Form

The legal use of the Tsd Withholding Licdorgagov Form is governed by federal and state tax laws. To ensure its validity, the form must be filled out accurately and submitted within the designated timeframes. Failure to comply with these regulations can result in penalties, including fines or additional tax liabilities. It is essential for taxpayers to understand their obligations under the law to avoid any legal complications.

Key elements of the Tsd Withholding Licdorgagov Form

The Tsd Withholding Licdorgagov Form includes several key elements that must be completed for it to be valid. These elements typically include:

- Personal identification information of the taxpayer.

- Details regarding the type of income subject to withholding.

- The specific amount of tax to be withheld.

- Signature of the taxpayer, affirming the accuracy of the information provided.

- Date of submission.

Filing Deadlines / Important Dates

Filing deadlines for the Tsd Withholding Licdorgagov Form are critical to ensure compliance with tax regulations. Typically, these deadlines align with the overall tax filing calendar, which may vary based on individual circumstances. It is advisable to stay informed about specific dates to avoid penalties. Taxpayers should consult the official guidelines or a tax professional for the most accurate and up-to-date information regarding deadlines.

Quick guide on how to complete tsd withholding licdorgagov form

Complete Tsd Withholding Licdorgagov Form effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Tsd Withholding Licdorgagov Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Tsd Withholding Licdorgagov Form with ease

- Find Tsd Withholding Licdorgagov Form and then click Get Form to initiate.

- Utilize the tools we provide to fill in your document.

- Highlight important sections of your documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Tsd Withholding Licdorgagov Form and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tsd withholding licdorgagov form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tsd Withholding Licdorgagov Form?

The Tsd Withholding Licdorgagov Form is a crucial document for businesses that need to comply with tax withholding regulations. It allows employers to report and remit withholding taxes to the appropriate authorities efficiently. Utilizing airSlate SignNow can streamline the process of filling out and submitting this form.

-

How can airSlate SignNow help with the Tsd Withholding Licdorgagov Form?

airSlate SignNow simplifies the management of the Tsd Withholding Licdorgagov Form by providing an easy-to-use platform for document creation, sending, and electronic signing. This not only saves time but also ensures compliance with tax regulations. Users can quickly generate and share the form to expedite the tax reporting process.

-

Is airSlate SignNow cost-effective for handling the Tsd Withholding Licdorgagov Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Tsd Withholding Licdorgagov Form. With various pricing plans, businesses can choose options that suit their needs without overspending. The savings in time and resources make it an economical choice for document management.

-

What features of airSlate SignNow are beneficial for the Tsd Withholding Licdorgagov Form?

AirSlate SignNow provides features like template creation, electronic signatures, and document tracking, which are particularly beneficial for the Tsd Withholding Licdorgagov Form. These tools help ensure accuracy and compliance while streamlining the filing process. The software's intuitive interface also enhances user experience.

-

Can I integrate airSlate SignNow with other applications for the Tsd Withholding Licdorgagov Form?

Absolutely! airSlate SignNow supports integrations with various applications, allowing seamless workflow for the Tsd Withholding Licdorgagov Form. This means you can connect it with your existing accounting or HR software to streamline data transfer and enhance overall efficiency.

-

What are the benefits of using airSlate SignNow for tax forms like the Tsd Withholding Licdorgagov Form?

Using airSlate SignNow for tax forms, such as the Tsd Withholding Licdorgagov Form, offers numerous benefits including improved accuracy, faster processing times, and enhanced security of sensitive information. The platform also reduces paperwork, helping businesses to go green by minimizing their reliance on physical documents.

-

Is eSigning the Tsd Withholding Licdorgagov Form legally binding?

Yes, eSigning the Tsd Withholding Licdorgagov Form through airSlate SignNow is legally binding and compliant with federal and state laws. This ensures that your electronically signed documents hold the same legal weight as traditional handwritten signatures. It's a secure way to expedite the signing process.

Get more for Tsd Withholding Licdorgagov Form

- Planned parenthood olympia pdfiller form

- Authorization form to release or planned parenthood plannedparenthood

- Proof of pregnancy planned parenthood form

- Heb community investment program form

- Oakland county bar association fax file form

- State of louisiana ss972 2011 form

- Police statement formpdffillercom

- Tdap consent form

Find out other Tsd Withholding Licdorgagov Form

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT